Surprise Briefing on U.S. Plant Acquisition Announced Just Three Hours in Advance

Celltrion Shares Surge Nearly 9% on the 23rd

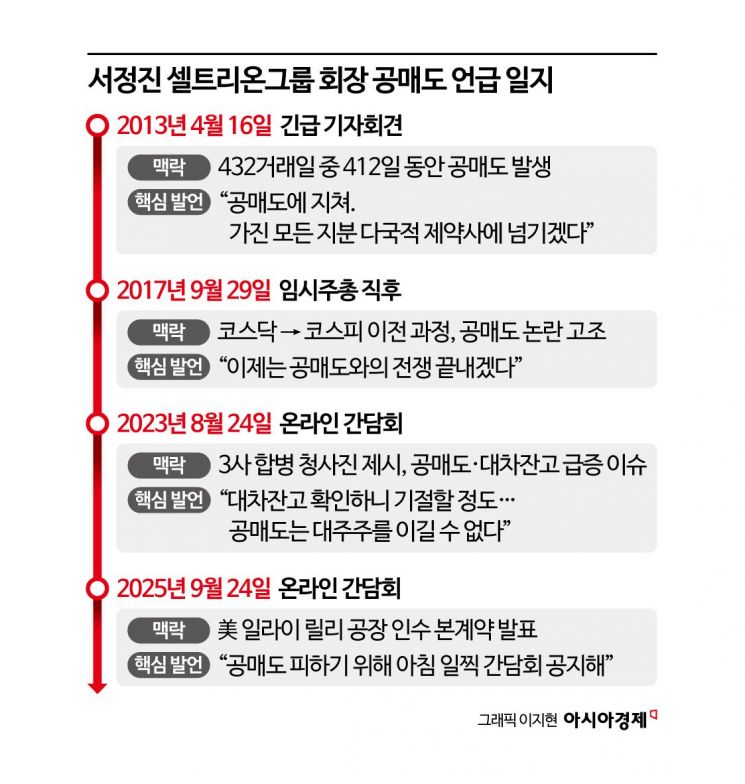

There is growing sentiment that Celltrion has opened a new chapter in its long-standing battle against short sellers. The company’s strategy to avoid short-selling attacks-by holding a surprise briefing regarding the signing of its main contract for the acquisition of overseas production facilities-has proven effective.

According to the bio and financial investment industries on September 24, Seo Jungjin, Chairman of Celltrion Group, held an online briefing at 10 a.m. the previous day and officially announced the signing of the main contract to acquire Eli Lilly’s production facility in New Jersey, United States. The briefing was announced at 7 a.m., just three hours before it began, breaking the usual practice of providing notice the previous afternoon and opting for a surprise announcement instead. Following the announcement, Celltrion’s share price closed up 8.87% at 184,200 won.

Chairman Seo explained directly, “Celltrion has been fighting against short selling for a long time. Every time we announced good news, short sellers would launch preemptive attacks. Today, to avoid that, we announced the briefing early in the morning.”

The adversarial relationship between Celltrion and short sellers dates back to the early 2010s. Whenever the company’s value surged, foreign hedge funds increased their short positions, citing “overvaluation relative to earnings.” Short-selling attacks intensified whenever concerns about clinical trial failures or accounting issues arose. In April 2013, Chairman Seo held an emergency press conference, revealing that short selling had occurred on 412 out of 432 trading days over the previous two years and even mentioned the possibility of selling his entire stake due to the pressure. Immediately after Celltrion’s transfer to the KOSPI in 2018, the short-selling balance held by foreign investors exceeded 10%, putting additional pressure on the stock price.

Chairman Seo has worked to restore trust by communicating directly with shareholders in the face of short-selling attacks. His practice of answering shareholders’ questions one by one for hours at general meetings and briefings has become a hallmark of Celltrion. Whenever he judged the stock to be undervalued, he carried out large-scale share buybacks and cancellations. This year alone, Celltrion has conducted nine rounds of share buybacks totaling over 850 billion won and decided to cancel shares worth 900 billion won to enhance shareholder value.

Celltrion Holdings completed the purchase of approximately 120 billion won worth of Celltrion shares by early June this year and is now pursuing an additional buyback of 500 billion won. Of this, 262 billion won worth of shares had been acquired by September, and the company recently announced plans to purchase an additional 125 billion won, with acquisitions set to begin in early October. The remaining approximately 125 billion won out of the planned 500 billion won is also scheduled to be completed within the year. Previously, Chairman Seo and Celltrion Skincure each acquired shares worth 50 billion won on the open market by July, further contributing to the enhancement of shareholder value.

There are also expectations that the overall direction of the company’s management may be brought into sharper focus. This investment is not merely seen as a defensive measure, but rather as a signal that Celltrion intends to proactively enter key markets like the United States and directly confront both domestic and international uncertainties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)