Excessive Concentration of Real Estate in South Korean Household Assets

Real Estate Assets Should Flow into the Capital Market

Active Consideration Needed for Enhanced Pension Tax Benefits

There are growing concerns that the proportion of real estate in South Korean household assets is excessively high, reaching nearly 80%, which is restricting economic development. Compared to advanced economies such as the United States, the share of real estate assets per household in South Korea is so elevated that funds are not being channeled into more productive industries.

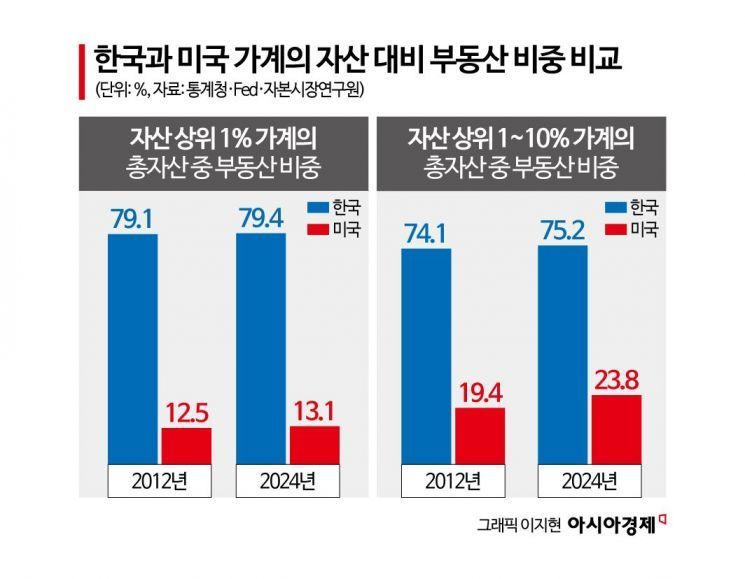

According to the Capital Market Research Institute and Statistics Korea on October 17, as of last year, real estate accounted for 79.4% of the total assets held by the top 1% of South Korean households by net worth. This figure has steadily increased from 77.3% in 2020, reaching an all-time high. Even among households in the top 1% to 10% bracket, real estate made up 75.2% of their assets, while for those in the top 10% to 50% bracket, the figure was 70.9%. This means a significant portion of South Korean households hold more than 70% of their assets in housing.

In contrast, among the top 1% of American households, real estate accounted for only 13.1% of their assets. For the top 1% to 10% in the United States, the proportion was 23.8%, showing a stark difference from South Korea. Looking at the asset composition of American households, the combined share of assets invested in capital markets-such as stocks, bonds, funds, and pensions-was about 50%, a very high level.

Even when comparing the proportion of financial assets in total household assets by country, South Korea stood at only 35%, which is significantly lower than other advanced economies. The proportion of financial assets among American households was 67%, Japan 63%, Canada 51%, the United Kingdom 49%, and Italy 46%. Most advanced economies have a much higher share of financial assets than South Korea.

The institute pointed out that the real estate-centered asset formation of South Korean households restricts the flow of surplus household funds into more productive industries, thereby weakening the overall growth potential and dynamism of the economy. It argued that it is necessary to channel the excessively concentrated real estate assets of Korean households into the capital market to support economic development.

Based on an empirical analysis of data from 65 countries, the institute found that when companies raise funds through the capital market, they grow faster, increase both employment and tangible and intangible assets, and enhance their production capacity. In particular, the faster growth effect was more pronounced for small startups or companies with high research and development (R&D) ratios, which face greater funding constraints. Jeong Hwayoung, a research fellow at the Capital Market Research Institute, explained, "If household funds flow into the domestic capital market, it can support the financing of more innovative and high-growth companies, thereby helping to increase the economic growth rate."

However, it was also noted that, at present, it is difficult for individuals in South Korea to voluntarily change their asset structure because they have invested too much in real estate. Therefore, the institute diagnosed that the government should provide policy incentives to encourage greater household participation in the domestic capital market.

Among various incentive measures, the institute strongly recommended actively considering enhanced tax benefits for pension contributions. As of 2023, South Korea's pension income replacement rate stood at 31.2%, which is significantly lower than the OECD average of 50.7%. With most assets tied up in real estate, many households are at risk of old-age poverty. Ultimately, the policy should be designed to provide substantial tax benefits for pension contributions, thereby channeling household assets into the capital market and supporting individuals' post-retirement income.

Research fellow Jeong also emphasized, "Along with tax benefits, it is necessary for the domestic capital market to provide high returns to gain investor trust," adding, "Continuous efforts must be made to improve the systems and operations of the capital market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)