"Possible Re-evaluation as a Specialized Investment Firm

with a Growth Portfolio"

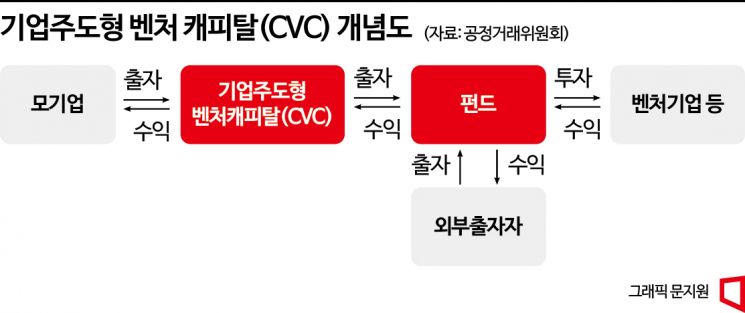

President Lee Jaemyung has instructed a review of partial deregulation, including the separation of industrial and financial capital, to promote investment in the artificial intelligence (AI) industry. This is expected to lead to the easing of regulations on corporate venture capital (CVC) for holding companies.

On October 2, Yuanta Securities researcher Lee Seungwoong stated, "It is expected that restrictions on the proportion of external capital in holding company CVC funds will be relaxed. This would make it possible to create mega-sized funds worth hundreds of billions to trillions of won and expand scaling-up investments in promising startups."

The previous day, after meeting with OpenAI's Sam Altman, President Lee instructed a review of easing certain regulations, including the separation of industrial and financial capital, to promote investment in the AI industry. OpenAI has requested Samsung Electronics and SK Hynix to supply 900,000 DRAM wafers per month until 2029. In response, President Lee directed a review of easing separation regulations within a safe framework that ensures there are no monopolistic abuses during procurement, in order to secure the astronomical funding required.

Currently, under the Fair Trade Act, a holding company’s CVC can only be established as a wholly owned subsidiary, and the debt ratio is limited to 200% of equity capital. When forming a fund, the proportion of external capital must be within 40%, and overseas investments are only allowed up to about 20% of the CVC’s total assets. Researcher Lee explained, "If restrictions on external capital are relaxed, it would become possible to attract funds not only from the parent company but also from external investors, enabling CVCs to take on the role of general partner (GP)."

As a result, it is expected that strategic investments aligned with the business direction of the holding company, as well as financial investments aimed at maximizing returns for external limited partners (LPs), will be pursued in parallel. Researcher Lee projected, "This will not only reduce the funding burden on holding companies but also expand investment opportunities in future growth engines for the group through the creation of large-scale funds, ultimately enhancing capital efficiency."

Additionally, Researcher Lee added, "Holding companies will increasingly be highlighted as group control towers investing in future growth engines through CVCs, and it will be possible to re-evaluate their valuation as specialized investment firms with growth portfolios."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.