Record 1.9997 Trillion Won Investment Since Establishment

40 Trillion Won Venture Investment Target by 2030

Annual Growth of Around 27% Required

Exit Market Must Open Up for IPOs and More

The government has decided to more than double the size of its investment in the Korea Fund of Funds for next year. Amid global economic uncertainty and a downturn in investment, the government is planning to create a virtuous cycle in venture investment by allocating a record-high budget. Industry insiders believe that the effectiveness of these policies will depend on how the blocked exit market is resolved.

According to the 2026 budget plan announced by the Ministry of Economy and Finance on September 1, 2025, the government has set next year's investment in the Korea Fund of Funds at 1.9997 trillion won, more than double this year's 989.6 billion won. This is the largest amount since the fund's establishment in 2009.

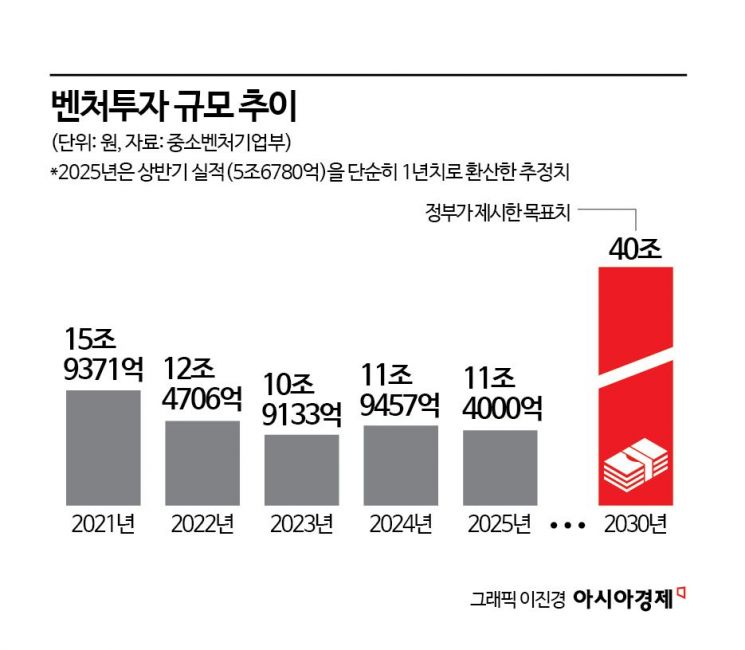

The domestic venture investment market has experienced both a sharp rise and a correction over the past five years. After surging from 810 billion won in 2020 to a peak of 1.59 trillion won in 2021, the market contracted to 1.24 trillion won in 2022 and 1.09 trillion won in 2023. Last year, it rebounded slightly to 1.19 trillion won, but with 570 billion won invested in the first half of this year, the annual total is expected to remain around 1.2 trillion won, similar to previous years. The expansion of liquidity during the COVID-19 pandemic sparked a venture boom, but the investment environment has since cooled due to external factors such as global interest rate hikes and sluggish initial public offerings (IPOs).

The Lee Jaemyung administration aims to achieve annual venture investment of 4 trillion won by 2030. To grow from the current 1.2 trillion won to 4 trillion won, an annual high growth rate of about 27% is required for the next five years. This means the rapid growth seen during previous venture booms must be repeated. A venture industry insider commented, "The venture investment market needs to grow in size to enable bold investments in early-stage startups and other risk capital. The expansion of the Korea Fund of Funds is expected to revitalize investment activity."

The Korea Fund of Funds has played a priming role in the venture investment market. When the government invests directly to create a fund, private capital follows in succession. Last year, a government investment of 1 trillion won led to the formation of funds totaling 10.6 trillion won. In the first half of this year, 84% of the 6.2 trillion won in new funds came from private capital. Investments from pension funds and mutual aid associations increased by 130% compared to the previous year. This demonstrates the government's ability to leverage multiple times more private capital through its spending.

The government is also accelerating institutional reforms to broaden the base of capital supply. The registration requirement for professional individual investors has been relaxed from 100 million won invested over the past three years to 50 million won, and the minimum size for private venture fund-of-funds has been lowered from 100 billion won to 50 billion won. In addition, various regulatory relaxations are being implemented, such as abolishing the "five-year mandatory sale" requirement for venture investment associations, including loans in the calculation of mandatory investment for M&A funds, and introducing the Business Development Company (BDC) system. These measures are creating conditions for individuals and general investors to participate in venture investment.

The problem lies in the exit market. The IPO market, the most common exit route for domestic venture startups, remains sluggish. Last year, there were 128 new listings on KOSDAQ, raising 2.4 trillion won, a decrease of about 30% compared to 2021 (132 companies, 3.58 trillion won). The mergers and acquisitions (M&A) market, another key pillar of the exit market, is also cooling. In the first quarter of this year, the share of M&A as a means of startup capital recovery fell from 42.7% last year to 38.0%. Amid concerns over an economic downturn, potential acquirers such as large corporations have become more cautious, leading to a contraction in transactions.

Industry insiders point out that if the exit market remains blocked, even an increase in the size of the Korea Fund of Funds will not allow investment capital to flow into subsequent investments. One venture capital (VC) industry insider said, "Even if the speed of fund formation increases, if capital recovery is delayed, a gap can emerge. Follow-up measures such as tax support should be implemented in parallel." Another VC insider added, "The biggest problem right now is the slow recovery of investment in late-stage startups. Expanding the Korea Fund of Funds is good, but measures to strengthen the exit ecosystem are also needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.