Surplus Funds of Banks Decrease Sharply in First Half Compared to Previous Years

Concerns Rise Over Diminished Capacity to Support Government's Productive Finance as Surplus Shrinks

In the first half of this year, banks' surplus funds significantly decreased, leading to concerns that there is now insufficient capacity to allocate funds to the government's productive finance initiatives. It is expected that banks will seek to expand deposits in the second half of the year, including raising deposit interest rates, in order to increase their surplus funds.

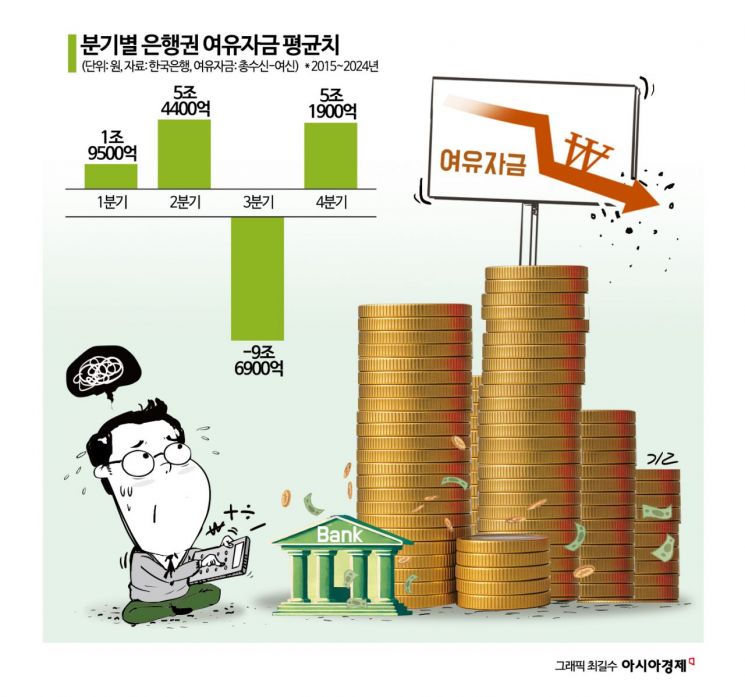

According to the Korea Institute of Finance on October 14, domestic banks' surplus funds (total deposits minus loans) in the first half of this year stood at negative 1.69 trillion won, a reversal from 360 billion won in the first half of last year. Surplus funds are calculated by subtracting loans from total deposits, which include demand deposits and savings deposits. Over the past ten years, from 2015 to 2024, the average surplus funds for domestic banks in the first half of the year was 7.39 trillion won, but this year, the figure turned negative.

This shortage of surplus funds is expected to continue into the second half of the year. Traditionally, banks' surplus funds have been negative in the third quarter, and since last month, the deposit insurance limit has been raised to 100 million won, which is expected to intensify competition among banks for deposits in the fourth quarter. In addition, although the benchmark interest rate was lowered this year, resulting in a decrease in deposit rates, loan rates have not dropped significantly due to the increase in household loans and regulatory factors.

Kim Youngdo, Senior Research Fellow at the Korea Institute of Finance, stated, "Unlike previous years, domestic banks' surplus funds decreased in the first half of this year, and due to seasonal factors, are expected to decrease in the third quarter as well. Therefore, it is difficult to conclude that banks currently have abundant surplus funds."

Senior Research Fellow Kim explained that the decrease in surplus funds could lead to a decline in investment capacity. When banks have more surplus funds, they tend to invest in securities such as bonds; conversely, when surplus funds decrease, their capacity to invest in bonds may also decline.

This situation could also negatively impact the government's ongoing efforts to expand productive finance. The government is working to secure investment funds for productive finance, such as by establishing a 150 trillion won National Growth Fund, with a significant portion to be raised through bond issuance. When bonds are issued, banks are expected to purchase a large share, but with their surplus funds now insufficient, banks may lack the capacity to absorb these bonds.

Senior Research Fellow Kim emphasized, "If banks are unable to establish an adequate deposit base, not only will the government's financial transformation policy stance be undermined, but the capacity to absorb various bond issuance demands linked to this policy in the market could also decline significantly." He added, "In order for banks to appropriately absorb future bond issuance demands, efforts will likely be made to secure deposits through measures such as raising deposit interest rates, offering special or structured deposit products, while maintaining a reasonable level of profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.