[Hyundai Motor, Over the Mobility] (32)

Hyundai Motor Falls Behind in Mass-Produced Autonomous Vehicles and Services

Gap with Leading Group Widens... Aggressive Strategies from Tesla and BYD

Motional Drops 10 Spots in Comprehensive Autonomous Dri

▲A Motional Ioniq 5 robotaxi, developed by Hyundai Motor Group's autonomous driving joint venture, undergoing test driving in the United States. Provided by Hyundai Motor Group

▲A Motional Ioniq 5 robotaxi, developed by Hyundai Motor Group's autonomous driving joint venture, undergoing test driving in the United States. Provided by Hyundai Motor Group

"Among traditional automakers, Hyundai is transitioning to Software Defined Vehicles (SDVs) at the fastest pace."

These are contrasting assessments from the domestic autonomous driving industry regarding Hyundai Motor Group's software technology strategy. At first glance, the two statements appear to be in opposition, but they share the same underlying concern: Hyundai Motor Group has lagged behind the industry's leading group in both SDV transition and autonomous driving technology development. The transition to SDVs and autonomous driving are closely intertwined. Building an SDV platform that allows vehicles to be controlled by software must come first, as autonomous driving technology can only be deployed on this foundation. In other words, autonomous driving is the killer content of SDVs.

Recently, there have been criticisms within the industry that Hyundai Motor Group's SDV strategy and autonomous driving technology are failing to close the gap with the leading group. In the mass production vehicle sector, the application of Level 3 (where the driver and the vehicle alternate driving) technology has been delayed, and in the service market, including robotaxis, the development of autonomous driving technology by Motional, Hyundai Motor Group's joint venture, has also been sluggish. It is necessary to examine the limitations of Hyundai Motor Group's SDV and autonomous driving strategies and what extraordinary measures are needed to catch up with the leaders.

Hyundai's Autonomous Driving: Lagging Behind

In 2023, Kia attempted to implement a "hands-off" function in its large electric SUV, the EV9, allowing drivers to take their hands off the wheel while driving at 80 km/h on highways, but ultimately withdrew the feature. This function is the first gateway to Level 3 autonomous driving. Kia promoted this feature extensively at the time of new car contracts, and dealerships accepted orders for this option. However, it was omitted from the final production vehicles due to concerns that stability was not sufficiently ensured during rainy or nighttime driving. In addition, with most countries regulating such features to speeds below 60 km/h, Kia's plan to raise the speed limit required even more stringent safety verification.

Meanwhile, competitor Mercedes-Benz launched mass-produced Level 3 autonomous vehicles supporting speeds up to 95 km/h starting this year, but actual sales have been minimal compared to the "world's first Level 3 mass-produced vehicle" title. This is because the additional cost for the feature is perceived as too high compared to its benefits. If drivers must pay an extra 10 million won for a function that can only be used on slow lanes of highways during clear daytime weather and only when there is a car ahead, few are likely to choose it.

Moreover, the moment a vehicle is released with the "Level 3" label, responsibility for accidents becomes ambiguous between automakers and drivers. For manufacturers, this means taking on significant legal risks from numerous accidents. For this reason, Hyundai Motor Group appears to have prioritized safety over aggressively pursuing the "first Level 3 mass-produced vehicle" title. For the time being, global automakers are likely to continue gradually expanding autonomous driving features under the "Level 2+" label, while leaving accident liability with the driver.

The autonomous driving service market, represented by robotaxis, is developing even faster than the mass production vehicle market. The leaders in this field are tech companies such as Waymo (Google) in the United States and Baidu in China. Hyundai Motor Group is also falling further behind the leaders in this sector. According to Guidehouse Insights, which compiles annual comprehensive autonomous driving rankings, Motional, Hyundai Motor Group's autonomous driving joint venture, plummeted to 15th place in the 2024 rankings, a drop of 10 spots from the previous year. Motional had consistently ranked in the top 5-6 since 2020, but suddenly fell out of the top 10 last year. This was due to delays in commercialization services as business conditions worsened. Aptiv, which co-invested with Hyundai, announced last year that it would halt further investment in Motional, and Motional responded by replacing its CEO and laying off over 500 employees. The robotaxi pilot service in Las Vegas was also suspended.

