Semiconductor Export Boom

27 Consecutive Months of Current Account Surplus, the Second Longest Streak Since 2000

K-Culture Gains Popularity with Titles Like K-Pop Demon Hunters

Increase in Foreign Tourists Narrows Travel Account Deficit

Gr

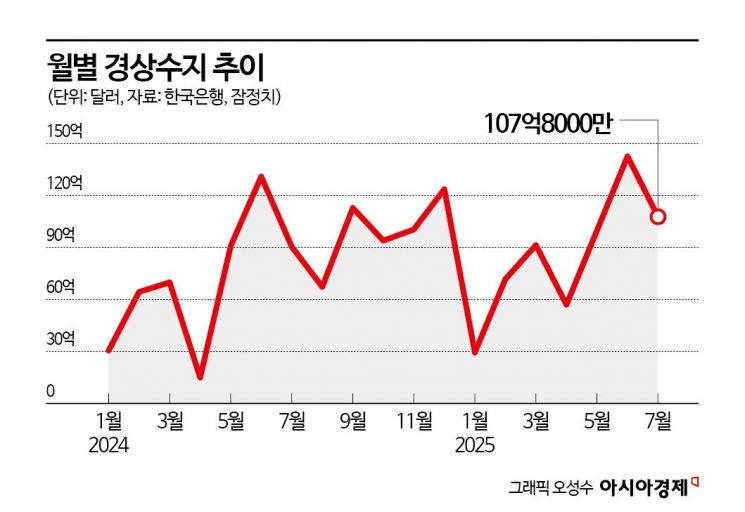

In July, South Korea's current account surplus reached $10.78 billion. Although this figure was lower than the previous month, which marked an all-time high, it set a new record for the month of July. Exports, led by semiconductors and passenger cars, remained strong, exceeding $10 billion for the third consecutive month and maintaining a robust surplus trend.

The key factor that will determine the current account trend for the remainder of the year is U.S. tariffs. There are forecasts that exports, especially of items subject to tariffs, will gradually be negatively affected. However, it is expected that the solid growth in semiconductors, a major export item, will continue, driven by sustained demand for artificial intelligence (AI) infrastructure and a focus on high value-added products, which will partially offset the negative impact.

Strong Semiconductor Exports... 27 Consecutive Months of Current Account Surplus, the Second Longest Streak Since 2000

According to the "Provisional International Balance of Payments for July 2025" released by the Bank of Korea on the 4th, South Korea's current account surplus in July reached $10.78 billion, the highest ever for the month of July. The surplus has continued for 27 consecutive months since May 2023, marking the second longest streak since 2000. While the surplus decreased from the previous month's record high of $14.27 billion, it increased compared to the same period last year ($9.05 billion).

The goods account, which accounts for the largest portion of the current account, posted a surplus of $10.27 billion. This is the third highest July figure on record, following July 2018 and July 2016. The surplus widened compared to the same month last year ($8.52 billion), but narrowed compared to the previous month ($13.16 billion).

Exports totaled $59.78 billion, up 2.3% from the same month last year. Semiconductors in the IT sector and passenger cars in the non-IT sector both showed strong performance, resulting in two consecutive months of growth. However, exports declined compared to the previous month. In July, semiconductor exports based on customs clearance reached $14.91 billion, a sharp increase of 30.6% from a year earlier. Passenger car exports rose 6.3% to $5.49 billion. In contrast, exports of computer peripherals (-17%), pharmaceuticals (-11.4%), and petroleum products (-6.2%) decreased.

