US Cuts Policy Rate by 0.25%P After Nine Months

Despite Dot Plot Suggesting Three Rate Cuts This Year, 'Hawkish' View Prevails

Powell: "Cut for Risk Management... Future Decisions Will Be Data-Dependent"

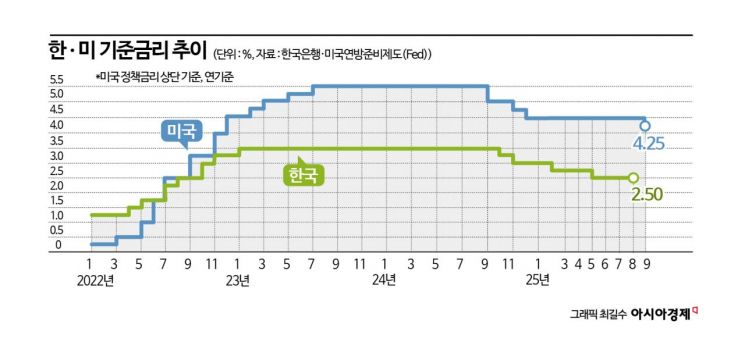

Korea-US Rate Gap Narrows to 1.75%P,

With the US Federal Reserve resuming its policy rate cuts after nine months, attention is focused on how this will affect the Bank of Korea’s Monetary Policy Committee’s base rate decision next month. The market has diagnosed that the narrowing of the interest rate gap between South Korea and the US has somewhat alleviated related pressures, creating conditions that allow for greater focus on domestic factors. However, there is a consensus that the outlook for US monetary policy remains uncertain, as Federal Reserve members are divided in their interest rate forecasts, so it is necessary to continue monitoring the situation. Domestically, expectations for rising housing prices, which were a major factor in the rate freeze decisions in July and August, remain a source of instability, making it important to watch developments over the next five weeks.

US Cuts by 0.25%P, Projects Two More Cuts... Why Is the Interpretation Still 'Hawkish'?

The market saw the Federal Reserve’s 0.25 percentage point cut to 4.00-4.25% at the Federal Open Market Committee (FOMC) meeting on the 16th-17th (local time) as in line with expectations. This was the first rate cut in nine months, following five consecutive rate freezes since January this year. In its policy statement, the Federal Reserve explicitly stated that downside risks to employment had increased. The dot plot also expanded the outlook for rate cuts within the year to three, suggesting two additional cuts.

Nevertheless, the market broadly interpreted this FOMC as hawkish. This view is based on several factors: Federal Reserve Chair Jerome Powell described the rate cut as a risk management move; only one member supported a ‘big cut’ of 0.5 percentage points or more; and the economic outlook saw upward revisions for economic growth and inflation, but a downward revision for the unemployment rate. There were also significant differences within the Federal Reserve regarding the future policy path. The dot plot’s projection of three rate cuts this year was a close call at 10 to 9, and seven members preferred to keep rates unchanged for the rest of the year. Gong Dongrak, an economist at Daishin Securities, assessed, “It is appropriate to view this rate cut as the resumption of a gradual rate cut cycle, not as an aggressive response to a sharp deterioration in employment or concerns over a recession.”

Park Jongwoo, Deputy Governor of the Bank of Korea, also said at a market situation review meeting held on the morning of the 18th, “There is now greater room to operate monetary policy with a focus on domestic economic conditions, inflation, and financial stability.” However, he added, “The outlook for policy rates among Federal Reserve members is quite divided, so uncertainty regarding the future path of US monetary policy remains high.” He also noted that external risk factors, such as uncertainties related to US tariff policy and concerns over fiscal soundness in major countries, persist, so the situation must be closely monitored.

‘Record High’ Korea-US Rate Gap Narrows, But Still Large at 1.75%P

Before this US policy rate cut, the interest rate gap between South Korea and the US had widened to a record high of 2.00 percentage points. With this cut, the gap has narrowed by 0.25 percentage points, easing some of the pressure, but the Korea-US rate gap still stands at a significant 1.75 percentage points. An expanded rate gap increases pressure on the exchange rate and the risk of capital outflows. The value of the won may fall, and foreign investment funds face a greater risk of exiting the domestic market in pursuit of higher returns elsewhere.

It is known that some members of the Monetary Policy Committee continue to express concerns about the interest rate gap between South Korea and the US. While it has not been a major risk factor so far due to various conditions, there is no guarantee this will remain the case, so the rate gap should continue to be considered a key variable in monetary policy. Bank of Korea Governor Lee Changyong also stated, “We do not adjust mechanically according to the Korea-US rate gap figures,” but acknowledged, “If the gap is large, it can be a burden, so we will monitor it along with other factors.”

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on August 28, 2025. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on August 28, 2025. Photo by Joint Press Corps

Expectations for Rising Home Prices in Key Seoul Areas Remain, Future Trends Are Crucial

Even when turning attention to domestic conditions, the key variables still require close monitoring. Expectations for rising home prices, which were a major reason for the rate freeze decisions in July and August, and the resulting upward trend in housing prices in key areas, have not subsided.

Although the government’s real estate measures on June 27 and September 7 have dampened sentiment among many buyers, some still expect further increases and are entering the market, causing prices to move. According to the Korea Real Estate Board, the sale price of apartments in Seoul rose by 0.48% in August compared to the previous month. Although this is a slower pace than in June (1.44%) and July (1.09%), the upward trend continues. In the second week of September, nationwide apartment prices rose by 0.01% compared to the previous week, marking a turnaround after ten weeks since the fifth week of June, when the June 27 measures were announced. Apartment prices in Seoul rose by 0.09%, with Gangnam-gu and Seocho-gu increasing by 0.15% and 0.14%, respectively.

According to the Bank of Korea, as of the end of August, the balance of household loans (including policy mortgages) at deposit banks increased by 4.1 trillion won compared to the end of July, marking another significant rise. Governor Lee emphasized, “The shared view among Monetary Policy Committee members is that rate cuts will not, at the very least, fuel expectations for rising home prices.” The market believes that since the upward trend and expectations for further increases in Seoul’s housing prices remain strong, the real estate market’s movements-such as whether the effects of the September 7 measures become apparent over the five weeks before the October Monetary Policy Committee meeting-will be a key variable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.