Despite Strong Index Gains in September, Entertainment Stocks Remain Weak

"Continued Korea-China Uncertainty"

"Expectations Rise for Next Year's BTS World Tour and Possible Big Bang Comeback"

Entertainment stocks managed to rebound in October after a period of poor performance last month. The anticipation that earnings will reach record highs, driven by large-scale concerts such as BTS’s upcoming performances starting next year, appears to have contributed to this recovery.

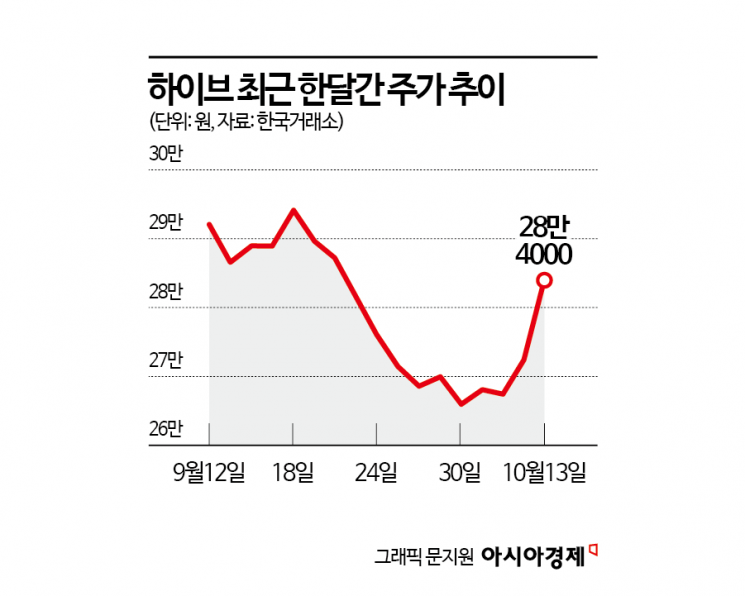

According to the Korea Exchange on October 14, HYBE closed at 284,000 won on the 13th, up 11,500 won (4.22%) from the previous trading day. In addition, SM Entertainment rose by 2.30%, YG Entertainment by 5.42%, and JYP Entertainment by 2.26%.

Last month, entertainment stocks failed to participate in the upward trend of both the KOSPI and KOSDAQ. In September, the KOSPI and KOSDAQ rose by 7.49% and 5.66%, respectively. In contrast, leading entertainment stock HYBE declined for six consecutive trading days starting September 19, while SM Entertainment fell for five straight days starting September 22, continuing their weak trend. On a monthly basis, HYBE dropped by 7.32%, SM Entertainment fell by 6.34%, and YG Entertainment decreased by 3.84%. However, JYP Entertainment rose by 2.61%.

The recent weakness in entertainment stocks is attributed to a lack of momentum and uncertainties related to China. The cancellation of concerts in China dampened the sector. The K-pop concert “Dream Concert,” scheduled for the end of last month, was postponed, and the girl group Kep1er’s concert, which was set for the 13th of the same month, was also canceled.

Lee Hwajeong, a researcher at NH Investment & Securities, stated, “Concerns over Korea-China relations have resurfaced, increasing uncertainty regarding the resumption of concerts.” Lee Gihun, a researcher at Hana Securities, commented, “There is currently a lack of short-term momentum for earnings upgrades, such as the announcement of large-scale world tours by Stray Kids and Blackpink.”

Nevertheless, securities firms expect that as earnings improvement from large-scale concerts becomes evident from the third quarter, stock prices will continue their rebound. Researcher Lee Hwajeong said, “In the third quarter, we can confirm economies of scale as tours by high-profile artists such as Blackpink and Twice resume.” She added, “We expect a rebound in stock prices starting from the third quarter earnings season.”

Furthermore, there are projections that entertainment stocks will achieve record-high earnings if large-scale concerts, led by BTS, are held next year. According to FnGuide, securities firms forecast that HYBE’s consolidated sales and operating profit will reach 3.7511 trillion won and 471.4 billion won, up 41.99% and 109.06% year-on-year, respectively.

Researcher Lee Gihun said, “In 2026, when BTS resumes full-group activities, their sales are expected to be on par with the combined sales of JYP Entertainment and YG Entertainment. A performance surprise has already been confirmed through Stray Kids’ world tour, and if Blackpink’s tour also results in a surprise, expectations for BTS-driven earnings momentum will rise significantly.”

In addition, there are high expectations for concerts by the group Big Bang. Next year marks the 20th anniversary of Big Bang’s debut. Researcher Lee Hwajeong emphasized, “There is also a possibility that Big Bang will hold a 20th anniversary tour. BTS’s last tour was in 2019, and Big Bang’s last tour was in 2016, so there is likely to be significant pent-up demand.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.