Once Again, "Immediate Implementation"...

On-Site Confusion Intensifies

Concerns Over Balloon Effect as Jeonse Loan Limits Are Reduced and Demand Shifts to Unsecured Loans

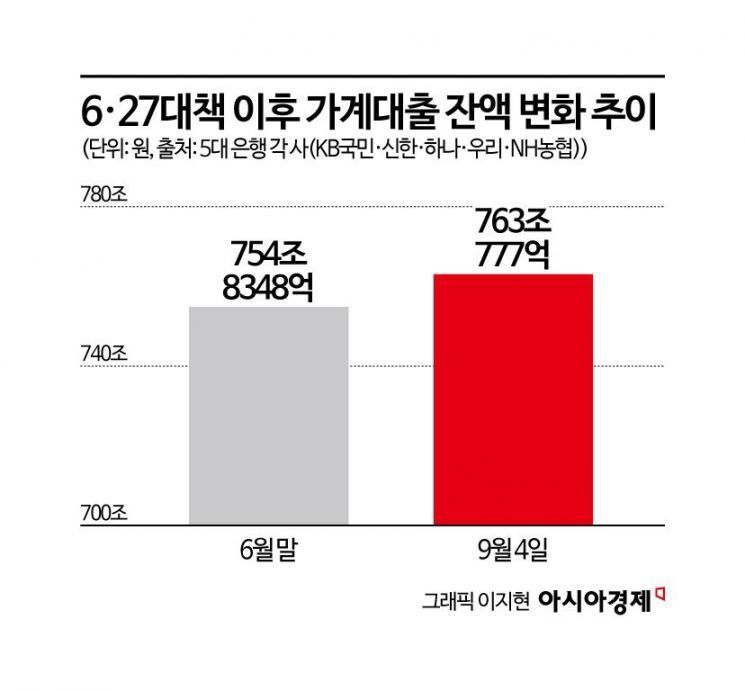

The aftermath of the September 7 household debt measures is intensifying. Following the June 27 measures, the government once again adopted the "immediate implementation upon announcement" approach, resulting in confusion at bank branches as banks were unable to update their systems to reflect the new conditions. Especially with jeonse prices on the rise ahead of the autumn moving season, there are growing concerns about a balloon effect, with demand shifting to unsecured loans as lending conditions tighten.

Shutdown of Non-Face-to-Face Channels Leads to On-Site Confusion... Consumer Inconvenience Unavoidable

