Mandatory Disclosure of Impact on Shareholder Interests and Resale Plans

EB Issuance Reaches 1.4 Trillion Won This Year

"Responding to Falling Stock Prices and Growing Market Distrust"

This year, as the issuance of exchangeable bonds (EBs) backed by treasury shares has surged among companies, leading to negative effects such as falling stock prices and weakened investor sentiment, the Financial Supervisory Service is strengthening disclosure standards to protect investors. Going forward, companies will be required to include key information in their disclosures, such as the reasons for issuance, the appropriateness of the timing, and the impact on shareholder interests.

On October 16, the Financial Supervisory Service announced that it has revised the disclosure preparation standards to require detailed descriptions of key information, including the impact on shareholder interests when deciding to issue EBs. The new standards will take effect on October 20.

This revision comes as companies have recently been rushing to issue EBs backed by treasury shares. According to the Financial Supervisory Service, there were 50 EB issuance decisions in the third quarter of this year, totaling 1.4455 trillion won. This already exceeds last year's 28 cases (986.3 billion won). In September alone, there were 39 cases (1.1891 trillion won), showing a sharp increase.

The Financial Supervisory Service pointed out, "From the company's perspective, the trust relationship with shareholders who had expected shareholder returns such as share cancellation is being damaged, which could negatively impact corporate value." The agency further noted, "If the surge in EB issuance continues and expands, negative effects such as a sharp decline in stock prices could spread, due to weakened investor sentiment and increased market supply."

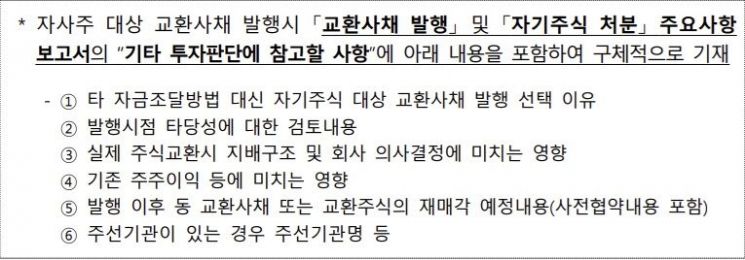

Under the revised disclosure standards, companies must specifically state the following in the "Other matters for investment judgment" section of both the major matters report on EB issuance decisions and the report on decisions to dispose of treasury shares: ▲the reasons for choosing EBs backed by treasury shares over other financing methods ▲an assessment of the appropriateness of the timing of issuance ▲the impact on governance structure and corporate decision-making ▲the impact on existing shareholder interests ▲and plans for the resale of exchanged shares after issuance.

Through this revision, the Financial Supervisory Service aims to encourage companies to more carefully consider EB issuance from the shareholders' perspective, in line with the introduction of the shareholder loyalty obligation, thereby establishing shareholder-centered management practices. The agency also expects that by providing investors with sufficient information necessary for investment decisions, the market will be able to make more objective and rational judgments and evaluations regarding EB issuance decisions.

The Financial Supervisory Service emphasized, "Soon, improvements to disclosures regarding treasury share holding and disposal plans, as well as stricter sanctions for disclosure violations, will be implemented." The agency added, "If any related disclosure violations are found, we will take strict measures, including correction orders and the imposition of fines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.