4.7 Trillion Won Invested in Materials, Parts, and Equipment R&D Over Five Years

Sales Declined Across All Sectors from 2022 to 2023

Exports Increased Over Five Years, But Growth Rate Stagnates

Patent Registrations Down, Ministry Unaware of Causes

The government has invested more than 4 trillion won in the past five years to localize materials, parts, and equipment (commonly referred to as "Sobu-jang"), but the results in the field have fallen short of expectations. Although the research and development (R&D) budget and the number of projects have doubled or tripled, sales and exports have recently entered a downward trend, and the number of patents has remained stagnant.

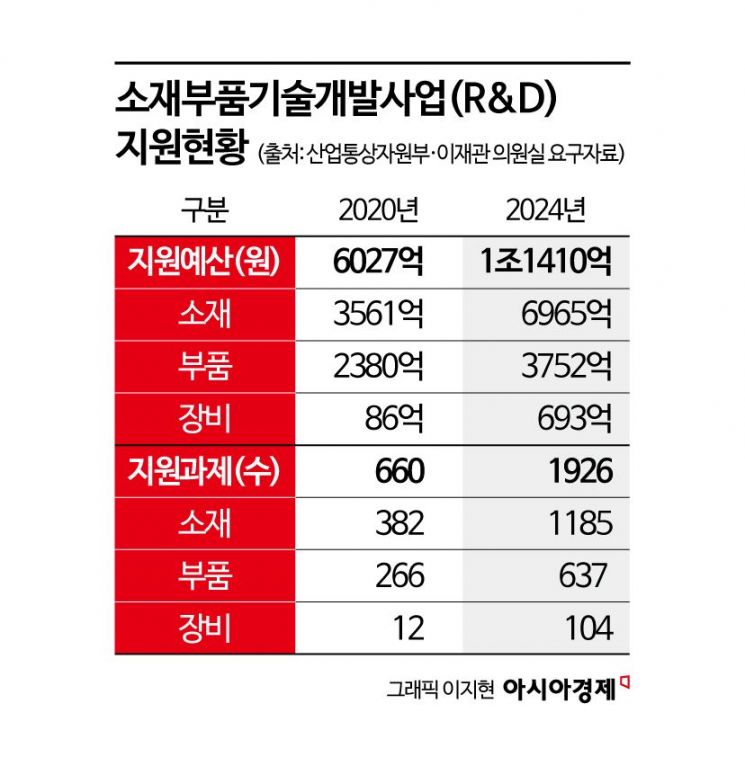

According to data requested by Assemblyman Lee Jaegwan of the Democratic Party of Korea from the Ministry of Trade, Industry and Energy on October 9, the government has allocated a total of 4.7 trillion won to support R&D for materials, parts, and equipment over the past five years. The budget allocated to companies in these sectors has increased every year, nearly doubling from 602.7 billion won in 2020 to 1.141 trillion won last year. During the same period, the number of supported projects also increased nearly threefold, from 660 to 1,926.

The Materials, Parts, and Equipment Technology Development Project is a government initiative aimed at reducing dependence on overseas sources for materials and parts, and enhancing global competitiveness through technological advancement. The Ministry of Trade, Industry and Energy oversees the project, while the Korea Evaluation Institute of Industrial Technology (KEIT) manages its implementation. After Japan announced export restrictions in 2019, supply chain instability became a major issue, prompting the government to introduce the "Measures to Strengthen Competitiveness of Materials, Parts, and Equipment" and establish a special law and special account for Sobu-jang the following year. Since then, the government has annually supported joint R&D, equity investments, and joint ventures for companies in these sectors.

