Sluggish Economy vs. Rising Housing Prices:

When Growth and Financial Stability Are in Conflict

Macroprudential Tightening Should Precede Rate Cuts for Maximum Effect

If Rates Are Cut First, Policymakers Seen as Passive

Expectations of

Amid sluggish economic conditions and rising housing prices-specifically, when the trade-off between growth and financial stability intensifies-a Bank of Korea analysis has found that implementing macroprudential strengthening measures before a policy rate cut is more effective. This report counters claims that the Bank of Korea missed an opportunity last August by not cutting rates despite an overheated real estate market and a weak economy.

On September 21, the Bank of Korea released its "BOK Issue Note-Analysis of the Impact of Macroprudential Policy and Effective Combination with Monetary Policy" (Choi Changhun, Chu Dongho, Yoon Jinwoon, Lee Gaeun). The report stated, "When economic sluggishness and concerns about expanding financial imbalances occur simultaneously, close policy coordination between monetary and macroprudential policy is necessary." It emphasized, "Strengthening macroprudential measures before cutting rates, rather than after, is a more effective policy combination."

Both this year and next, South Korea’s economic growth rate is expected to remain below potential, indicating continued sluggishness. Since the second half of last year, the upward trend in Seoul housing prices and the increase in household debt have heightened financial stability risks. When the trade-off between growth and financial stability intensifies, a rate cut can further increase risks to financial stability, making it difficult to achieve both economic and financial stability with monetary policy alone. Therefore, close coordination with macroprudential policy is required.

Choi Changhun, head of the Macro Model Team at the Bank of Korea’s Economic Modeling Division, explained, "This study was conducted to suggest an effective policy combination between monetary and macroprudential policy in situations where the trade-off between growth and financial stability is significant, based on model analysis of the factors affecting Seoul apartment prices and the financial stability-enhancing effects of macroprudential policy."

Choi noted, "Since June last year, the upward trend in Seoul apartment prices has been driven by supply-demand dynamics, sentiment, and interest rate factors, even as economic factors exerted downward pressure. This is similar to the period from October 2019 to April 2020, when the trade-off between growth and financial stability was also significant in monetary policy operations."

To analyze the financial stability-enhancing effects of macroprudential policy, the Bank of Korea conducted a comprehensive review of government policies introduced to stabilize the Seoul housing market and household debt, and calculated a macroprudential policy index. The index considered the introduction of new regulations, scope of application, changes in regulatory levels, and the designation or removal of regulated areas, reflecting the intensity of individual policies based on recent research. Choi pointed out, "Statistical analysis shows that changes in Seoul apartment prices precede macroprudential policy, suggesting that macroprudential measures have been tightened (or eased) in response to rising (or falling) housing prices."

Model analysis including the macroprudential policy index found that strengthening macroprudential policy had a significant effect in curbing the rise in Seoul apartment prices and the increase in mortgage lending. In contrast, the impact on constraining economic growth was not significant. Choi interpreted this as "indicating that strengthening macroprudential policy can partially offset the negative impact of accommodative monetary policy on financial stability."

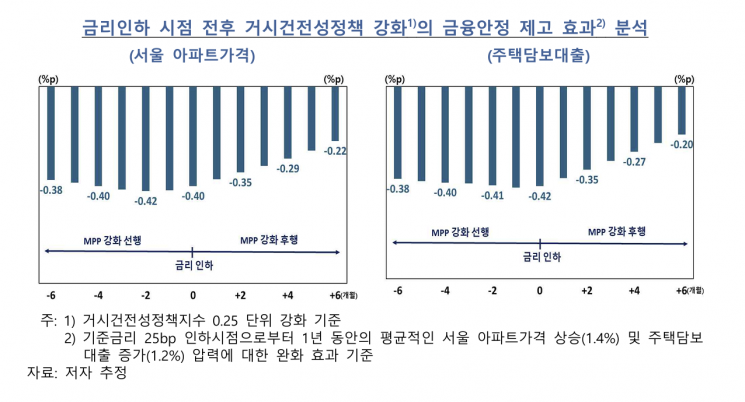

To identify the most effective combination of monetary and macroprudential policy, the study compared the financial stability effects depending on when macroprudential strengthening measures were implemented. The results showed that strengthening macroprudential policy before adopting accommodative monetary policy was more effective in curbing the rise in housing prices and the increase in household lending than implementing it afterward. Specifically, strengthening macroprudential policy ahead of a rate cut was estimated to reduce the upward pressure on Seoul apartment prices (which would average 1.4% over one year following a 0.25 percentage point rate cut) by about 0.4 percentage points.

Conversely, the later macroprudential policy strengthening follows a rate cut, the less effective it becomes in enhancing financial stability. In particular, if macroprudential strengthening lags the rate cut by four to six months, the effect in curbing the rise in Seoul apartment prices is estimated at only 0.2 to 0.3 percentage points, significantly lower than the 0.4 percentage point effect when it precedes the rate cut. The effect in curbing the increase in household lending was found to be similar.

Choi emphasized, "If rates are cut first without strengthening macroprudential policy in a situation where housing prices and household debt continue to rise, economic agents may perceive the authorities as being passive in addressing financial stability, which could fuel expectations of further housing price increases. The risk to financial stability from a rate cut would be amplified, while its effect in boosting growth could be weaker than usual."

In August last year, when the economy was sluggish and housing prices continued to rise, intensifying the trade-off between growth and financial stability, the Bank of Korea kept rates unchanged. In September, after the government strengthened macroprudential policy by introducing the second phase of the stress-based debt service ratio (DSR), the policy rate was cut by 0.25 percentage points from 3.50% to 3.25% in October. Although the August decision to hold rates faced some criticism, this study suggests it was an appropriate measure. Similarly, in July last year, the Reserve Bank of New Zealand strengthened macroprudential policy by introducing a new debt-to-income (DTI) ratio, followed by a policy rate cut from 5.25% to 5.00% in August.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.