1 billion won cap eased by September 7 measures

Woori Bank leads, KB Kookmin, Shinhan, and Hana to follow

Uncertain demand as household lending limits tighten in second half

Mortgage refinancing loans, which had been effectively suspended due to the June 27 measures, will gradually resume starting this week. This move comes after the government eased regulations through the September 7 measures, following criticism that even genuine borrowers seeking to reduce their interest burdens were being adversely affected. Woori Bank was the first to resume these loans, and other major commercial banks are also set to restart them within the week. However, since refinancing loans are included in the total household loan cap, it remains uncertain whether borrowers will actively switch lenders to reduce their financial costs.

According to the banking sector on September 16, KB Kookmin Bank, Shinhan Bank, and Hana Bank have decided to resume mortgage refinancing loans exceeding 100 million won this week. Woori Bank resumed such loans on September 12 and will also accept non-face-to-face applications within the week. However, only refinancing loans without any increase in the loan amount are allowed. Among the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup), only Nonghyup Bank has decided not to allow refinancing loans exceeding 100 million won due to limited capacity for household lending.

Previously, the financial authorities had limited refinancing loans for the purpose of living stabilization funds to 100 million won through the June 27 measures. While this was intended to prevent excessive concentration of funds in the housing market, most mortgage loans in the Seoul metropolitan area and regulated regions exceed 100 million won, leading to criticism that the policy amounted to a de facto suspension. Nationwide, the average outstanding mortgage per borrower is 150 million won, and the figure is even higher in the metropolitan area, making refinancing practically impossible. As criticism mounted that the excessive regulation was harming genuine borrowers seeking to lower their interest burdens, the financial authorities eased the regulation through the September 7 measures.

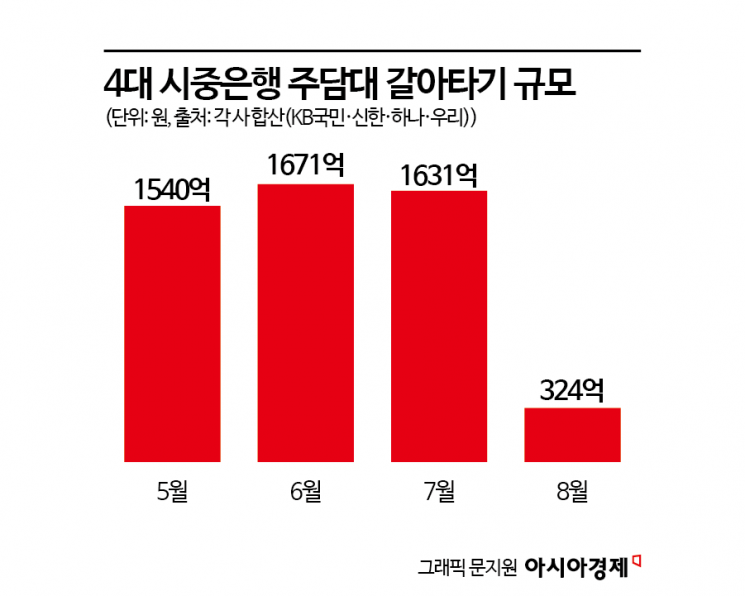

In fact, just before the June 27 measures were announced, the four major commercial banks (KB Kookmin, Shinhan, Hana, and Woori) were issuing over 100 billion won in refinancing loans each month. The figures were 154 billion won in May, 167.1 billion won in June, and 163.1 billion won in July, but dropped to 32.4 billion won in August, a decrease of nearly 80%. Since there is usually a one-month time lag before refinancing loans are executed, the impact of the June 27 measures became fully apparent starting in August.

The confusion affected not only borrowers but also banks. Until earlier this year, financial authorities had actively encouraged refinancing loans to curb the growth of household debt and ease interest burdens for ordinary citizens. In the case of mortgage loans, refinancing does not increase the total household loan amount, so there is no change in the overall scale. Borrowers could switch to lower interest rates and reduce their principal and interest repayment burdens, so the authorities instructed banks to prioritize refinancing loans over new loans. In response, banks lowered their refinancing loan rates to attract customers.

Meanwhile, although refinancing loans have resumed, it is uncertain whether they will be actively utilized. This is because the total household loan target for the second half of the year has been reduced by about half, leading to stricter loan management by each bank. While refinancing loans do not affect the total lending volume of the financial sector as a whole, they do count toward each individual bank's loan cap, making them a burden for banks.

An official at a major commercial bank said, "Most banks have already completed preparations for their refinancing loan IT systems," but added, "Unlike the first half of the year, when refinancing loans were actively encouraged, in the second half, with the household loan target cut in half, even banks with some leeway are feeling burdened by an increase in refinancing loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.