KOSPI Surpasses 3,700 Mark

Semiconductor Leaders and Foreign Buying Drive Rally

Structurally Bullish Market... Some See 5,000 Possible Next Year

Cautious Voices Over Sharp Gains Without Fundamental Changes

The KOSPI has surpassed the 3,700 mark, setting new all-time highs day after day. As the KOSPI continues its relentless upward trajectory, expectations are mounting for it to reach the 4,000 level. In the securities industry, there are even forecasts that the index could hit 5,000 next year. However, some voices are urging caution, pointing out that the rally is happening without fundamental changes.

On October 17, the KOSPI opened at 3,732.76, down 15.61 points from the previous day, but quickly rebounded to break through the 3,760 level, continuing its record-breaking streak.

This upward momentum has not been dampened, even though the New York Stock Exchange closed lower the previous day due to concerns over credit risk.

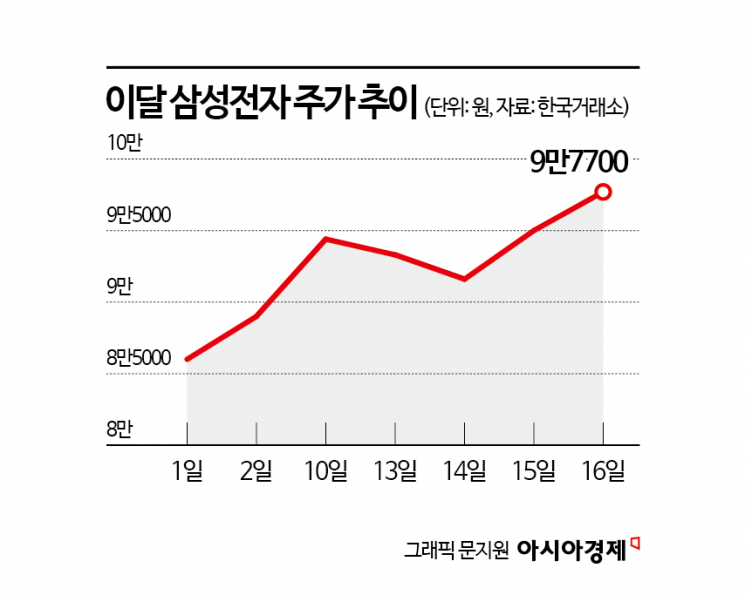

The bullish trend in the KOSPI is expected to continue. The semiconductor sector, which is leading this rally, is anticipated to enter an unprecedented growth trajectory driven by artificial intelligence (AI) momentum. Samsung Electronics and SK Hynix are hitting new all-time highs daily, driving the market upward. In October alone, SK Hynix has surged by 30.22%, while Samsung Electronics has risen by 16.45%. Kim Dongwon, head of research at KB Securities, projected, "DRAM prices in the fourth quarter are expected to rise by 10-15% compared to the previous quarter, and since current inventory levels are lower than during the previous upcycle (2017-2018), the upward trend in DRAM prices is likely to continue into next year." He added, "With global AI collaboration expanding from October, the AI ecosystem is rapidly growing, but a meaningful increase in DRAM supply, including high-bandwidth memory (HBM), will only be possible from 2028, when Samsung Electronics' Pyeongtaek D5 plant and the Yongin semiconductor cluster begin full-scale operations. Therefore, the DRAM market is expected to face a severe supply shortage in 2026-2027. During this period, Samsung Electronics and SK Hynix will enter a new phase of growth, showing differentiated performance and stock price trends not seen before."

In terms of market liquidity, foreign investors have been the driving force behind the KOSPI's record rally. So far this month, foreign investors have made net purchases of 5.5886 trillion won in the KOSPI market. This follows net purchases of 7.4 trillion won last month, indicating a continued strong buying trend. In particular, foreign investors have net purchased 3.7089 trillion won of Samsung Electronics this month, making it their top pick. More than 60% of their total net purchases have been concentrated in Samsung Electronics. The buying trend by foreign investors in Samsung Electronics is expected to continue. Seo Sangyoung, executive director at Mirae Asset Securities' WM Innovation Division, analyzed, "Foreign investors reached a short-term peak in August last year and began selling Samsung Electronics from September, reducing their shareholding ratio. At that time, foreigners held a 55% stake in Samsung Electronics, but now it is around 52%, suggesting there is room for additional net buying."

Securities firms are diagnosing the market as being in a structurally strong phase, with some predicting the KOSPI could reach 5,000 next year. Kim Byungyeon, head of investment strategy at NH Investment & Securities Research Division, said, "Although the index's short-term rise has been steep, we believe reaching the 5,000 mark next year is possible." He explained, "The essence of the current market is a structural bull run, where differences in industrial efficiency are reshaping market value. The KOSPI at 5,000 is not merely a liquidity-driven illusion but can be interpreted as a justified period of structural overvaluation caused by industrial polarization." He added, "The net profit forecast for 2025 is 208 trillion won, and for 2026, 270 trillion won is achievable. Compared to current estimates, the semiconductor, IT hardware, and securities sectors have further potential for earnings upgrades. Furthermore, if we factor in mandatory share buybacks and cancellations, separate taxation on dividends, and assume an average annual reduction in shares of 1%, a dividend payout ratio of 35%, and dividends exceeding 90 trillion won in 2026, achieving the KOSPI 5,000 mark becomes feasible."

However, the concentration in large-cap stocks and the elevated valuations due to the sustained rally are seen as burdensome factors. Yeom Dongchan, researcher at Korea Investment & Securities, noted, "The KOSPI 200 index has risen 19% since September, but only 17 out of the 200 constituent stocks have risen more than 19% during that period, while 87 stocks have posted negative returns." He analyzed, "This phenomenon is due to the rally being led by large IT companies with high market capitalization. In a market dominated by a handful of large-cap firms, the broader market sentiment is not as strong."

Jung Haechang, researcher at Daishin Securities, said, "Currently, the KOSPI is facing increasing valuation pressure due to the short-term rally. In a market where optimism has been priced in from various angles, it will inevitably become more vulnerable to unexpected variables."

Moreover, as the index has surged sharply in a short period without fundamental changes in earnings or corporate fundamentals, calls for caution are growing. Seo also commented, "The current market is highly sensitive to positive news, while negative factors are not being reflected at all. With valuations already high and economic conditions not particularly favorable, it is better to take a wait-and-see approach rather than rushing in at this point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)