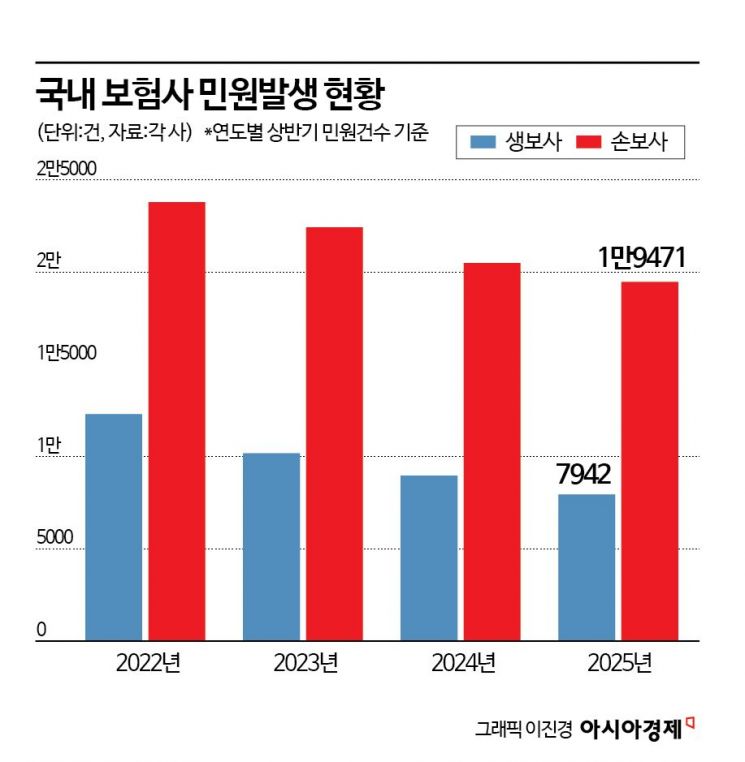

Complaints Against Life Insurers Drop to 7,942 in First Half, Down 11.5% Year-on-Year

Non-Life Insurer Complaints Fall to 19,471, Down 5% from Previous Year

Stricter Complaint Management Expected Under New FSS Governor's Consumer Protection Focus

In the first half of this year, consumer complaints against insurance companies generally declined. This trend appears to be influenced by strengthened internal controls and the introduction of accountability structures. With the new Financial Supervisory Service governor emphasizing enhanced consumer protection and the potential establishment of a Financial Consumer Protection Agency, consumer complaint management is expected to become even more rigorous.

According to disclosures from the Korea Life Insurance Association and the Korea Non-Life Insurance Association on August 29, the number of complaints filed against life insurance companies in the first half of this year was 7,942, down 11.5% compared to the same period last year. During the same period, complaints against non-life insurance companies totaled 19,471, a decrease of 5%. Over the past several years, complaints against insurance companies have been on a downward trend. From the first half of 2022 to the first half of this year, complaints against life insurers fell by 35.5%, while those against non-life insurers dropped by 18.1%.

An image depicting an insurance company actively working to reduce consumer complaints, as described by ChatGPT. ChatGPT

An image depicting an insurance company actively working to reduce consumer complaints, as described by ChatGPT. ChatGPT

To compare complaints by company, the number of complaints per 100,000 contracts was calculated. Among life insurers, Hana Life saw the largest quarter-on-quarter decrease in complaints in the second quarter of this year, with a 59% reduction. This was followed by iM Life (-22.6%), Chubb Life (-18.3%), and KB Life (-14%), which also recorded significant declines. In contrast, Kyobo Lifeplanet (207.1%), Heungkuk Life (65%), and Fubon Hyundai Life (34%) experienced increases in complaints.

Among non-life insurers, Shinhan EZ General Insurance set an example by reducing complaints by 84.8%. Kakao Pay General Insurance (-52.1%), Hanwha General Insurance (-16.6%), and AXA General Insurance (-3.6%) also achieved notable reductions compared to other insurers. On the other hand, Heungkuk Fire & Marine Insurance (14%), Carrot General Insurance (13.8%), and Hana General Insurance (10.1%) saw an increase in complaints.

The overall decline in complaints in the insurance industry is attributed to institutional improvements, such as the establishment of internal control committees under the board of directors. At the shareholders' meetings held in March, insurance companies including Samsung Life, Hanwha Life, Mirae Asset Life, Samsung Fire & Marine, Hyundai Marine & Fire, DB General Insurance, and Hanwha General Insurance passed resolutions to establish or strengthen their internal control committees. This move was in line with the Act on Corporate Governance of Financial Companies, which took effect in July last year to prevent recurring financial accidents. Since last month, accountability structures have also been implemented for insurance companies with assets of over 5 trillion won, further strengthening consumer protection measures.

Among all financial sectors, insurance receives the highest number of consumer complaints. In fact, two out of the three divisions in the Financial Supervisory Service’s Dispute Mediation Bureau are exclusively dedicated to handling insurance-related complaints and disputes between consumers and financial institutions.

Going forward, financial supervisory authorities are expected to manage insurance-related consumer complaints even more strictly. This is because Lee Chanjin, who was appointed as the first head of the Financial Supervisory Service under the Lee Jaemyung administration, has repeatedly stated that consumer protection will be his top priority from the outset of his term. The government’s plan to separate the Financial Consumer Protection Department from the Financial Supervisory Service and elevate it to an independent Financial Consumer Protection Agency is also seen as a sign of its commitment to more rigorous consumer complaint management.

In this process, non-life insurance companies are expected to focus even more on strengthening their complaint management capabilities. This is due to the increasing collective and sophisticated nature of complaints and lawsuits regarding coverage for indemnity health insurance and auto insurance. In fact, from the first half of 2022 to the first half of this year, the number of external complaints against non-life insurers decreased by 30.2%, from 16,491 to 11,506, while internal complaints increased by 9%, from 7,309 to 7,965. Internal complaints are those filed directly by consumers with the insurance company, while external complaints are those filed by consumers through organizations such as the Financial Supervisory Service and handled by the insurer.

An official from a non-life insurance company stated, "Consumer protection should not be managed simply by increasing insurance payouts," adding, "Detailed consumer protection measures are needed, such as establishing countermeasures against insurance fraud and improving ambiguous regulations related to insurance payouts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.