Four Exclusive Usage Rights Secured This Year

Expanded Cancer-Related Coverage in Pet Insurance

Chasing Market Leader Meritz Fire & Marine Insurance... Will the Pet Insurance Landscape Shift?

DB Insurance is ramping up efforts to secure exclusive sales rights for pet insurance and launch new products. With the growth of human insurance stagnating due to low birth rates and an aging population, the company is seeking to pioneer a new market targeting the 15 million pet owners in South Korea.

According to the financial sector on October 17, DB Insurance launched a new coverage rider for pet insurance the previous day, which expands the benefit amount for anti-cancer drug treatments. This rider, which covers not only oral anticancer drugs but also injectable anticancer drugs, is the first of its kind in the non-life insurance industry. The probability of an adult dog dying from cancer is between 30% and 33%, and the risk increases for older or larger dogs. DB Insurance developed this product in anticipation of rising demand for cancer-related pet insurance, given that advances in veterinary medicine are gradually extending the lifespan of companion dogs.

DB Insurance has been the most prominent player in the pet insurance sector this year. It has acquired the largest number of exclusive usage rights-four in total-related to pet insurance among non-life insurers so far this year. Exclusive usage rights are a form of temporary patent in the insurance industry, granted for originality and innovation, and guarantee exclusive sales rights for a certain period.

In January, DB Insurance obtained six-month exclusive usage rights for two products: one that covers pet care costs when a pet owner is hospitalized and subsequently visits a tertiary hospital as an outpatient, and another that differentiates coverage limits based on the pet’s weight. Previously, pet insurance in the industry only covered pet care costs during hospitalization. DB Insurance developed a new product that also covers outpatient care after hospitalization. The differentiated coverage limit by weight reflects the fact that pet care service fees increase with the pet’s weight. The lighter the pet, the lower the insurance premium, while for large dogs, the coverage amount was increased up to 70,000 won to account for additional weight-based costs.

In May, DB Insurance acquired a six-month exclusive usage right for a product that covers fines related to dog bite incidents. This product provides coverage in cases where a pet owner receives a criminal fine under Article 266 (Injury by Negligence) or Article 267 (Death by Negligence) of the Criminal Act due to a dog bite incident. Whereas existing pet insurance only covered liability or civil lawsuits resulting from dog bite incidents, DB Insurance was the first in the industry to expand coverage to include criminal liability.

In June, DB Insurance secured a nine-month exclusive usage right for a product that covers behavioral correction training costs following a dog bite incident. This is the longest exclusive sales right ever granted for pet insurance. The product provides reimbursement for behavioral correction training expenses if a pet dog causes a dog bite incident. While prior pet insurance focused mainly on medical expenses, this new coverage expands protection to include accident prevention and behavioral correction. A DB Insurance representative stated, "The existing pet insurance market has mainly focused on covering treatment costs after a diagnosis of illness or injury, which has not fully addressed the diverse needs of pet owners. To address these limitations, we are continuously developing products that go beyond simple medical expense coverage to include care for abnormal behavior and protection for pet owners."

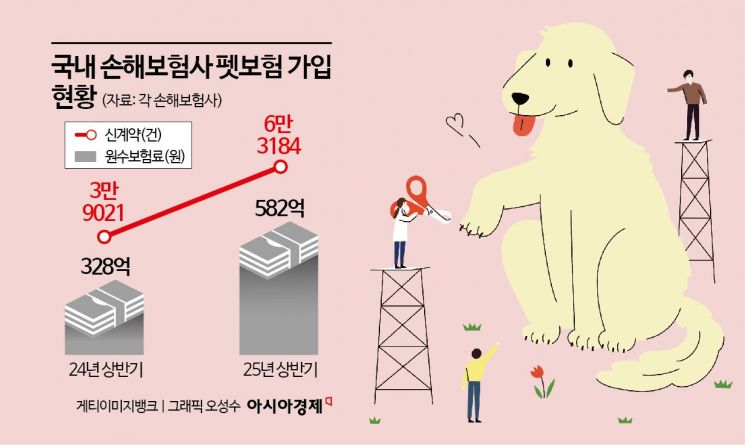

With DB Insurance aggressively seeking to acquire pet insurance customers this year, market competition is expected to intensify. Currently, Meritz Fire & Marine Insurance, which was the first to launch related products in 2018, leads the pet insurance market. DB Insurance, along with other major players such as Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, and KB Insurance, are close behind. As of the first half of this year, the number of new pet insurance contracts at 12 domestic non-life insurance companies reached 63,184, a 62% increase from 39,021 during the same period last year. Over the same period, direct premiums for pet insurance rose by 77%, from 32.8 billion won to 58.2 billion won. As the number of pet owners in South Korea surpassed 15 million last year, the related market continues to grow.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)