Growth Forecast for This Year Raised from 0.8% to 0.9%

Next Year’s Growth Rate Maintained at 1.6%

Inflation Outlook Upgraded to 2.0% for This Year, 1.9% for Next Year

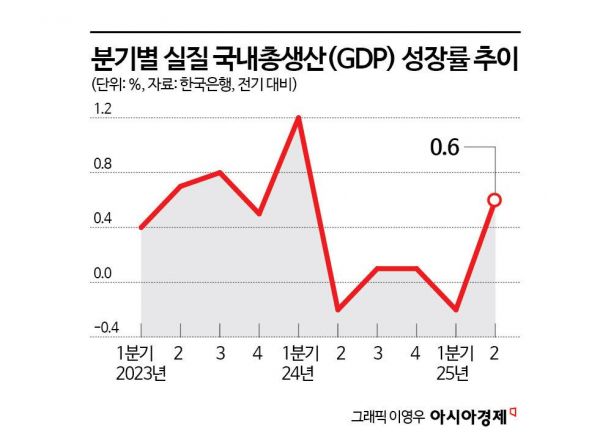

The Bank of Korea has raised its economic growth forecast for South Korea this year to 0.9%.

After sharply lowering the forecast from 1.5% to 0.8% in May, the bank has slightly revised it upward for the first time in three months. This suggests that conditions have improved compared to May, when sluggish consumption and tariff uncertainties persisted. However, the bank still expects that, despite a recovery in the second half of the year, growth will remain in the 0% range.

In its revised economic outlook released on August 28, the Bank of Korea projected that the South Korean economy would grow by 0.9% this year. This matches the government's forecast released on August 22 and is higher than the 0.8% projections recently announced by the Korea Development Institute and the International Monetary Fund.

The growth forecast for 2025 has been continuously revised downward. It was lowered from 2.1% in August last year to 1.9% in November, then to 1.5% in February this year, and finally dropped to 0.8% in May.

The Bank of Korea's decision to raise the growth forecast for the first time appears to reflect the effects of the second supplementary budget. The bank has stated that the second supplementary budget is expected to boost this year's growth rate by 0.1 percentage points. The effects of the supplementary budget were not included in the May forecast because the size and method of distribution had not yet been determined, but they have now been factored in. The fact that major tariff negotiations between South Korea and the United States were settled at expected levels also helped limit downward pressure on the growth rate.

The situation for the South Korean economy has somewhat improved compared to May, when weak domestic demand and tariff uncertainties were prevalent.

Domestic demand is showing a clear recovery, led by private consumption. The decline in private consumption that followed the declaration of emergency martial law at the end of last year reversed after the second quarter. In June, retail sales increased by 0.5% from the previous month, driven by higher sales of semi-durable and non-durable goods. Last month, domestic credit card spending rose by 6.3% year-on-year, marking the highest growth rate since February (6.8%). As consumption coupons aimed at supporting livelihoods, included in the second supplementary budget, are being distributed, consumer sentiment is also on the rise. The Composite Consumer Sentiment Index (CCSI) compiled by the Bank of Korea reached 111.4, the highest level in seven years and seven months. A reading above 100 indicates that consumer sentiment is more optimistic than average. Bank of Korea Governor Rhee Changyong also predicted during a recent National Assembly work report that "the South Korean economy will continue to recover in the second half of the year, centered on domestic demand, due to the implementation of the supplementary budget."

Exports have also eased their burden, as the tariff negotiations with the United States did not deviate significantly from previous expectations. The result of the negotiations, which set mutual tariffs at 15% and automobile tariffs at 15%, is not much different from the scenario assumed by the Bank of Korea in its May economic outlook. Overall export performance is also solid. According to the Korea Customs Service, total exports last month reached $60.8 billion, up 5.8% from a year earlier, while exports to the United States increased by 1.5% ($10.33 billion). From the beginning of this month through the 20th, exports to the United States amounted to $5.037 billion, down 2.7% year-on-year, but total exports increased by 7.6% ($35.5 billion).

However, downside risks to growth remain significant.

Mutual tariffs with the United States began to be imposed on August 7, and the negative effects of the tariff hikes are expected to become more apparent in the second half of the year. Tariff uncertainties have not been completely eliminated. The Trump administration in the United States has announced plans to impose additional tariffs on items such as semiconductors and pharmaceuticals. While these items are expected to receive most-favored-nation treatment, meaning the conditions are not worse than those for other countries, there are concerns that, since South Korean semiconductors are used as intermediate goods in Taiwan and ASEAN countries, the impact on the South Korean economy could be negative in multiple ways. The outcome of tariff negotiations between the United States and China will also have a significant impact on the South Korean economy, making it difficult to let down our guard.

On the domestic front, sluggish construction investment is constraining the recovery in growth. According to the Bank of Korea, domestic construction investment has declined for four consecutive years, indicating a prolonged slump. This year, construction investment fell by 13.3% year-on-year in the first quarter and by 11.7% in the second quarter, dragging down the growth rate. The Bank of Korea expects the construction sector to recover somewhat in the second half of the year, but there is considerable uncertainty regarding the timing and pace of the recovery, due to delays in normalizing the real estate project financing market, tighter lending regulations, and the impact of safety accidents at construction sites. This is why the Bank of Korea has only slightly raised its growth forecast for this year, despite two rounds of supplementary budgets.

The economic growth forecast for next year remains at 1.6%. While the bank expects some recovery compared to this year, it still anticipates growth will fall below the potential growth rate. This is a different pattern from the past, when the economy rebounded due to base effects after a period of low growth. Kang Sungjin, a professor of economics at Korea University, said, "The key to breaking the structure of entrenched low growth is how quickly restructuring toward new growth industries can occur," adding, "It is time for policies or corporate support measures that can help transform the industrial structure."

Meanwhile, the consumer price inflation forecast has been raised to 2.0% for this year and 1.9% for next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.