Samsung Electronics and SK Hynix Lead the Stock Market

Performance Outlook Brightens for SiC Focus Ring Manufacturers

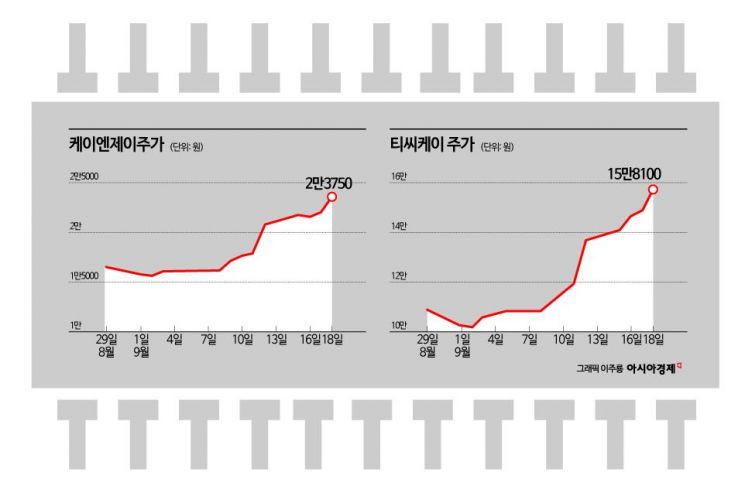

Share Prices Soar Over 40% This Month

Recently, the stock prices of semiconductor companies such as Samsung Electronics and SK Hynix have been steadily rising in the domestic stock market. As expectations for an improvement in the semiconductor industry continue to grow, the share prices of consumable semiconductor parts manufacturers TCK and KNJ have also surged significantly this month.

According to the financial investment industry on September 18, the stock prices of TCK and KNJ have risen by 44.4% and 43.7%, respectively, so far this month.

TCK is a semiconductor parts manufacturer specializing in the production of high-purity silicon carbide (SiC) components required for semiconductor etching processes. The SiC focus rings produced by TCK serve to hold wafers in place during plasma etching processes and are among the key components that maintain equipment stability and etching uniformity in high-temperature and high-plasma environments. While silicon (Si) focus rings were mainly used in the past, they are now being replaced by SiC, which offers a longer lifespan and generates fewer particle issues. Since focus rings also wear out during wafer etching processes, the occurrence of particles can impact yield and productivity.

Park Sanguk, a researcher at Shin Young Securities, stated, "TCK counts global etching equipment companies, including Lam Research, among its clients," adding, "Based on the structural changes in the NAND market, the demand for SiC focus rings for NAND is expected to increase."

Kim Hyungtae, a researcher at Shinhan Investment Corp., analyzed, "TCK is estimated to achieve sales of 314.1 billion won and an operating profit of 90.4 billion won this year," noting that "these figures represent increases of 13.9% and 11.9%, respectively, compared to last year."

KNJ also produces SiC focus rings. KNJ became the second company in the world to successfully develop SiC focus rings for semiconductor etching processes. The company began supplying them to SK Hynix for the first time in 2016. In 2019, it was also registered as a supplier of SiC focus rings for Samsung Electronics.

Park Seongsun, a researcher at the Korea IR Council, analyzed, "KNJ is expanding its deposition equipment lines every year to meet steadily increasing demand," and added, "The penetration rate of SiC focus rings currently stands at 35%, but there is potential for it to expand to 50%."

Researcher Park estimated that KNJ will achieve sales of 80.2 billion won and an operating profit of 22 billion won this year. These figures represent increases of 29.0% and 55.5%, respectively, compared to last year.

The market outlook is positive. There are multiple factors driving the growth of the consumable semiconductor parts market, including an increase in the cumulative number of equipment installed at client companies, rising process complexity, and a recovery in utilization rates. In addition, as process complexity increases due to high-bandwidth memory (HBM), gate-all-around (GAA), and higher-layer NAND, the lifespan of components is becoming shorter. Furthermore, as recent semiconductor manufacturing processes increasingly use high-power plasma, demand for consumables that can withstand such specialized environments is rising, further boosting expectations for improved performance among parts manufacturers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.