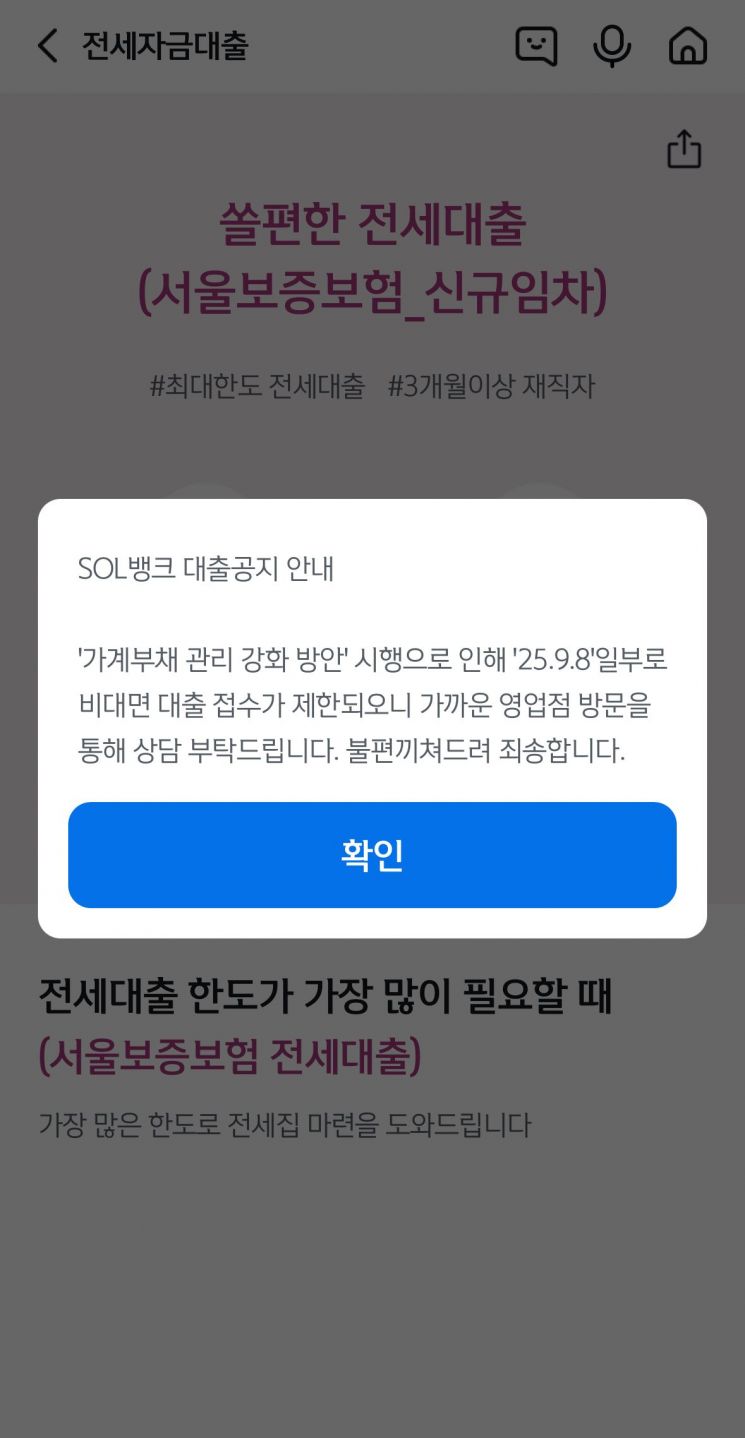

A major commercial bank's mobile application is informing users about restrictions on non-face-to-face applications for jeonse loans. Photo by Jaehee Kwon

A major commercial bank's mobile application is informing users about restrictions on non-face-to-face applications for jeonse loans. Photo by Jaehee Kwon

According to the banking sector on September 9, the previous day saw all major commercial banks shut down their non-face-to-face mortgage and jeonse loan channels. This was because the government's measures were implemented immediately, leaving banks with no time to update their systems to reflect the new conditions.

Under the September 7 measures announced by the government the previous day, the loan-to-value (LTV) ratio for mortgage loans in regulated areas (Gangnam 3 districts and Yongsan District) was lowered from 50% to 40%. In addition, the jeonse loan limit for single-home owners in the Seoul metropolitan area was uniformly capped at 200 million won. As a result, the maximum loan amount for purchasing a home in regulated areas decreased from 600 million won to 480 million won. Previously, jeonse loans were available in amounts ranging from 200 million to 300 million won depending on the guarantor-300 million won from SGI Seoul Guarantee, 220 million won from Korea Housing Finance Corporation, and 200 million won from Korea Housing & Urban Guarantee Corporation-but with the new uniform cap of 200 million won, the maximum amount has been reduced by up to 100 million won.

On September 8, Shinhan Bank announced on its "SOL Bank" app, "Due to the implementation of strengthened household debt management measures, non-face-to-face loan applications will be restricted as of today," and directed customers to visit branches for consultations. A Shinhan Bank official stated, "We have temporarily suspended non-face-to-face applications due to system updates required to reflect the new policies. It is expected to take about a week to ten days."

The same applies to internet-only banks, where non-face-to-face channels are the only option. A KakaoBank official said, "All loan products are operating normally, but applications for jeonse and monthly rent loans for single-home owners in the Seoul metropolitan area and regulated areas are currently unavailable. We had no other choice but to suspend these due to the need for system development to reflect the reduced limits for single-home owners, but we will work to resume them as soon as possible."

Some banks have stated that in-person applications at bank branches are still possible. However, interest rates for in-person applications are 0.1 to 0.2 percentage points higher, increasing the burden on consumers.

‘Aftermath’ of Loan Limit Reductions Ahead of Moving Season... Concerns Over Surge in Unsecured Loans

With demand for jeonse rising ahead of the autumn moving season and loan limits being reduced at the same time, market confusion is growing. According to Korea Real Estate Board, in the first week of September, jeonse prices for apartments in Seoul rose by 0.07% compared to the previous week, marking the second consecutive week of increased growth. Jeonse prices rose in 17 out of 25 districts in Seoul. This is due to a shortage of available properties. The number of apartment jeonse listings in Seoul has dropped by about 10% over the past three months to just 23,239, deepening the shortage. The jeonse supply-demand index from KB Real Estate is 152.4, indicating that demand far exceeds supply.

In this situation, the reduction of jeonse loan limits could lead to a concentration of demand for unsecured loans. A commercial bank official said, "When the June 27 measures uniformly capped loan limits at 600 million won regardless of home price or borrower repayment ability, there was a temporary surge in demand for unsecured loans as borrowers rushed to secure loans, but it subsided after a month. This time as well, with the reduction of jeonse loan limits, there is a possibility that borrowers who urgently need funds will flock to unsecured loans."

The new regulations also apply to requests for increased loan amounts when extending the maturity of jeonse loans, further fueling concerns about a balloon effect in unsecured loans. If the lease agreement was signed before September 7, the implementation date of the measures, the new rules do not apply. However, for contracts signed or jeonse loan maturities extended after September 7, the revised regulations are in effect. According to the Financial Services Commission, there are about 52,000 single-home owners in the Seoul metropolitan area who have taken out jeonse loans from the three major guarantors (SGI Seoul Guarantee, Korea Housing Finance Corporation, and Korea Housing & Urban Guarantee Corporation), and among them, about 17,000-or 30%-have loans in the 200 million to 300 million won range.

A bank official said, "While the intention is to block gap investments, single-home owners who inevitably need jeonse loans due to reasons such as work or education will face difficulties in securing funds. Since unsecured loans carry greater risk than secured loans, this also increases the burden on banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.