Bank of Korea's Financial Stability Situation Report

"Bottom 20" in Soundness See 0.9% Decline

31% of Deposits Maturing in Q4... "Year-End Money Movement May Expand"

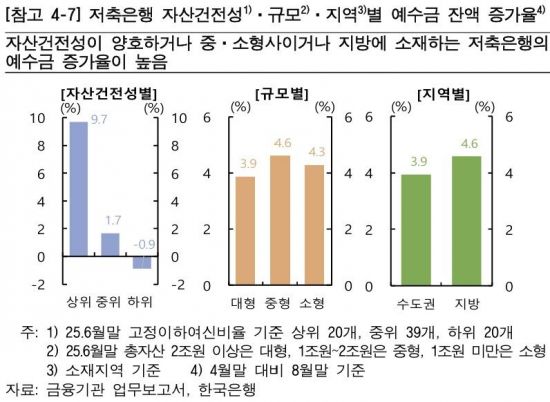

Following the increase in the deposit insurance limit, savings banks have seen a rise in deposit balances. However, it has become apparent that funds have been concentrated in a select group of savings banks with strong financial health. The top 20 savings banks, based on soundness criteria, experienced a 9.7% increase in deposits over four months, while the bottom 20 saw a 0.9% decrease. There are projections that this internal "money move" within savings banks may intensify toward the end of the year, when a large volume of deposits reaches maturity.

According to the Bank of Korea's "Financial Stability Situation" report released on September 25, the deposit balances of savings banks have consistently increased since May, when the legislative notice regarding the increase in the deposit insurance limit was issued. As of the end of August (provisional data), the balance was up 4% compared to the end of April. The deposit insurance limit was raised from 50 million won to 100 million won on September 1, following the enactment of the law in January and the legislative notice in May.

The Bank of Korea analyzed that the confirmation of the implementation date after the legislative notice affected the sentiment of savings bank depositors. In fact, deposits exceeding 50 million won at savings banks rose by 5.4% between May and June, in contrast to deposits of 50 million won or less, which increased by only 0.4%. As a result, the proportion of deposits exceeding 50 million won in total deposits rose from 14.1% at the end of April to 14.8% at the end of June.

Among savings banks, those with stronger asset quality showed higher deposit growth rates. The top 20 savings banks in terms of asset soundness (measured by the ratio of substandard and below loans) saw a 9.7% increase in deposits as of the end of August compared to the end of April. In contrast, savings banks in the middle tier of soundness saw only a 1.7% increase, while the bottom 20 experienced a 0.9% decrease.

By size, large savings banks recorded a 3.9% increase, while medium-sized and small savings banks posted higher growth rates of 4.6% and 4.3%, respectively. Regionally, savings banks in the Seoul metropolitan area saw a 3.9% increase, whereas those in other regions posted a larger increase of 4.6%. A Bank of Korea official stated, "Savings banks, concerned about deposit outflows to large and metropolitan institutions, raised their deposit rates above the industry average, which appears to have contributed to the growth."

The Bank of Korea expects the growth in deposit balances at non-bank deposit-taking institutions, such as savings banks and mutual finance companies, to continue. In addition to the higher deposit insurance limit, factors such as increased demand for high-interest deposit products due to falling market interest rates and inflows of funds ahead of the reduction of tax exemptions on mutual finance products are also expected to have an impact.

However, with the increase in the deposit insurance limit, the need to spread deposits across multiple institutions has diminished, raising the possibility that deposits will become further concentrated in institutions with strong asset quality within the sector. In particular, both savings banks and mutual finance companies have a high proportion of deposits maturing in the fourth quarter of this year, so the scale of money movement triggered by the increased deposit insurance limit could expand further toward year-end.

Meanwhile, the impact of the higher deposit insurance limit on commercial banks and other deposit banks appears to be limited. The growth rate of time deposits slowed after April, with the increase from January to August this year (3.9%) falling short of the same period last year (5.4%). This is believed to be the result of a combination of factors, including banks' proactive deposit-gathering strategies and a slowdown in demand for funds following the tightening of household debt regulations on June 27.

While the impact of money movement to secondary financial institutions is expected to remain limited for the time being, the Bank of Korea noted that, depending on interest rate levels, some deposit migration from commercial banks to internet-only banks could occur.

A Bank of Korea official commented, "The expansion of the deposit insurance limit is not expected to result in significant fund movement between financial institutions. However, if competition for deposits intensifies and interest rate differences widen, the scale could increase. Care must be taken to ensure that excessive competition over deposit rates does not undermine the soundness of financial institutions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.