Samsung Asset Management Becomes First in Korean ETF Industry to Surpass 100 Trillion Won in Net Assets

Mirae Asset Global Investments Achieves 100 Trillion Won in U.S. ETF Assets Under Management

Korea Investment, KB, and Shinhan Make Strides Amid

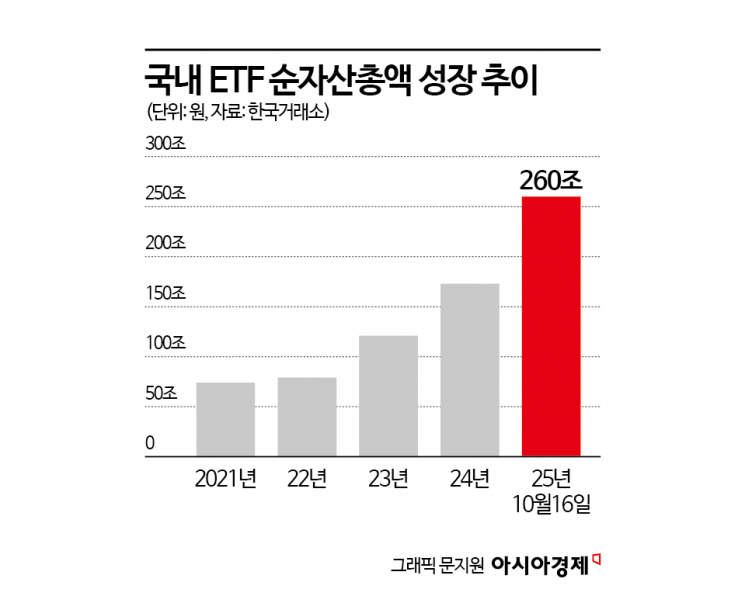

The size of the domestic exchange-traded fund (ETF) market, which surpassed 200 trillion won in the first half of this year, has grown to 260 trillion won in just four months. As capital continues to flow into the Korean stock market, ETFs are establishing themselves as a 'national wealth management tool.' Domestic asset management companies are fiercely competing to increase their share of the ETF market.

According to the asset management industry on October 17, as of October 15, the total net assets under management (AUM) of Samsung Asset Management's KODEX ETF reached 100.5071 trillion won. Samsung Asset Management, which launched Korea's first ETF, the 'KODEX 200' ETF, on October 14, 2002, has achieved the milestone of 100 trillion won in net assets in 23 years.

Samsung Asset Management, the leading asset manager in the domestic ETF market by market share, has driven market growth by introducing a variety of ETFs through its KODEX ETF lineup. In 2007, it launched Korea's first overseas investment ETF, and in 2009, it introduced the country's first bond-type ETF. By offering actively managed equity ETFs and domestic and international thematic ETFs, it has broadened the base of ETF investment.

Park Myeongje, Head of the ETF Business Division at Samsung Asset Management, said, "Going forward, KODEX ETF will become more customer-oriented, and we will strive to protect financial consumers."

Following Samsung Asset Management, the second-largest player, Mirae Asset Global Investments, is achieving remarkable results not only in Korea but also in overseas markets. Mirae Asset Global Investments announced the previous day that the AUM of Global X, its ETF management subsidiary, has surpassed 100 trillion won in the United States. The net asset size has grown 13-fold in about seven years since its acquisition in 2018.

Global X, which manages 101 ETFs in the United States, has a total AUM of 73.5 billion dollars, which is close to 105 trillion won. Over the past five years, it has recorded an average annual growth rate of 37.7%. This figure exceeds the average annual growth rate of the U.S. ETF market, which was 20.2% during the same period.

Kim Younghwan, Head of Innovation and Global Management at Mirae Asset Global Investments, said, "Mirae Asset Global Investments is enhancing its competitiveness in the global ETF market, not only in the world's largest ETF market, the United States, but also worldwide, based on an extensive global network," adding, "We will continue to strive to provide innovative ETF solutions."

While Samsung Asset Management and Mirae Asset Global Investments maintain a 'two-strong' structure in the domestic ETF market, Korea Investment Management, KB Asset Management, and Shinhan Asset Management are also scaling up. The total net assets of Korea Investment Management and KB Asset Management's ETFs have grown to around 20 trillion won. Shinhan Asset Management surpassed 10 trillion won in total net assets just four years after entering the ETF market.

Jo Jaemin, CEO of Shinhan Asset Management, said, "The surpassing of 250 trillion won in ETF net assets is not just an expansion in scale, but shows that national assets are shifting in earnest from deposits to investment products," adding, "As a self-directed investment culture takes root, we will continue to supply differentiated products so that SOL ETF can play a key role in increasing investors' assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.