The Financial Supervisory Service has issued a consumer alert as the gap between domestic and international gold prices has widened significantly.

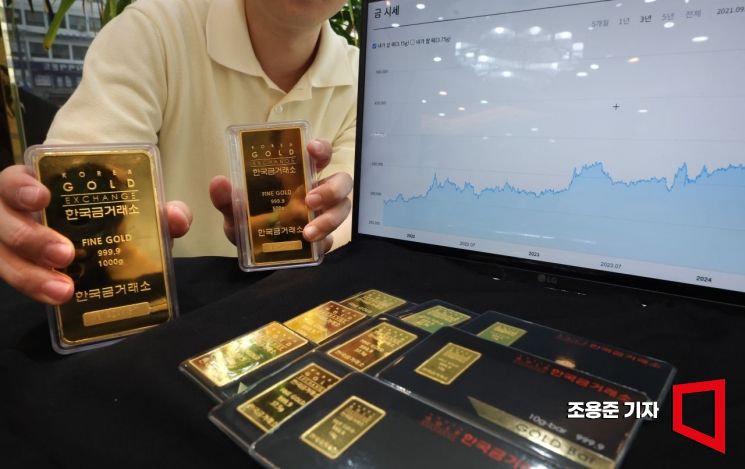

According to the Financial Supervisory Service on the 17th, the domestic spot gold price stood at 218,000 won per gram the previous day, about 13.2% higher than the international price (approximately 193,000 won).

The agency explained that this is an unusual situation, as there have only been two instances in the past five years where the price gap exceeded 10%.

The Financial Supervisory Service warned that investing without considering the disparity between domestic and international gold prices could lead to losses. In fact, in February of this year, the domestic gold price was 22.6% higher than the international price, but returned to the average level (0.7%) after about 18 trading days.

The agency stated, "While temporary supply restrictions or information asymmetry can cause a gap between domestic and international gold prices, the law of one price dictates that these prices will eventually converge. Therefore, investors must check whether the underlying asset of a gold investment product tracks the domestic or international gold price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)