Ken Griffin, CEO of Hedge Fund Firm Citadel

"Skeptical of the Rush Toward Dollar-Alternative Assets"

As international gold prices attempt to settle in the $4,000-per-ounce range (approximately 5.68 million won), continuing the 'gold rally,' a billionaire investor on Wall Street has expressed concerns about this trend.

Ken Griffin, CEO of the hedge fund firm Citadel, stated at the Citadel Securities Conference held in New York this week, "Investors are flocking not only to gold but also to other dollar-alternative assets such as Bitcoin," adding, "It's hard to believe." He further told Bloomberg News, "It is really concerning that the dollar is being viewed as it once was, with gold seen as a 'safe haven asset.'" Griffin is also well known as a major political donor to the U.S. Republican Party.

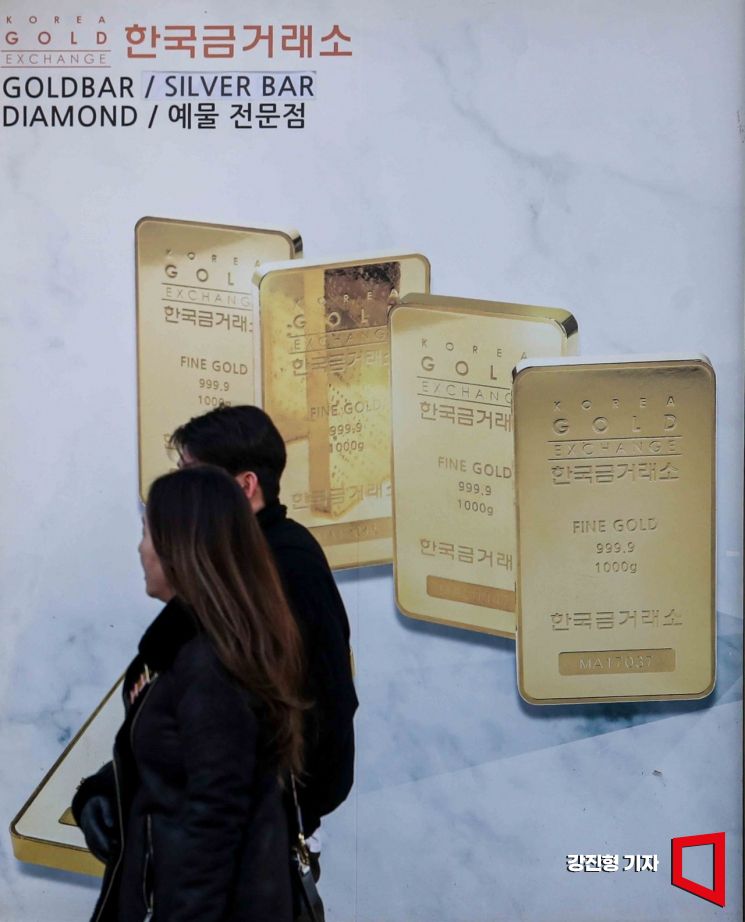

As gold prices soar, a photo of gold bars is displayed on the exterior wall of the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul.

As gold prices soar, a photo of gold bars is displayed on the exterior wall of the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul.

He analyzed, "As investors look for ways to effectively reduce their dollar exposure or lower portfolio risk relative to U.S. Treasury risk, there is significant inflation occurring in assets outside the dollar." He questioned the current situation in which investors view gold as a safer asset than the dollar. In a recent report, Goldman Sachs projected, "If only 1% of U.S. Treasuries held by individuals are converted into precious metals, gold prices could approach $5,000 per ounce."

Regarding the current economic situation, Griffin pointed out, "The United States is implementing fiscal and monetary stimulus measures similar to those typically used during recessions, and this is heating up the market," adding, "The U.S. economy is definitely in a state of temporary over-stimulation right now."

Gold Prices Pause After Surpassing $4,000 Per Ounce

Meanwhile, gold prices surpassed $4,000 for the first time ever on October 8, driven by investors' preference for safe-haven assets amid the U.S. federal government shutdown and political instability in France, as well as expectations of U.S. interest rate cuts. On this day, the spot price of gold reached an all-time high of $4,000.96 per troy ounce (31.1034768g) during intraday trading. The December delivery U.S. gold futures price also rose 0.4% to $4,020 per troy ounce, surpassing the $4,000 mark for the first time ever. Gold prices have repeatedly set new all-time highs this year, rising by as much as 52% so far. On October 9, gold futures for December delivery closed at $3,972.6 per ounce on the New York Mercantile Exchange (COMEX).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.