Raising 35.1 Billion Won Through Shareholder Allocation Rights Offering

Preliminary Issue Price Set at 9,940 Won; Current Share Price at 14,970 Won

Subscription for Existing Shareholders on December 4-5

As attention turns to robot component manufacturers in the domestic stock market, expectations are rising for the success of RS Automation's rights offering.

According to the Financial Supervisory Service's electronic disclosure system on October 16, RS Automation, which is pursuing a rights offering through a shareholder allocation method, has set the preliminary issue price for new shares at 9,940 won. The company plans to issue 3,536,700 new shares to raise 35.2 billion won.

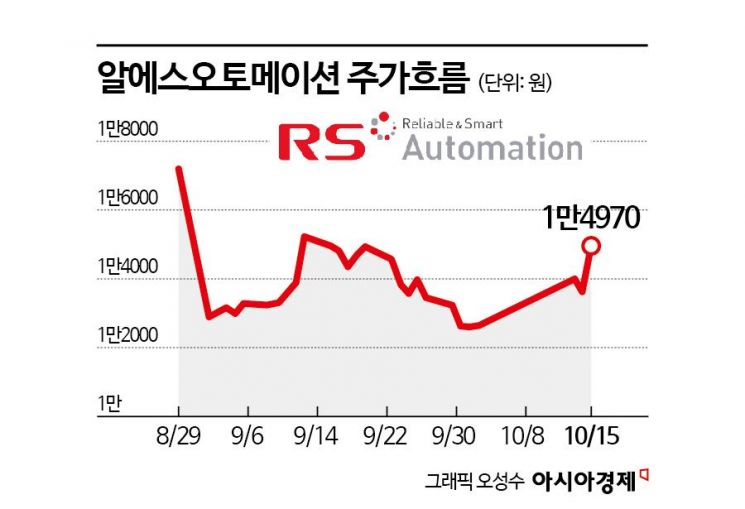

The previous day, RS Automation closed at 14,970 won. The share price has risen more than 18% this month, making it more than 50% higher than the preliminary issue price for new shares.

The final issue price for the new shares will be determined on December 1, and subscription for existing shareholders will take place from December 4 to 5. If there are forfeited shares from the shareholder subscription, additional investors will be recruited through a public offering.

RS Automation's share price plunged 25% on September 1, the trading day following the board of directors' resolution on August 29 to proceed with the rights offering, falling from 17,200 won to below 13,000 won. Since confirming the list of shareholders eligible for new share allocation on October 1, the share price has been rebounding.

Since last month, as robot-related stocks such as Hyundai Movex, Wonik Holdings, Robostar, HanlaCast, KNR Systems, and Robotis have ranked among the top-performing listed companies, this appears to have influenced RS Automation's share price as well.

RS Automation plans to use the funds raised through the rights offering for research and development (R&D) investment. The company aims to develop artificial intelligence (AI) control software platform technology, and to secure new growth engines in next-generation fields such as humanoid robots and the defense industry.

A company official explained, "We decided on the rights offering to develop high-end robot motion control products and to strengthen our technological capabilities in the field of physical AI."

Established in 2010, RS Automation develops related components based on robot motion control technology applied to smart factories. The company has secured in-house development capabilities in the control drive module sector, one of the four essential divisions of humanoid robots.

RS Automation also expects to achieve results in overseas markets. On September 15, the company held a next-generation Smart Motor Controller (SMC) strategy meeting with global automation company Rockwell Automation to strengthen cooperation. The companies also specified a roadmap for product development progress and further collaboration. Since 2022, RS Automation has secured revenue stability through a five-year supply contract worth 63 billion won with Rockwell. The company expects to increase overseas sales and improve profitability through this partnership.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.