After Earnings Season, Bank Stocks Drop an Average of 11% in One Month

Significant Outflows from KB, Shinhan, and Hana with High Foreign Ownership

All Eyes on Overseas IR Activities in the Second Half of the Year

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

The chairmen of the four major financial holding groups (KB, Shinhan, Hana, and Woori) are set to embark on a mission in the second half of the year to reassure overseas investors. Over the past month, continued selling by foreign investors has led to bank stocks falling by more than 10% on average from their recent peaks. In response, the chairmen are taking to the global stage to emphasize their commitment to enhancing corporate value (value-up). With factors such as bad bank contributions, increased education tax rates, fines for collusion on loan-to-value (LTV) ratios, tax reform proposals, and caps on household lending all dampening investor sentiment, the heads of these financial groups are stepping up to restore trust.

According to the Korea Exchange on August 29, the closing prices of the four major financial holding groups-KB, Shinhan, Hana, and Woori-fell by an average of 11.7% from their peaks as of the previous day. KB Financial Group declined by 13.94%, Shinhan Financial Group by 9.80%, Hana Financial Group by 14.80%, and Woori Financial Group by 8.29%.

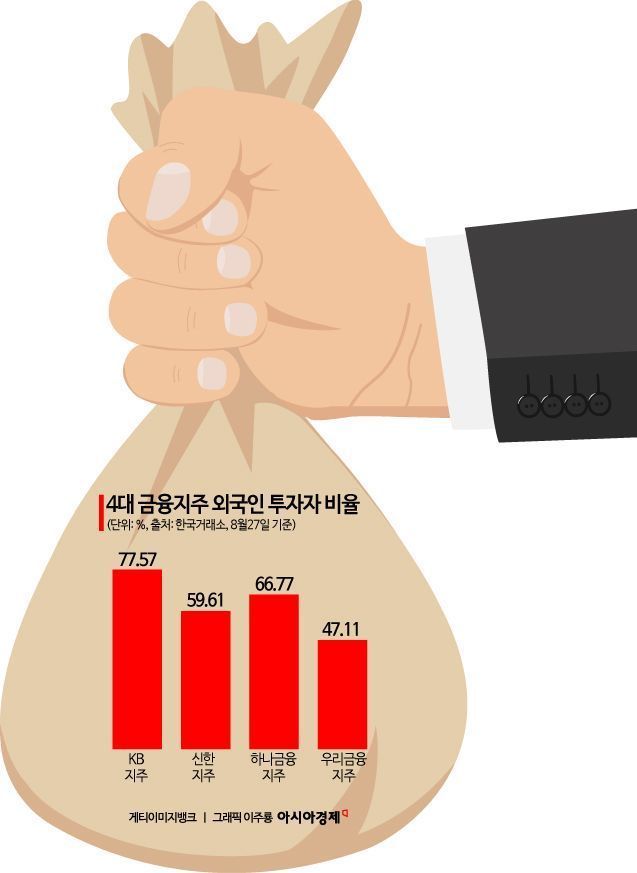

This trend is attributed to net selling by foreign investors over the past month. The outflow was particularly pronounced in KB Financial Group (with a foreign ownership ratio of 77.57%), Hana Financial Group (66.77%), and Shinhan Financial Group (59.61%). During this period, foreign investors made net sales of 51.4 billion won in KB Financial Group, 57.6 billion won in Hana Financial Group, and 99.8 billion won in Shinhan Financial Group.

The reversal in the previously soaring bank stocks over the past month is due to increased uncertainty in the second half of the year and growing concerns over earnings pressure. The announcement of tax reform proposals, which would increase the education tax burden on financial institutions, bad bank contributions, the pending results of fines for LTV collusion to be announced at the end of the year, concerns over potential fines related to sales of Hong Kong equity-linked securities (ELS), and the possibility of raising risk weights on mortgage loans have all affected foreign investor sentiment.

Kim Jaewoo, a researcher at Samsung Securities, analyzed, "In fact, apart from ELS, the burden of individual issues is estimated to be in the single digits as a percentage of annual profits. However, when combined, these factors are sufficient to undermine investor sentiment. The actual burden on the financial sector could be even greater."

In response, the chairmen of the four major financial holding groups plan to actively meet with overseas investors starting in September to explain their corporate value strategies. They will hold direct meetings when overseas investors such as JP Morgan and Morgan Stanley visit Korea, and in October, they are expected to conduct investor relations (IR) presentations on-site during international events such as the International Monetary Fund (IMF) and World Bank (WB) Annual Meetings in Washington, D.C. Traditionally, the chairmen of the four major financial holding groups have conducted overseas IR sessions once each in the first and second halves of the year.

Whereas overseas IR was previously handled mainly by working-level staff, chairmen have recently taken a more hands-on and proactive approach.

Yang Jonghee, Chairman of KB Financial Group, has personally overseen overseas IR since last year and even sent a handwritten letter to overseas investors earlier this year to express his commitment to value-up. Jin Okdong, Chairman of Shinhan Financial Group, has been actively engaging in overseas IR, starting with Japan in February this year and continuing with the United Kingdom, Germany, and Poland in May. Ham Youngjoo, Chairman of Hana Financial Group, has conducted IR sessions in Hong Kong, Singapore, the Netherlands, and the United Kingdom, and this year pledged active shareholder returns for value-up to global investors via a YouTube video. Lim Jongryong, Chairman of Woori Financial Group, also held his first solo IR in Hong Kong after taking office in May this year.

A financial industry official commented, "Overseas IR is easier when stock prices are strong, but it becomes burdensome when prices are low. Even if the company presents its vision and plans for shareholder returns, it is not easy to dispel concerns about the unfavorable environment surrounding the financial sector, which is why the group chairmen are taking the lead themselves."

Another financial industry official added, "Since the inauguration of the new president, various pressures on the financial sector have heightened concerns about the profitability of financial companies, leading to a surge in related inquiries from overseas investors. It is expected that responses to these issues will be the main focus of questions during IR sessions in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.