Import Prices Up 0.2% from Previous Month

Both International Oil Prices and Exchange Rate Rise

Import Volume Index Surges 13.7%

Highest Level in Three Years and One Month

Driven by Increased Imports of Semiconductors and Primary Metals

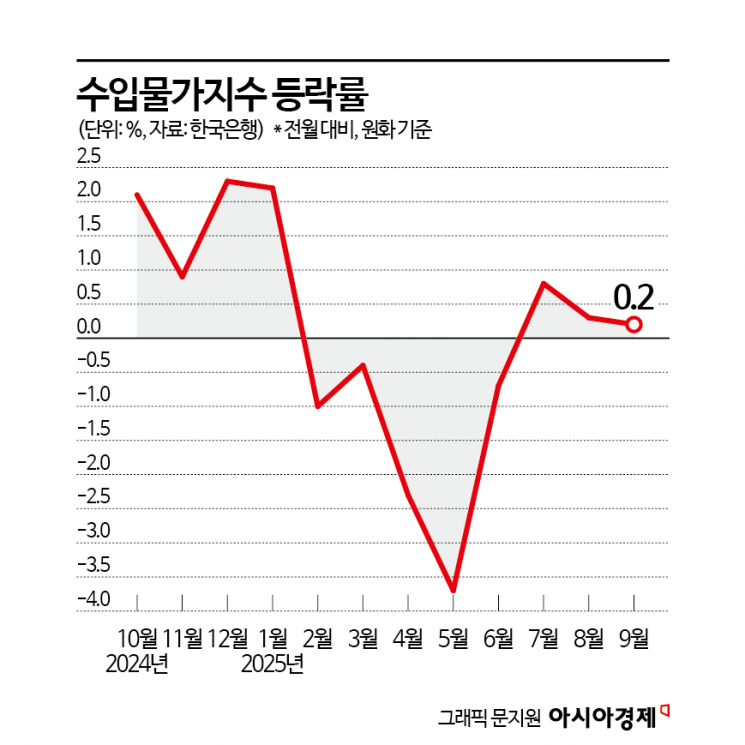

Import prices have been on the rise for three consecutive months. This trend is attributed to increases in both international oil prices and the won-dollar exchange rate, which have a significant impact on import prices. However, as international oil prices are undergoing an adjustment this month, analysts suggest that it remains to be seen whether the upward trend in import prices will continue.

According to the “Export and Import Price Index and Trade Index (Provisional) for September 2025” released by the Bank of Korea on the 17th, last month’s import prices (based on the Korean won) rose by 0.2% compared to the previous month. On a year-on-year basis, they increased by 0.6%. This result was due to the simultaneous rise in both international oil prices and the won-dollar exchange rate. The average monthly price of Dubai crude oil last month was $70.01 per barrel, up 0.9% from $69.39 in August. The average won-dollar exchange rate also rose by 0.2%, from 1,389.66 won in August to 1,391.83 won in September.

By usage, raw materials saw a 0.1% decrease compared to the previous month, as crude oil prices rose but liquefied natural gas (LNG) prices fell, particularly among mineral products. Intermediate goods increased by 0.5% month-on-month, driven by higher prices for primary metal products, computers, electronic and optical devices, and coal and petroleum products. Capital goods declined by 0.2% compared to the previous month, while consumer goods increased by 0.1%. Excluding the effects of exchange rates, import prices last month remained flat compared to the previous month on a contract currency basis. Year-on-year, they fell by 3.5%.

Although import prices have continued to rise this month, it remains uncertain whether this upward trend will persist for a fourth consecutive month. Since import prices are typically reflected in consumer prices with a lag of one to three months, a sustained increase in import prices could put upward pressure on consumer prices. Lee Moonhee, head of the Price Statistics Team 1 at the Bank of Korea’s Economic Statistics Department, stated, “Looking at the external conditions affecting import prices, such as international oil prices and exchange rates, the price of Dubai crude oil has fallen by 7.3% so far in October compared to the previous month, but the won-dollar exchange rate has risen by 1.7%. Given the considerable uncertainty in both domestic and international conditions, we will need to monitor the trend through the end of the month.”

Last month, export prices rose by 0.6% compared to the previous month, as the won-dollar exchange rate increased and prices for coal and petroleum products, as well as computers, electronic and optical devices, went up. Year-on-year, export prices increased by 2.2%. By item, prices for agricultural, forestry, and fishery products rose by 0.6% compared to the previous month. Prices for manufactured goods also increased by 0.6% month-on-month, driven by coal and petroleum products, and computers, electronic and optical devices. On a contract currency basis, export prices last month rose by 0.4% compared to the previous month. Year-on-year, they decreased by 2.0%.

The export volume index, which reflects changes in export and import volumes, rose by 14.4% in September compared to the same month last year. This marks the highest increase in one year and eight months since the 17.4% rise in January last year, led by growth in computers, electronic and optical devices, and chemical products. Lee explained, “Exports of computers, electronic and optical devices such as semiconductors have been strong, and export volumes of chemical products and automobiles have also increased significantly.” The export value index rose by 12.0%.

During the same period, the import volume index jumped by 13.7%. This is the highest increase in three years and one month since the 15.7% rise in August 2022. Lee analyzed, “The import volume of computers, electronic and optical devices increased, particularly in items such as semiconductors and computer memory devices, as well as computers and peripheral equipment. The import volume of primary metal products such as aluminum and copper also rose.” The import value index increased by 7.8%.

In September, the net barter terms of trade index rose by 3.2% year-on-year, as import prices (-5.2%) fell more sharply than export prices (-2.1%). The income terms of trade index surged by 18.1%, as both the net barter terms of trade index (3.2%) and the export volume index (14.4%) increased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.