NPL Ratio of Banks Reaches 0.59% in Q2

Three Consecutive Years of Increase Amid Economic Downturn

As the economic downturn persists, the non-performing loan (NPL) ratio of domestic banks has been rising for the third consecutive year. While the current level is not considered dangerous, there are concerns that the overall soundness of the banking sector is gradually deteriorating.

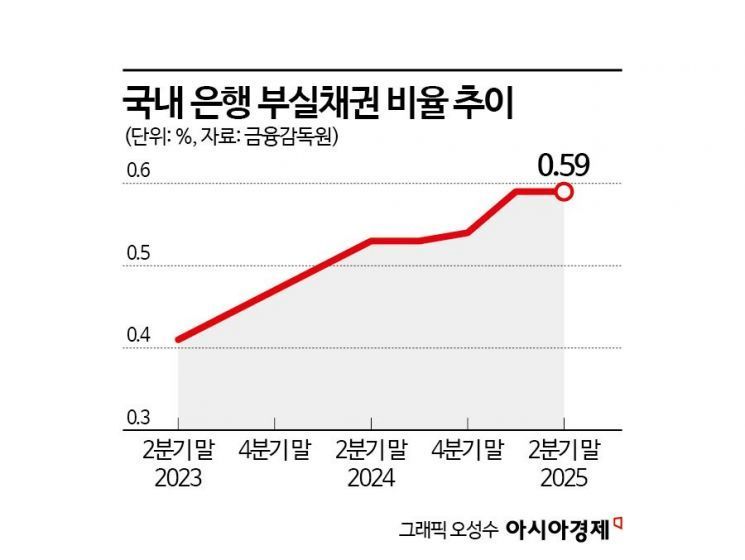

According to the "Status of Non-Performing Loans at Domestic Banks as of the End of June (Provisional)" released by the Financial Supervisory Service on September 5, the NPL ratio of domestic banks at the end of the second quarter this year stood at 0.59%. This represents an increase of 0.06 percentage points compared to 0.53% recorded during the same period last year, and is similar to the previous quarter.

The NPL ratio of domestic banks had fallen to 0.40% at the end of 2022, but rose to 0.47% at the end of 2023, and further increased to 0.54% at the end of 2024, marking a three-year upward trend. The NPL ratio refers to the proportion of non-performing loans out of the bank's total loans.

At the end of the second quarter, the total non-performing loans of domestic banks amounted to 16.6 trillion won, consisting of 13.1 trillion won in corporate loans, 3.2 trillion won in household loans, and 300 billion won in credit card receivables.

Newly generated non-performing loans in the second quarter reached 6.4 trillion won, an increase of 400 billion won compared to the previous quarter (6 trillion won). Newly non-performing corporate loans amounted to 4.9 trillion won, up 400 billion won from the previous quarter. While non-performing loans from large corporations decreased by 100 billion won, those from small and medium-sized enterprises increased by 500 billion won. Newly non-performing household loans were 1.4 trillion won, similar to the previous quarter.

The amount of non-performing loans resolved in the second quarter was 6.5 trillion won, an increase of 2 trillion won from the previous quarter. This consisted of 4.1 trillion won in sales and write-offs of non-performing loans, 1.1 trillion won in loan normalization, and 1 trillion won in loan recovery through collateral disposition.

By sector, the NPL ratio for corporate loans was 0.72%, similar to the previous quarter. The NPL ratio for large corporate loans was 0.41%, down 0.04 percentage points from the previous quarter (0.45%), while the ratio for small and medium-sized enterprises was 0.90%, up 0.01 percentage points from the previous quarter (0.89%).

The NPL ratio for household loans was 0.32%, unchanged from the previous quarter. The ratio for mortgage loans was 0.23%, up 0.01 percentage points from the previous quarter, while the ratio for other unsecured loans was 0.61%, down 0.01 percentage points from the previous quarter. In addition, the NPL ratio for credit card receivables was 1.93%, down 0.08 percentage points from the previous quarter.

At the end of the second quarter, the balance of loan loss provisions stood at 27.4 trillion won, a decrease of 1 trillion won compared to the previous quarter. As a result, the loan loss provision coverage ratio dropped by 5 percentage points to 165.5% from the previous quarter.

An official from the Financial Supervisory Service stated, "We plan to continuously encourage banks to strengthen their management of non-performing loans and increase loan loss provisions in preparation for the potential expansion of credit risk in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.