Until the early 2020s, the leading group in this category included many traditional automakers such as General Motors (GM), Ford, and Volkswagen. However, the landscape has changed completely in just a few years. In 2024, the leaders are big tech companies like Waymo (Google), Baidu, Mobileye (Intel), and Nvidia. Guidehouse ranks companies based on various criteria, including corporate vision, market entry strategy, business partners, product strategy, technological capability, regulatory compliance, and innovation. Last year, Motional received the lowest scores in business partner and market entry (commercialization) strategies.

Hyundai has also been evaluated as lagging behind newcomers such as Tesla and BYD in building SDV platforms. At CES 2024, the world's largest electronics and IT exhibition, Hyundai Motor Group presented its vision for a centralized electric/electronic (E/E) architecture equipped with high-performance computers. The plan is to launch pilot vehicles in the third quarter of 2026 and begin full-scale mass production in 2027. The group also aims to introduce vehicles with Level 2+ advanced driver assistance systems (ADAS) by 2027. The problem is that the features Hyundai and Kia plan to introduce in 2027, such as traffic light recognition and overtaking stopped vehicles, have already been implemented by Tesla and Chinese companies. A representative from FortyTwoDot commented, "China is ahead of us simply by having developed services that operate in real-world environments," but added, "However, in terms of driving convenience and safety, we can provide better services."

Despite the announcement of a new vision, Hyundai's stock price has remained stagnant. This is because the E/E architecture scheduled for release in 2026 is not considered a disruptive innovation that will drive market change. Tesla first introduced this architecture to the industry in 2019, and BYD has been expanding its vehicle lineup using it since 2023. The specifications of Hyundai's high-performance architecture currently under development also lag significantly behind those of new entrants. Hyundai and Kia have announced plans to gradually raise the neural processing unit (NPU) computing power from the current 200 TOPS (200 trillion operations per second) to 800 TOPS by 2030, but as of 2025, Tesla and Chinese smart cars already offer computing hardware at the 500 TOPS level. The industry criticizes Hyundai Motor Group for being overly conservative and slow to respond.

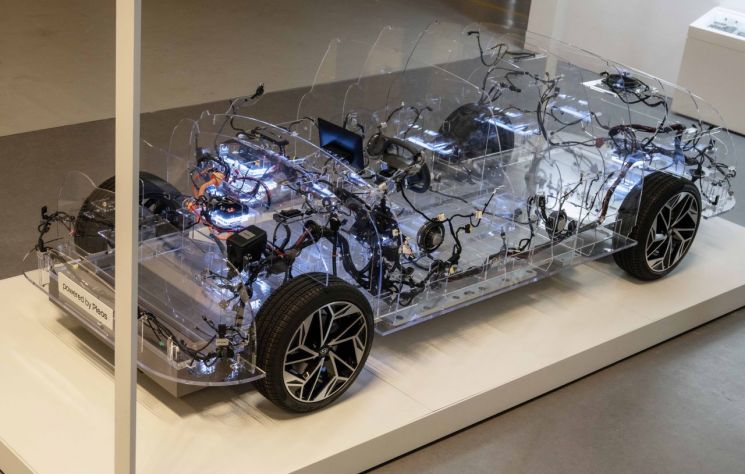

Electric/Electronic (E/E) architecture being developed by Hyundai Motor Group for the transition to Software Defined Vehicle (SDV). Provided by Hyundai Motor Group

Electric/Electronic (E/E) architecture being developed by Hyundai Motor Group for the transition to Software Defined Vehicle (SDV). Provided by Hyundai Motor Group

Where Did Hyundai's Autonomous Driving Strategy Stall?

The problems surrounding Hyundai's SDV transition are comprehensive. First, the group's investments in new technologies are excessively dispersed. In addition to SDVs and autonomous driving, there are simply too many new industries requiring investment, such as robotics, advanced air mobility (AAM), and hydrogen energy. To use an exam analogy, Hyundai has studied all subjects to avoid falling behind in any, but does not excel in any particular area. If the group had focused its investments and resources on SDVs and autonomous driving, where the most visible results could be achieved, Hyundai Motor Group might have become a leading company in autonomous driving by now.

Not only investments, but also Hyundai Motor Group's autonomous driving technological capabilities and workforce are spread across multiple divisions. Within the group, autonomous driving research organizations are divided among Motional in the United States (developing robotaxi services), the AVP division at the Hyundai and Kia Namyang Research Center, and the group software affiliate FortyTwoDot. The lack of integration of personnel and technical capabilities is said to be slowing development.

