$13.8 Trillion in Technology Transfers by Korean Firms as of September

Alteogen's SC Formulation Technology Powers Keytruda

Oscotec, Original Developer of Leclaza, Also Gains Royalty Revenue

The domestic bio industry is establishing itself as a "profit-generating industry." Once criticized as a "dream-chasing industry" that focused only on announcing clinical results without generating revenue, the ecosystem is now seen as reaching a turning point, as more companies have begun to create actual cash flow in recent years.

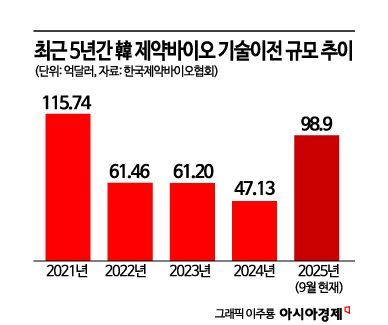

According to the industry as of September 2025, the total value of technology transfer contracts by domestic pharmaceutical and bio companies reached $9.89 billion (approximately 13.8954 trillion won). This figure has already far surpassed last year's annual total of $4.713 billion (about 6.3908 trillion won) and is on track to exceed the record high of $11.574 billion (about 15.6943 trillion won) set in 2021. There has long been skepticism that the scale of technology transfer contracts by pharmaceutical and bio companies was just a "rosy number" achievable only at the commercialization stage. However, an increasing number of domestic pharmaceutical and bio companies are now generating real cash flow not only through upfront payments and milestone payments from technology transfers, but also through royalties from commercialization.

Alteogen's recent achievements are particularly notable. The subcutaneous injection formulation of Merck's anti-cancer drug "Keytruda SC," which utilizes Alteogen's technology, received product approval from the U.S. Food and Drug Administration (FDA) on September 21. The value of the license-out (technology transfer) agreement for Keytruda, including upfront and milestone payments, amounts to about $1 billion (approximately 1.4 trillion won), and there are projections that annual revenue from royalties alone could reach 1.6 trillion won after 2030.

Oscotec, the original developer of the lung cancer drug "Leclaza" (ingredient: Lazertinib) and a domestic bio company, is also transforming into a "profit-generating company." In the first half of this year, Oscotec received a total of 10.6 billion won in milestone and royalty payments from Yuhan Corporation for Leclaza. Including the upfront payment received when Leclaza was initially licensed out in 2015, Oscotec's cumulative earnings from milestones and royalties surpassed 100 billion won as of the first half of this year. Yuhan Corporation, which licensed out Leclaza to Johnson & Johnson, receives more than 10% of Leclaza's sales as royalties and pays 40% of this amount to Oscotec. With sales expected to increase further, the scale of future royalty payments is also anticipated to grow.

Further achievements are also expected from bio companies such as Ligachem Bio and ABL Bio, which have transferred new drug and platform technologies to global big pharma companies. In addition, the "profit-generating bio era" pioneered by the "bio big two"-Samsung Biologics in the contract development and manufacturing organization (CDMO) sector and Celltrion in the biosimilar sector-is now in full bloom.

The increase in profit-generating companies signals a transformation of the entire industry ecosystem. In the past, stock prices would fluctuate sharply based on event-driven news such as "Phase 2 clinical trial success," but now, tangible figures like CDMO order backlogs, projected royalties, and direct sales of new drugs have become the benchmarks for evaluating corporate value. This enhances the predictability and stability of investments for investors and improves the overall capital-raising structure of the industry. As more companies establish stable profit models, latecomers can take bolder risks, and the government can also justify increased support for the industry.

Lee Seungkyu, Vice Chairman of the Korea Biotechnology Industry Organization, said, "This is a sign that the bio industry ecosystem is rapidly maturing. In particular, the recent technology transfer achievements of highly scalable platform technologies have opened a new breakthrough for the Korean bio industry." He added, "From 2023 to last year, domestic bio companies were in a slump due to reductions in R&D budgets, but this could serve as a turning point. However, public investment in the venture stage still needs to be expanded." Reported by Chung Donghoon and Choi Taewon.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)