Nearly 5 Trillion Won in Net Profit for Four Major Financial Groups in Q3

Profitability Maintained Despite Slowing Growth in Household Loans

The four major financial holding companies in Korea-KB, Shinhan, Hana, and Woori-are expected to post a combined net profit approaching 5 trillion won in the third quarter of this year. Despite an unfavorable environment characterized by falling interest rates and stringent household debt measures that have slowed interest income growth, these groups managed to defend their profitability by selectively lowering interest rates to control the total volume of household loans. Following record-breaking results in the first half of the year, expectations are rising that they will once again achieve their highest-ever annual performance.

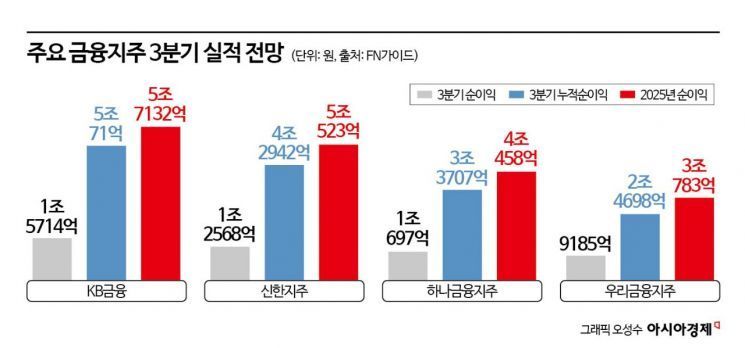

According to financial information provider FnGuide on October 15, the combined net profit attributable to controlling shareholders of the four major financial holding companies for the third quarter (July to September) was tallied at 4.8164 trillion won. This figure is a 3.13% decrease from 4.972 trillion won in the same period last year, but considering the slowdown in loan growth due to the government's strict regulations, it is being evaluated as a relatively strong performance.

As of the end of September, the increase in household loans at the five major commercial banks-KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup-stood at 1.1964 trillion won. This is about one-third of the previous month's increase (3.9251 trillion won) and just one-fifth compared to June, when the increase was the largest this year (6.7536 trillion won). Excluding January, which saw a month-on-month decrease, this is the smallest increase recorded so far this year.

Nevertheless, the solid performance of the four major financial holding companies is attributed to their ability to secure net interest income by selectively lowering interest rates to manage the total volume of household loans. Typically, a declining interest rate environment leads to a contraction in net interest margin (NIM)-a key profitability indicator for banks-which negatively impacts earnings. However, by maintaining higher spreads for household loans to control their total volume, the banks were able to keep NIM at a certain level.

Non-interest income also appears to have contributed to the financial holding companies' ability to defend their earnings. Kang Seunggeon, a researcher at KB Securities, said, "Despite the decline in market interest rates, the financial holding companies are expected to deliver strong results in the third quarter, with NIM maintained at the previous quarter's level. In particular, despite weak credit card fee income, brokerage fees and investment banking (IB) related fees from securities subsidiaries are expected to grow thanks to a booming stock market, which will drive overall performance."

On an annual basis, record-high earnings are also anticipated. By financial holding company, KB Financial Group's annual net profit is projected at 5.7132 trillion won, up 13% from last year's 5.0286 trillion won. It is expected to join the "5 trillion won club" for the second consecutive year and break its own record for highest earnings. Shinhan Financial Group is also expected to join the "5 trillion won club," with annual net profit projected at 5.0523 trillion won. Hana Financial Group is expected to maintain its "4 trillion won club" status with 4.0458 trillion won, while Woori Financial Group's net profit is expected to decline slightly to 3.0783 trillion won compared to last year.

Kim Hyunsoo, a researcher at SangSangIn Securities, analyzed, "Although lending rates continue to fall, deposit rates have dropped even faster, reducing funding costs. As a result, the loan-deposit margin has remained stable without significant fluctuations, allowing banks to maintain profitability. While there was rapid growth in the first half of the year, more moderate growth is expected in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.