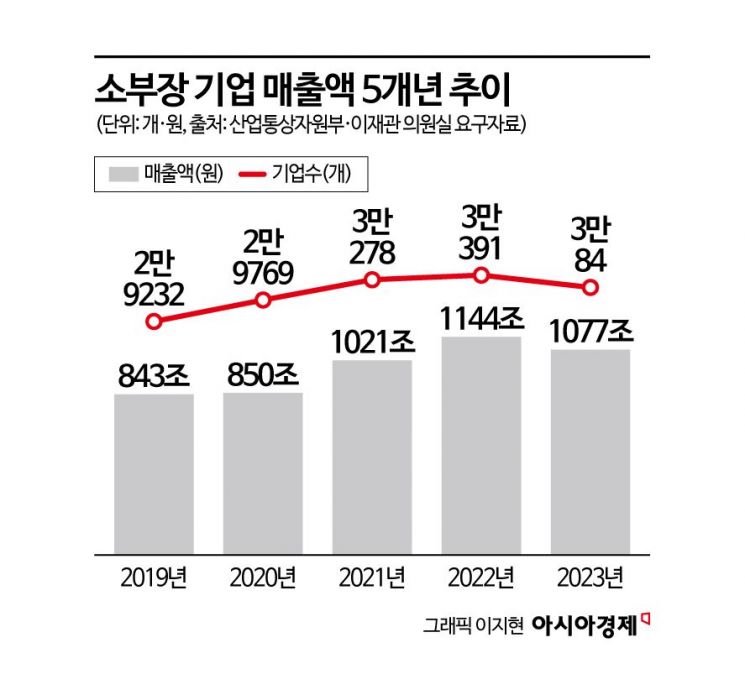

However, the results have been somewhat disappointing. The sales of Sobu-jang companies fell from 1,144 trillion won in 2022 to 1,077 trillion won in 2023. Compared to five years ago in 2019, this represents an increase of about 234 trillion won, but after peaking in 2022, sales declined again. During the same period, sales decreased across all sectors: materials companies (from 432 trillion won to 396 trillion won), parts companies (from 652 trillion won to 624 trillion won), and equipment companies (from 60 trillion won to 58 trillion won).

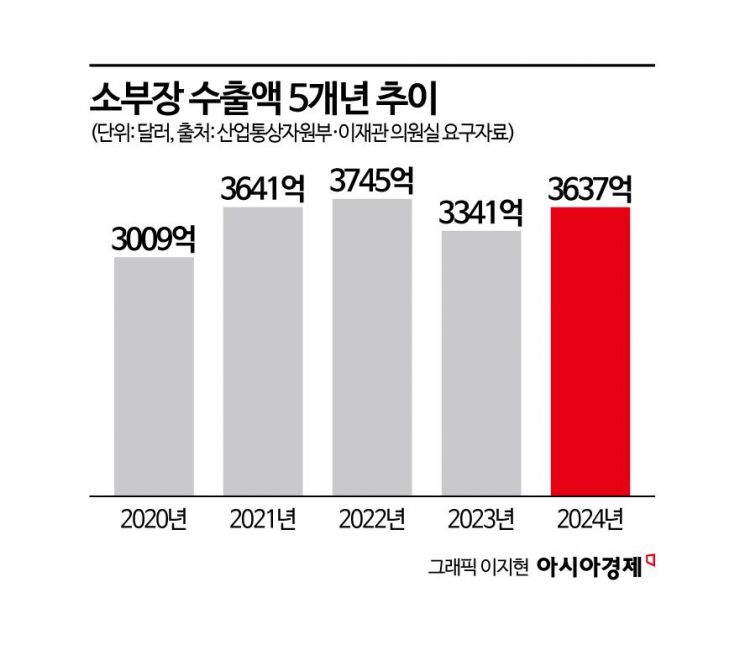

Over the past five years, exports by Sobu-jang companies have shown an upward trend. Total exports rose about 21% over four years, from 300.9 billion dollars (421 trillion won) in 2020 to 363.7 billion dollars (510 trillion won) last year. However, export figures also dropped sharply from 2022 to 2023. Total exports in this sector fell from 374.5 billion dollars in 2022 to 334.1 billion dollars in 2023, before rebounding to 363.7 billion dollars last year.

When converted to average annual growth rates, sales growth was found to be 2 to 3 percentage points higher than the manufacturing sector's average growth rate of around 4%. In particular, the average annual sales growth rate of materials companies was the highest, at about 7%. On the other hand, export competitiveness has effectively stagnated. While the average annual export growth rate for the entire manufacturing sector is in the 7% range, the growth rate for Sobu-jang exports has remained below 5%. Among these, the average annual export growth rate for materials companies was in the double digits, higher than the manufacturing average, while the rate for parts companies was the lowest, in the 2% range.

Looking at the results in the R&D support sector, sales rose steadily over the past five years but plummeted from 385.81 billion won in 2023 to 304.52 billion won in 2024, a sharp drop of about 80 billion won. This was largely due to the sales of materials companies falling by more than 100 billion won, from the 300 billion won range to the 200 billion won range. Private sector investment increased every year, from 85.61 billion won in 2020 to 127.91 billion won in 2024.

The number of registered patents actually decreased, from 490 in 2020 to 478 in 2024. In particular, the number of patents registered by materials companies plummeted from 353 to 249 over five years.

The Ministry of Trade, Industry and Energy, which is the department in charge, has not conducted a detailed performance analysis for Sobu-jang companies. An official from the ministry stated, "We conduct surveys on the utilization of results related to the materials and parts technology development project, but we have not analyzed the specific causes," adding, "Performance management for Sobu-jang companies is carried out on a mid- to long-term basis, in five-year cycles." The official further explained, "In 2022, demand for semiconductors slowed, the economy contracted after the COVID-19 pandemic, and external factors such as the US-China conflict had a combined impact, which appears to have led to the decline in sales and exports."

The head of a domestic parts company commented, "Korean companies now have to compete globally, but while China provides direct subsidies to each company based on sales, our support is focused mainly on R&D." He added, "Direct support could violate World Trade Organization (WTO) agreements, but with the WTO system collapsing, it is time for Korea to reconsider whether we need to comply with the regulations as strictly as before."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)