U.S. Government Shutdown Halts Economic Indicators

Uncertainty Over Outcome of Korea-U.S. Summit Talks

Exchange Rate Expected to Fluctuate in the 1,400-Won Range for Now

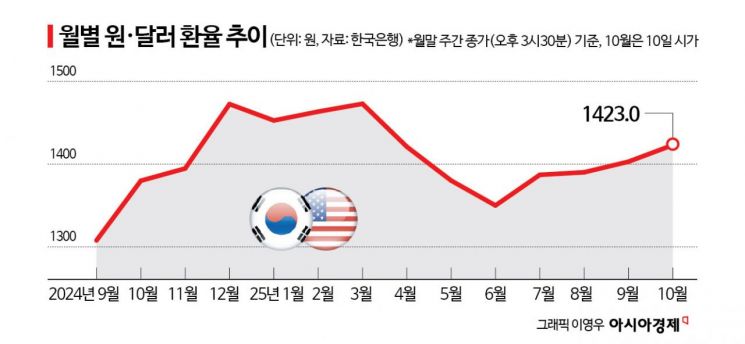

The won-dollar exchange rate surged above 1,420 won, rapidly absorbing a series of major variables during the long Chuseok holiday. Ongoing fiscal concerns due to the temporary shutdown of the U.S. federal government, combined with the weakness of non-dollar currencies-particularly the Japanese yen-have fueled the depreciation of the Korean won.

On the morning of October 10 in the Seoul foreign exchange market, the won-dollar exchange rate jumped more than 20 won from the previous session’s closing price (as of 3:30 p.m.), hovering around the 1,420-won mark. The exchange rate opened at 1,423.0 won, up 23.0 won from the previous session, and has been fluctuating within the 1,420-won range since.

As the U.S. Congress delayed the passage of the budget bill, the federal government shutdown has continued for the ninth consecutive day since October 1 (local time). The dollar index, which measures the value of the dollar against the currencies of six major countries, climbed to the 99 level, up from the closing price of 97.881 on October 2. The ongoing deadlock in Korea-U.S. trade negotiations over the method of investing $35 billion in the U.S. has also added to the downward pressure on the Korean won. The Japanese yen weakened on expectations that Sanae Takaichi, the leading candidate for the next prime minister and president of the Liberal Democratic Party, will continue Abenomics.

Experts predict that the won-dollar exchange rate will continue to fluctuate within the 1,400-won range for the time being, as global political events unfold. Moon Daun, a researcher at Korea Investment & Securities, commented, “There are no clear factors to drive the exchange rate lower until a definitive resumption of dollar weakness, which is unlikely until U.S. employment slows further. Moreover, even economic indicators are temporarily suspended due to the U.S. government shutdown. It is also uncertain whether the Korea-U.S. summit scheduled for the end of the month will result in an agreement favorable to Korea and the won.”

However, the potential for further sharp increases in the exchange rate is expected to be limited by concerns over the high level and possible intervention by authorities. Wi Jaehyun, an economist at NH Futures, noted, “For the exchange rate to rise further, supply and demand factors such as increased foreign exchange demand for overseas investment would be necessary.” He added, “Concerns about the elevated level, sustained global risk appetite, and the resulting inflow of foreign capital into the domestic stock market are factors that could restrain dollar buying.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.