Analysis of First Half Management Performance of Golf Courses by Korea Leisure Industry Institute

Sales Down 7.9%, Profits Down 34.6% Year-on-Year

Domestic Economic Slump, High Costs, and Surge in Overseas Golf Travel

The profitability of domestic golf courses, which had benefited from the COVID-19 boom, has significantly declined in the first half of the year.

According to the "Analysis of First Half Management Performance of Domestic Golf Courses" recently released by the Korea Leisure Industry Research Institute, the average sales of 15 domestic golf courses in the first half of this year amounted to 9.883 billion won, a 7.9% decrease compared to the same period last year. The average operating profit was 1.696 billion won, down by 34.6%.

The revenue of domestic golf courses in the first half of the year has significantly declined. The photo is unrelated to the article.

The revenue of domestic golf courses in the first half of the year has significantly declined. The photo is unrelated to the article.

This report analyzes the first-half management performance of 15 golf course companies (16 locations) that disclosed their results through the Financial Supervisory Service's electronic disclosure system. While the data covers only 15 companies and not all member companies, and thus has limitations in representing the entire industry, it still provides valuable insight into recent trends.

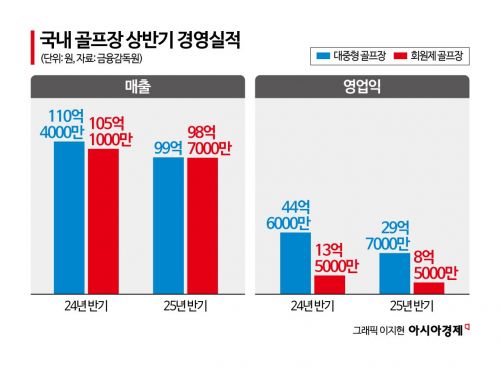

Both public golf courses and membership golf courses faced difficulties. For the six public golf course companies, the average sales in the first half of this year was 9.9 billion won, a 10.3% decrease year-on-year, while operating profit plummeted by 33.4% to 2.97 billion won. The operating margin for these six public golf course companies dropped by 10.4 percentage points, from 40.4% in the first half of last year to 30.0% this year.

The nine membership golf course companies also saw their average sales in the first half fall to 9.87 billion won, a 6.1% decrease from the same period last year, and operating profit plunged by 37.3% to 850 million won. The operating margin for these nine membership golf course companies fell by 4.2 percentage points, from 12.8% in the first half of last year to 8.6% this year. The Korea Leisure Industry Research Institute stated, "Although the sample size is small, the data analysis reveals management performance trends," and added, "The profitability of golf courses has clearly weakened."

Domestic golf courses are being affected by the economic downturn. Amid growing concerns about worsening economic conditions, large corporations are increasingly restricting the use of corporate credit cards at golf courses. After seeing record-high performance driven by increased corporate card sales following COVID-19, golf courses are now experiencing a downturn. Golf courses rely on corporate cards for one-third of their sales. The spread of corporate card restrictions among large companies is resulting in decreased revenue for golf courses.

The burden of golf course fees has also contributed to the decline in profitability. Millennials & Gen Z, feeling the pinch from high green fees, are turning to tennis instead. During the COVID-19 boom, domestic golf courses significantly raised green fees. Public golf courses increased weekday green fees by 31.8%, while membership and non-membership golf courses charged 22.2% more on weekdays. Caddie fees and cart usage fees also rose, bringing the cost of a single round of golf in the greater Seoul area to about 300,000 to 400,000 won per person.

Weekend golfers are turning their attention overseas, such as to Japan's Satsuma Golf & Onsen Resort, due to cost burdens.

Weekend golfers are turning their attention overseas, such as to Japan's Satsuma Golf & Onsen Resort, due to cost burdens.

With the end of the COVID-19 pandemic, overseas travel has become easier. The number of people traveling abroad for golf has surged. Existing golfers are now traveling to countries with cheaper golf costs, such as Japan, Thailand, Malaysia, and Singapore. Weather has also played a role; extreme heat and heavy rain have made it difficult to play rounds. In addition, some golfers burdened by costs have been observed shifting to screen golf, which is becoming increasingly high-tech.

Although the profitability of domestic golf courses has declined, it is not unfavorable compared to the pre-COVID-19 period. Last year, the average sales of domestic golf courses increased by more than 30 to 40% compared to 2019, before the pandemic. The average sales of public golf courses (excluding 9-hole courses) last year was 18 billion won, up 33.6% from 2019, while membership golf courses recorded 20.6 billion won last year, a 44.6% increase from 2019.

It is expected to be difficult for domestic golf courses to make a strong rebound in the second half of the year. With the domestic economic downturn continuing, partly due to tariff impositions by U.S. President Donald Trump, it is unlikely that the annual management performance of golf courses will see significant improvement. In particular, persistently hot and humid weather is expected to negatively impact sales. For golf courses outside the Seoul metropolitan area, the extension of green fee discount periods during the off-season is likely to further worsen profitability.

Seo Cheonbeom, director of the Korea Leisure Industry Research Institute, pointed out, "There is a possibility that golf courses may lower green fees to attract more customers and improve profitability. However, as the days become shorter from autumn onward, the number of available tee times is limited, making it difficult to expect a significant reduction in green fees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.