Consumption Rises 2.5% from Previous Month

Largest Increase in 29 Months

Inventory Ratio at Lowest in 38 Months

Construction Investment Continues Downward Trend Since Last August

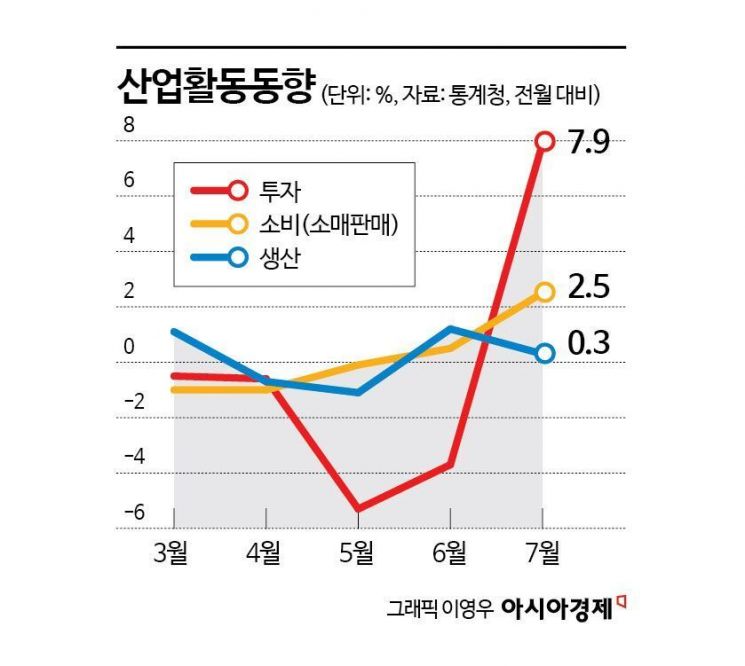

In July, industrial production, retail sales, and facility investment all increased for the first time in five months, marking what is being called a "triple increase." Retail sales saw the largest jump in 29 months, driven by government-issued consumer coupons aimed at revitalizing livelihoods, home appliance rebate programs, and the launch of new telecommunications devices-factors stemming from both policy and market trends. Expectations are rising that a consumption-led economic recovery may be underway. However, sluggish construction activity and growth concentrated in certain industries remain sources of concern.

According to the "Industrial Activity Trends for July" released by Statistics Korea on the 29th, total industrial production rose by 0.3% from the previous month. The service sector grew by 0.2%, and mining and manufacturing increased by 0.3%. Within mining and manufacturing, electronic components (20.9%) and machinery equipment (6.5%) led the growth, while automobiles declined by 7.3% due to industry-wide summer vacations and partial strikes. Compared to the same month last year, total industrial production increased by 1.9%, with semiconductors (20.5%) and other transportation equipment (30.0%) supporting the growth.

During the same period, inventories in the manufacturing sector decreased by 1.7% from the previous month and by 6.8% year-on-year, led by reductions in semiconductors and primary metals. Shipments in manufacturing fell by 1.1% from the previous month but increased by 4.0% compared to a year earlier. The inventory-to-shipment ratio for manufacturing in July dropped by 0.7 percentage points from the previous month to 101.7%, marking the lowest level in 38 months since May 2022 (101.3%). The trend of declining inventories and increasing shipments, resulting in a lower inventory ratio, suggests that more products are being sold and more are being produced and shipped out, which is interpreted as a sign of economic strength. A Statistics Korea official stated, "Overall, the current inventory ratio for semiconductors, which had accumulated significantly in 2023, is now at a record low," and added, "As the previously problematic inventories are being resolved, we are seeing a slight recovery in exports."

Consumption, Durable Goods Lead to Highest Level in 29 Months

Retail sales increased by 2.5% from the previous month, the largest rise in 29 months since February 2023 (6.1%). Durable goods (5.4%), semi-durable goods (2.7%), and non-durable goods (1.1%) all saw increases, indicating broad-based growth. Year-on-year, retail sales rose by 2.4%, marking the highest growth rate in 42 months since January 2022 (5.3%). Sales of telecommunications devices and computers jumped by 16.8%, while home appliances increased by 6.6%.

Lee Dowon, Director of Economic Trend Statistics at Statistics Korea, explained, "The combined effects of new telecommunications device launches, the high-efficiency home appliance rebate program, and the distribution of consumer coupons from the second supplementary budget led to significant increases both month-on-month and year-on-year." He added, "The impact of consumer coupons was reflected not only in retail sales but also in service sector production, with clear growth seen in wholesale and retail, arts, sports and leisure, and personal services."

By business type, duty-free shops (-20.5%) and supermarkets/general merchandise stores (-2.4%) declined year-on-year, but passenger car and fuel retailers (7.1%) and non-store retail (4.6%) increased. This suggests that the recovery in consumption is spreading beyond specific items. Rising demand for food and pharmaceuticals also boosted sales of non-durable goods, while semi-durable goods-including clothing and recreational or sports equipment-also saw increases.

Facility Investment Sees Largest Growth in Five Months

Facility investment rose by 7.9% from the previous month, driven by increases in transportation equipment (18.1%) and machinery (3.7%). This is the largest rebound in five months since February (21.3%). However, compared to the same month last year, overall facility investment fell by 5.4% due to a 16.5% decline in transportation equipment. Domestic machinery orders plummeted by 40% year-on-year, with public sector orders down 86.9% and private sector orders down 24.4%, which could act as a constraint on future facility investment expansion.

Construction investment has been declining continuously since August of last year. In July, despite a 10.1% increase in civil engineering performance, weak building construction (-4.8%) led to a 1.0% decrease from the previous month. Year-on-year, both building construction (-16.4%) and civil engineering (-6.4%) fell, resulting in an overall 14.2% decrease. The value of construction orders in current prices increased by 22.4% year-on-year due to a 45.7% rise in housing construction, but civil engineering orders showed a marked decline (-14.6%).

Leading and coincident economic indicators show a coexistence of recovery expectations and risk factors. The cyclical component of the coincident composite index, which reflects the current state of the economy, fell by 0.1 points from the previous month due to decreases in domestic shipment and import values. In contrast, the cyclical component of the leading composite index, which forecasts future economic trends, rose by 0.5 points, influenced by gains in the Korea Composite Stock Price Index (KOSPI) and a widening gap between short- and long-term interest rates.

Some experts point out that while the increase in consumption could spark an economic recovery, it remains to be seen whether this upturn is a temporary effect of government policies or the start of a structural rebound. They explain that if investment and construction do not recover alongside consumption, it will be difficult for an economic recovery to be sustained solely by consumption over the long term. Lee, the director, said, "The effect of consumer coupons may continue into August and September, but whether consumption will remain strong after that needs to be monitored."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.