Imports totaled $49.51 billion, down 0.9% from the same month last year. This decline, which came after just one month, was due to falling energy prices. However, compared to the previous month, imports increased by 4.9% due to higher import volumes of energy products. In July, imports of raw materials based on customs clearance amounted to $24.49 billion, down 4.7% from a year earlier, mainly due to decreases in crude oil (-16.7%), petroleum products (-5.8%), and coal (-2.9%). Gas imports increased by 0.2%. Imports of capital goods rose 6.2% to $20.47 billion, with increases in semiconductor manufacturing equipment (27.7%), information and communication devices (12.6%), and semiconductors (9.4%). On the other hand, imports of transport equipment saw a steep decline of 33.8%. Imports of consumer goods also increased by 4.2% to $9.24 billion, with passenger cars up 9.6% and direct consumer goods up 8.6%. However, grain imports fell by 15.4%.

K-Culture on the Rise with "K-Pop Demon Hunters"... Increase in Foreign Visitors, Travel Account Deficit Narrows

The service account, which includes the travel account, recorded a deficit of $2.14 billion, narrowing from the previous month’s $2.53 billion deficit. The travel account deficit was reduced to $900 million, thanks to a surge in foreign visitors during the summer peak season, driven by the popularity of K-culture, including the Netflix movie "K-Pop Demon Hunters." Song Jaechang, Director of the Financial Statistics Department at the Bank of Korea's Economic Statistics Bureau, explained, "The effect of 'K-Pop Demon Hunters' has been partially reflected in music copyright income," adding, "The popularity of K-culture is having a ripple effect on the travel account and related sectors."

The primary income account, mainly driven by dividend income, recorded a surplus of $2.95 billion, narrowing from $4.16 billion in the previous month. The dividend income account posted a surplus of $2.58 billion, down from $3.44 billion in the previous month, as direct and portfolio investment dividend income decreased compared to the previous month.

Net external assets, calculated as assets minus liabilities in the financial account, increased by $11.08 billion, a smaller increase compared to the previous month's $17.92 billion. Direct investment saw an increase of $3.41 billion in overseas investments by domestic residents and a $1.72 billion increase in foreign investment in South Korea. In portfolio investment, overseas investment by domestic residents surged by $10.1 billion, mainly in stocks, while foreign investment in South Korea increased by $7.64 billion, mainly in bonds. Derivatives decreased by $240 million. Other investments saw assets, mainly cash and deposits, rise by $3.16 billion, while liabilities, mainly borrowing, decreased by $1.96 billion. Reserve assets increased by $2.05 billion.

Gradual Strengthening of U.S. Tariff Impact... AI Infrastructure-Driven Semiconductor Boom and Export Diversification as Offsetting Factors

The impact of U.S. tariffs is expected to gradually intensify in the second half of the year. However, the continued boom in the semiconductor industry, fueled by growing AI infrastructure demand, and strengthened export diversification strategies are expected to partially offset the negative effects.

In July's current account, negative impacts on exports were already observed, particularly for items subject to tariffs. Song noted, "The impact is already being seen, especially in automobiles, auto parts, and steel," and added, "Exports of steel to the U.S. had already been declining due to reduced demand and falling prices caused by a slowdown in the global construction and manufacturing sectors. Now, with tariffs extended to include steel and home appliances, the impact is becoming more pronounced."

For automobiles, the decline in U.S. exports has continued, not only due to tariffs but also because of summer vacations at the end of July and beginning of August, as well as the expansion of local electric vehicle production following the opening of a new U.S. plant in March. Song explained, "Automakers have refrained from raising prices, so the impact on sales has not been significant so far. However, if tariffs are increased in the future and passed on to sales prices, demand is expected to shrink and exports to decrease." On a positive note, export diversification to the European Union and Australia is underway.

The continued strength in semiconductor exports is also expected to offset some of the negative effects of tariffs. Song stated, "Demand for high value-added semiconductors is being supported by demand for servers and mobile devices, maintaining a solid growth trend," and added, "For general-purpose semiconductors, preemptive buying ahead of the phase-out of DDR4 is also playing a role." He concluded, "For the time being, the most important factor will be sustained demand for AI infrastructure, which is expected to continue into next year, and while tariffs have been announced for certain items, the impact remains to be seen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)