Airline Stocks Left Behind Amid Recent Stock Market Rally

Jin Air, Jeju Air, and Air Busan All Hit New 52-Week Lows

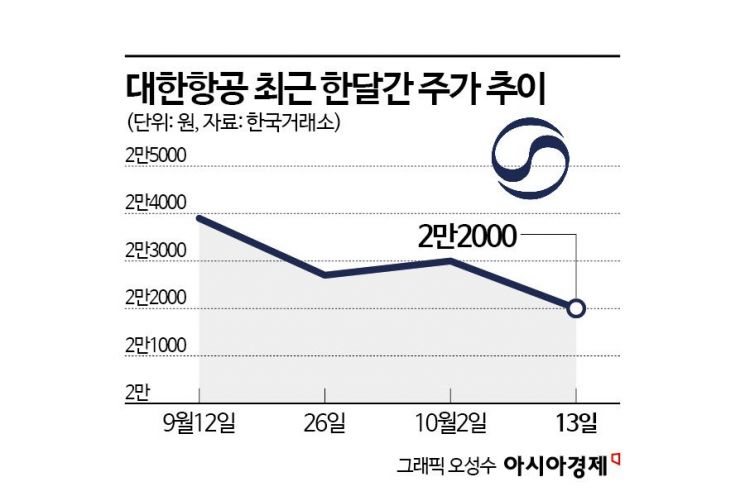

Korean Air Drops Over 7% in the Past Month

Growth Stagnates Due to Intensifying Competition and Rising Economic Uncertainty

Although the stock market is experiencing record-breaking bullishness, airline stocks remain neglected, continuing their sluggish performance. With growth stagnating due to intensifying competition and increasing economic uncertainty, a conservative approach appears necessary for the time being.

According to the Korea Exchange on October 14, Jin Air, Jeju Air, and Air Busan all hit new 52-week lows during the previous trading session. Jin Air closed at 7,660 won, down 1.42% from the previous day, after dropping to 7,650 won during the session, marking another 52-week low. Jin Air’s share price, which was in the 10,000 won range at the beginning of the year, has steadily declined throughout the year, now falling into the 7,000 won range. Jeju Air also hit a 52-week low, dropping to 6,130 won during the session, while Air Busan set a new 52-week low by falling to 1,861 won.

Korean Air and Asiana Airlines are also experiencing sluggish stock performances. Over the past month, Korean Air has declined by 7.95%. During the same period, Asiana Airlines has fallen by more than 5%.

Expectations that third-quarter results this year will fall short seem to have impacted share prices. According to financial information provider FnGuide, the consensus for Korean Air’s third-quarter results this year (the average of securities firms’ forecasts) is 6.3506 trillion won in revenue, up 35.83% year-on-year, and 616 billion won in operating profit, down 7.47%. Asiana Airlines’ revenue is projected at 1.855 trillion won, down 14.8% year-on-year, with operating profit forecast at 76 billion won, a decrease of 57.01%. Jin Air’s operating profit is estimated to decrease by 40.3% year-on-year to 24 billion won, Jeju Air’s by 63.87% to 16.8 billion won, and Air Busan’s by 60% to 15 billion won, all showing significant declines.

Kang Sungjin, a researcher at KB Securities, stated, “The reason transportation sector stocks have been relatively weak is because there is no clear driver for profit growth. This concern among investors is unlikely to improve significantly during the third-quarter earnings season for transportation companies.”

Yang Seungyun, a researcher at Eugene Investment & Securities, commented, “The airline industry has emerged from the long tunnel of COVID-19 and returned to normal. Now, it needs to move into a growth phase beyond the previous peak in 2019, but the current conditions are not favorable. The Russia route, once popular for travel to nearby Europe, remains closed; demand for Southeast Asian routes is weak compared to the past; and while demand for Japan was strong, it has stagnated. The only bright spots are the solid North American routes and the Chinese routes, which are still recovering and have some upside potential.” He added, “Prices are under downward pressure as supply normalizes and competition intensifies. Revenue growth has stagnated amid increasing economic uncertainty, while costs are facing upward pressure due to rising inflation, including labor costs and airport fees. As a result, profitability is inevitably entering a period of gradual deterioration.”

Even the previously robust North American routes are now facing uncertainty due to the United States’ stricter immigration policies. Kang noted, “The U.S. government’s tough crackdown on illegal immigrants is reducing demand for travel from Koreans to the U.S. and for visits to Korea by Korean-Americans living in the U.S. In addition, as Korean investment in the U.S. increases, the won-dollar exchange rate has risen again. This leaves no choice but to turn negative on the outlook for the airline passenger sector.”

Overall, with industry conditions remaining weak, some analysts believe that full-service carriers (FSCs) are in a relatively better position than low-cost carriers (LCCs). Yang explained, “Looking at the profitability of the Korean and U.S. airline markets, there is a clear difference between FSCs and LCCs. LCCs continue to show a trend of deteriorating profitability, whereas FSCs are maintaining relatively solid profit strength. The biggest reason for this is the expansion of premium demand.”

For Korean Air, a recovery in performance is expected in the fourth quarter. Bae Seho, a researcher at iM Securities, said, “Although Korean Air’s third-quarter results are likely to be sluggish due to intensified competition on short-haul routes, the base effect from last year’s Chuseok holiday, and weakness in the cargo segment, the number of Chinese visitors to Korea is rising sharply, and considering the October holiday season, passenger performance could rebound as early as the fourth quarter.” He added, “While short-term performance is weakening and uncertainty in the cargo segment persists, resulting in sluggish recent stock performance, in the medium to long term, investment points such as strengthening profitability in long-haul segments and enhancing competitiveness in the aerospace business remain valid.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.