Deposit Rates Raised by Five Major Banks for the First Time in Over a Year

Gap Between Lending and Deposit Rates Widens for Third Consecutive Month

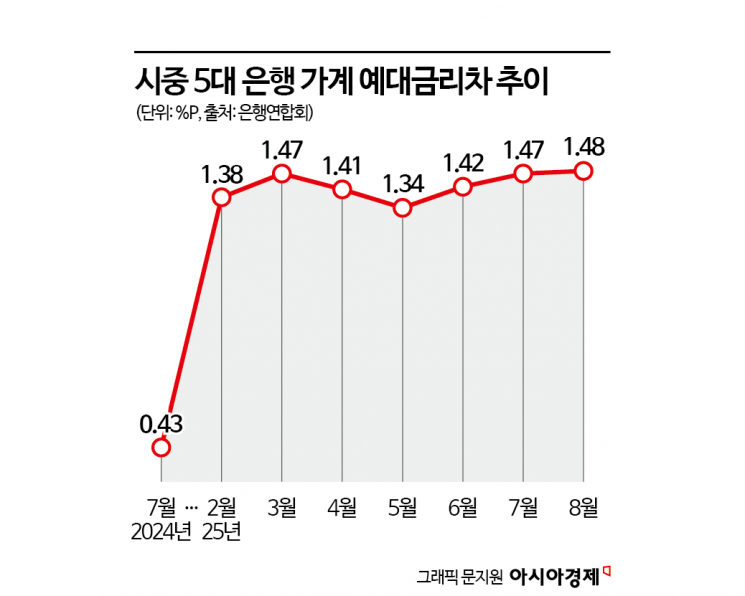

Although major commercial banks have slightly raised their deposit interest rates for the first time in over a year, the interest rate spread between loans and deposits (loan-deposit margin) has actually widened further. This is because, while the rise in market interest rates-which directly affects deposit rates-has been reflected in deposit products, loan interest rates have remained high due to the government's strengthened household debt management policy. The loan-deposit margin has now widened for three consecutive months, and with expectations that this trend will continue, borrowers are likely to face an even greater interest burden going forward.

According to the banking sector on October 2, the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) recently raised their term deposit rates by 0.02 to 0.05 percentage points. KB Kookmin Bank increased the interest rate on its flagship product, 'KB Star Term Deposit,' by 0.05 percentage points from 2.45%. Shinhan Bank also raised the rate on its one-year 'Solpyeonhan Term Deposit' from 2.45% to 2.50%. Hana Bank increased the maximum rate for its 'Hana Term Deposit' from 2.50% to 2.55%. Woori Bank raised its one-year 'WON Plus Deposit' rate by 0.05 percentage points to offer 2.50%. NH Nonghyup Bank increased the rate on its 'NH All One e-Deposit' by 0.02 percentage points, from 2.53% to 2.55%. This marks the first increase in one year and three months since June of last year.

The background for raising deposit rates despite an overall trend of falling interest rates is an adjustment in response to rising market rates. Separate from the Bank of Korea's base rate, banks' deposit rates are directly linked to market rates, such as bond yields. With recent volatility in mid- to long-term market rates due to uncertainties over US interest rates and an increase in government bond issuance, deposit rates have also been adjusted.

Competition to attract deposits is also cited as a reason for the increase in deposit rates. Typically, as the year-end approaches, corporate demand for funds rises and household loans increase, leading to fiercer competition among banks to secure deposits. For banks, this is a time when they need to attract more deposits, so they may raise deposit rates to prevent customer attrition. However, banks explained that this is not a response to concerns over money movement following the increase in deposit insurance coverage to 100 million won.

An official at one commercial bank explained, "Banks can raise funds not only through deposits but also by issuing bonds, and as bank bond yields have recently risen, deposit rates have also been increased. As the year-end approaches, banks face more outflows, so this is a measure to defend deposit balances, not a response to the Deposit Insurance Act or the government's warnings about widening loan-deposit margins."

In reality, the increase in deposit rates by banks has not been enough to reverse the trend of a widening loan-deposit margin. In fact, despite the rise in deposit rates, the margin has grown even larger. According to the Korea Federation of Banks, the average loan-deposit margin for new household loans (excluding policy-based loans for low-income borrowers) at the five major commercial banks stood at 1.48 percentage points in August, up 0.01 percentage points from 1.468 percentage points in the previous month, marking a third consecutive month of increase. By bank, Nonghyup Bank had the highest margin at 1.66 percentage points, followed by Shinhan Bank (1.50 percentage points), Kookmin Bank (1.44 percentage points), Hana Bank (1.43 percentage points), and Woori Bank (1.37 percentage points).

The problem is that the trend of a widening loan-deposit margin is likely to continue. While there are expectations that the US Federal Reserve may cut its benchmark interest rate, domestic financial authorities are strengthening household debt management, making it difficult for banks to lower loan rates easily.

Additionally, as part of the new government's emphasis on transitioning to productive finance, the minimum risk weight for new mortgage loans has been raised from 15% to 20%. As a result, banks now have a greater incentive to increase interest rates on new mortgage loans.

An official in the financial sector stated, "Although deposit rates have been raised, the increase is too minimal to significantly narrow the loan-deposit margin, and with household debt risks still present, it will be difficult for loan rates to come down. While the adjustment of mortgage risk weights is positive from a soundness management perspective, it will increase the interest burden for borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)