On October 16, Kyobo Life Insurance announced that it has launched the industry’s first MyData-based “Retirement Planning Simulation Service” to help address the retirement concerns of people in their 40s and 50s. This service was developed based on survey results showing that the biggest worry for this age group, as they approach retirement in the era of 100-year lifespans, is a lack of retirement preparedness.

This retirement planning service is designed so that users can check all three layers of their pension system-National Pension, Retirement Pension, and Private Pension-at once through the Kyobo Life Insurance application. It eliminates the hassle of having to check various scattered pension assets, including public pensions, and allows users to see the estimated monthly pension amount they will receive after retirement.

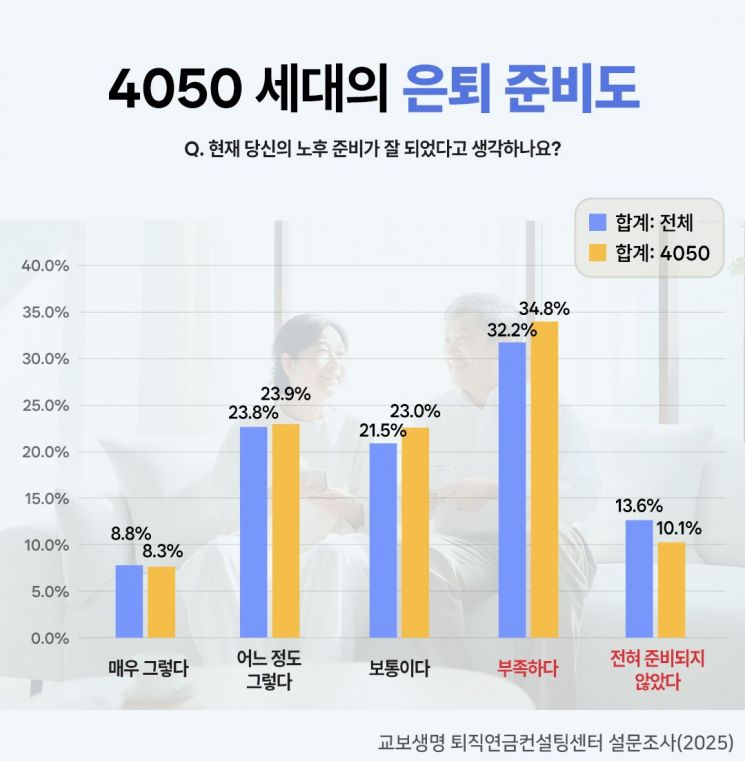

Survey conducted by Kyobo Life Insurance on the retirement preparedness of the 40s and 50s generation. Kyobo Life Insurance

Survey conducted by Kyobo Life Insurance on the retirement preparedness of the 40s and 50s generation. Kyobo Life Insurance

Unlike existing similar services, which simply aggregate pension assets, Kyobo Life Insurance’s retirement planning service allows customers to simulate various retirement scenarios by setting the pension commencement age, post-retirement living expenses, and pension payout methods themselves. Customers can also apply for one-on-one consultations with retirement pension specialists within the service to establish a customized retirement strategy tailored to their individual situations.

Mr. A, a Kyobo Life Insurance digital member and an office worker in his mid-40s, used the retirement planning simulation to discover that he would need 2.5 million KRW per month after retirement, but his secured pension amount was only about 1.8 million KRW per month. Realizing the need to strengthen his private pension to fill the income gap between his retirement and the start of his National Pension at age 65, he was able to create a concrete action plan to increase his pension by up to 40% through additional contributions.

During the development of this service, Kyobo Life Insurance conducted a “Retirement Trends Survey” through its retirement pension YouTube channel in June. According to the survey, among the 1,384 respondents, 35% of those in the 40s and 50s generation (40.2% of the total) said they were “not sufficiently prepared for retirement,” while 10% said they were “not prepared at all.”

When asked about the moment they most strongly felt the need to prepare for old age, 30.3% of respondents in their 40s and 50s answered “when checking the estimated pension amount,” making it the most common response. As for the most desired retirement planning services, “setting and reviewing post-retirement financial goals” (27.2%) and “guidance on asset management strategies” (25.2%) were cited in that order. In terms of service delivery methods, “one-on-one consultations with experts” (44.3%) and “convenient app or web platforms” (22.8%) were the most preferred.

A Kyobo Life Insurance representative stated, “Through this survey, we learned that the closer people in their 40s and 50s get to retirement, the more they want to check the status of their pension assets in concrete numbers and the greater their demand for accessible digital tools,” adding, “The retirement planning service is a result that reflects these customer needs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.