Foreign Exchange Reserves Rise for Third Straight Month

Dollar Weakness and Higher Investment Returns Drive Increase

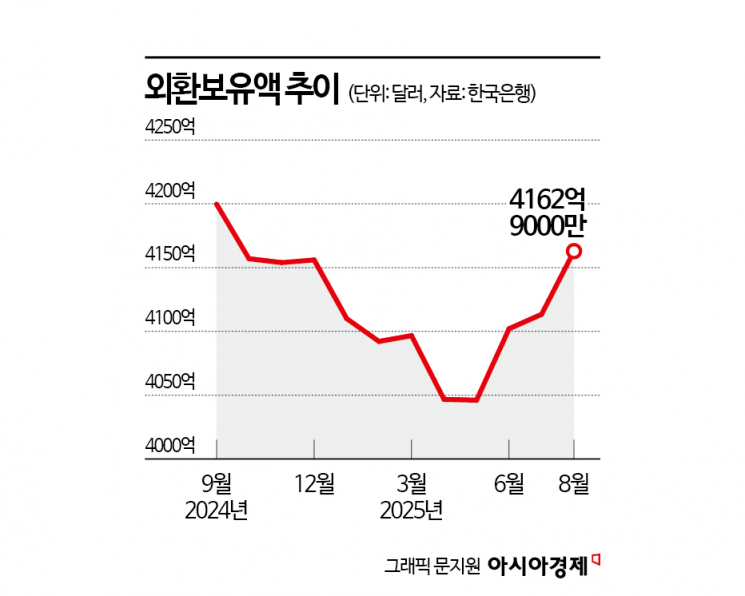

South Korea's foreign exchange reserves have increased for the third consecutive month. This rise is attributed to the weakening of the US dollar, which led to a higher dollar-converted value of foreign currency assets held in other currencies, as well as increased investment returns.

According to the Bank of Korea on September 3, South Korea's foreign exchange reserves stood at 416.29 billion dollars at the end of last month, up 4.95 billion dollars from 411.33 billion dollars at the end of the previous month. During this period, the US dollar depreciated, resulting in a relative increase in the value of other currency-denominated foreign assets when converted into dollars. Higher investment returns also contributed to the expansion of the foreign exchange reserves. In August, the US Dollar Index (DXY) fell by about 2.0%.

South Korea's foreign exchange reserves had steadily increased until the second half of 2021. At the end of October 2021, the reserves reached 469.2 billion dollars, approaching the 470 billion dollar mark. However, starting in 2022, the US Federal Reserve's interest rate hikes led to a reduction in the reserves. In October last year, heightened uncertainty over trade policy following the election of US President Donald Trump, combined with domestic political risks such as the year-end emergency martial law situation, contributed to a strong dollar. This resulted in continued dollar selling to defend the exchange rate, causing the reserves to decline. From February to May this year, the reserves even fell below the 410 billion dollar level, but have now shown an upward trend for the past three months.

Among the components of the foreign exchange reserves in August, securities-including government bonds, corporate bonds, and government agency bonds-rose by 1.1 billion dollars from the previous month to 366.16 billion dollars. Securities accounted for 88.0% of the total foreign exchange reserves. Deposits increased by 3.75 billion dollars to 25.0 billion dollars (6.0%). Special Drawing Rights (SDRs) from the International Monetary Fund (IMF) amounted to 15.78 billion dollars (3.8%), gold stood at 4.79 billion dollars (1.2%), and the IMF position was 4.54 billion dollars (1.1%).

Meanwhile, as of the end of July, South Korea maintained its position as the world's 10th largest holder of foreign exchange reserves. Within the top 10, only Germany (ranked 7th) and South Korea (ranked 10th) saw increases in their reserves, with Germany's reserves rising by 0.9 billion dollars and South Korea's by 1.1 billion dollars.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)