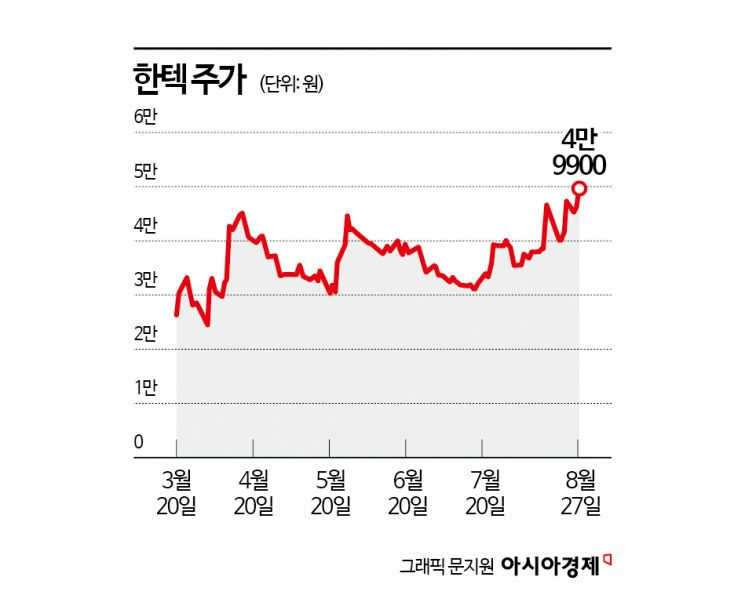

Listed on KOSDAQ in March at an IPO price of 10,800 won

Hit an intraday high of 51,700 won on the 27th

Expectations for orders from U.S. LNG projects

As U.S. President Donald Trump once again expressed his commitment to advancing the 'Alaska Liquefied Natural Gas (LNG) Project,' shares of Hantech hit an all-time high since listing. Expectations for orders of U.S. LNG petrochemical equipment are driving up the stock price.

According to the financial investment industry on August 28, Hantech's share price has risen 362% in the five months since its listing on the KOSDAQ market in March this year, compared to its initial public offering price of 10,800 won. On the previous day, it reached a new record high of 51,700 won during intraday trading. Since its listing, institutional investors have recorded a cumulative net sale of 34.6 billion won, while individual and foreign investors have recorded net purchases of 32.1 billion won and 4 billion won, respectively.

Hantech primarily manufactures petrochemical equipment and storage tanks. Its petrochemical division produces core facilities needed for the petrochemical industry, including heat exchangers. The tank division installs industrial gas storage tanks. In the first half of this year, the company posted sales of 83.1 billion won and operating profit of 20.3 billion won. Compared to the same period last year, sales increased by 4.4%, and operating profit surged by 210.6%.

The petrochemical equipment division, with over 50 years of experience, has established delivery records in most countries around the world. The company has been recognized for its unrivaled technological capabilities in special materials, including non-ferrous products. As the U.S. government actively invests in LNG plants, expectations for new orders are rising.

Park Jungin, a researcher at Korea Investment & Securities, stated, "During Trump's first term, Hantech's LNG order volume was 80 million dollars," adding, "With the resumption of projects that were suspended under the previous Joe Biden administration, the expected bidding volume is anticipated to reach 200 million dollars." He continued, "We expect orders related to major clients' large-scale LNG projects by the end of this year," and added, "Due to the order recognition structure, about 60% of new orders this year will be reflected in next year's performance."

The Trump administration's commitment to expanding LNG supply in its second term is clear. President Trump signed an executive order lifting restrictions on LNG exports immediately after taking office this year. He announced final investment decisions (FID) for major LNG projects along the southern coast of the United States. To secure demand, the Trump administration is using expanded LNG exports as a bargaining chip in tariff negotiations.

Hantech also expects to benefit from increased demand for ammonia tanks. The company supplied ammonia tanks by participating in the infrastructure construction of the Samcheok hydrogen compound co-firing power plant. It is expected that new orders will continue as coal-fired power plants are replaced with co-firing power generation in line with government policy.

Park Janguk, a researcher at Daishin Securities, analyzed, "The government aims to convert more than 20 coal power plants into power plants with an ammonia co-firing ratio of over 20% by 2030," adding, "Each coal power plant site will require at least one ammonia tank with a capacity of over 2,000 tons." He continued, "The order amount per tank is 20 billion won, and the accessible market size by 2030 is 800 billion won," emphasizing, "There are only two companies in Korea capable of handling the entire process from design, procurement, and construction (EPC) to manufacturing of domestic ammonia tanks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.