Another issue is Hyundai Motor Group's perfectionism. The group has always prioritized quality and safety, considering the trust and durability it has built up over time as core assets that cannot be compromised. These values have driven Hyundai Motor Group to become the world's third-largest automaker. However, innovation, especially pioneering uncharted territory, inevitably involves trial and error. While American and Chinese companies have rapidly improved their technologies through repeated failures, Hyundai Motor Group's reluctance to accept failure has instead slowed the pace of innovation.

Consider the case of Tesla, widely viewed as an innovative company. Tesla distributes its not-yet-fully-mature autonomous driving technology to a small group of drivers for free to verify safety. If defects or issues are found during this process, they are addressed in the next software update. The company continuously collects data and improves upon failure cases, creating a structure for steady advancement. The more drivers agree to share their data, the faster the technology evolves. Tesla has thus created a virtuous cycle of growth through failure.

Chinese automakers, including BYD, are taking a similar approach. BYD recently announced that it would equip all its vehicles, including low-cost models, with its in-house ADAS "Shenyi Zhi Yan" ("Eye of God") as a standard feature. This is a far more aggressive policy than Tesla, which offers full self-driving (FSD) as an option. Furthermore, BYD has taken the bold step of promising to take full responsibility and provide compensation if an accident occurs while using the "Eye of God" feature. While acknowledging failures and mistakes, BYD demonstrates a strong commitment to rapidly advancing technology through the collection of massive amounts of data.

Finally, Hyundai's speed as a "fast follower" has dropped significantly. In the past, Hyundai Motor Group was an organization renowned for its speed. It developed its own Alpha engine in just nine years and completed a dedicated electric vehicle platform in about five years. While it succeeded in transitioning from internal combustion engines to electric vehicles faster than anyone else, transitioning into a software company requires a fundamental transformation of the organization's structure.

In contrast, new companies such as Tesla and Chinese electric vehicle makers are advancing at a rapid pace. They do not have legacy assets such as internal combustion engines or hybrids. As a result, they do not need to worry about depreciation costs from development or facility investments. Starting from scratch, they have been able to boldly introduce innovative platforms. Compared to them, Hyundai Motor Group is a massive organization. Its accumulated assets and systems act as a drag, making it virtually impossible to discard all existing frameworks and start over from the beginning.

What Must Hyundai Do to Lead in Autonomous Driving?

Does this mean Hyundai Motor Group has no future in the era of autonomous driving? Not at all. The group can fully leverage its strengths as a traditional automaker. In autonomous driving technology development, securing data for diverse testing is crucial. Hyundai and Kia have the potential to collect massive amounts of data in a short period of time. Achieving the world's top sales and collecting vast driving data globally is key. The more Hyundai and Kia vehicles are sold worldwide, the more exponentially the amount of collected data increases. There is still an opportunity for a quantum leap. In 2024, Hyundai and Kia sold 7.2 million vehicles in the global market. This far exceeds Tesla's sales of 1.8 million units during the same period. Even if, conservatively, only half-3.5 million vehicles-collect autonomous driving data worldwide each year, Hyundai can amass a vast dataset for learning.

What if countries erect barriers to protect their domestic data? Even the Korean market alone can yield meaningful data. As of 2024, Hyundai and Kia's domestic sales reached 1.2 million units. Considering the market size and population, this is by no means small. With high traffic volume, a large floating population, and well-established telecommunications infrastructure, Korea can provide high-quality data. During the same period, BYD's sales in China were 4.27 million units, Volkswagen Group's sales in Germany were 1.12 million units, and Tesla's sales in the United States were 630,000 units. Ko Taebong, head of research at iM Securities, who has analyzed the automotive industry for nearly 30 years, said, "Even if only a portion of Hyundai and Kia vehicles sold each year-including taxis-are allowed to collect data, most of the map data needed for domestic autonomous driving can be gathered," adding, "Going forward, it is imperative to build data centers capable of collecting and utilizing this data for artificial intelligence (AI) learning."

Next-generation infotainment system PLEOS Connect under development by Hyundai Motor Group. Provided by Hyundai Motor Group

Next-generation infotainment system PLEOS Connect under development by Hyundai Motor Group. Provided by Hyundai Motor Group

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)