Although the Korea-U.S. summit led to expanded investment in the United States and a tariff agreement, the business community has assessed that key challenges remain unresolved in major industries such as automobiles, steel, and semiconductors. While some sectors have seen increased opportunities, overall, both tariff burdens and investment pressures are at play, making it inevitable for companies to strengthen their competitiveness. Experts point out that although the agreement to lower tariffs is positive, many of the measures are conditional and linked to the direction of U.S. industrial policy, creating significant uncertainty for Korean companies.

According to the business community on August 27, in the automotive sector, the agreed tariff rate has been reduced from the previous 25% to 15%, but the actual implementation date has not yet been determined. As the signing of the executive order by U.S. President Donald Trump has been delayed, the European Union and Japan are facing the same situation, and the United Kingdom also took 50 days to implement the tariff reduction after making its decision. The industry emphasizes that since Korea has already removed the upper limit on U.S. vehicle safety regulations, the United States should also expedite the promised tariff reduction. However, there are concerns that the U.S. demand to expand sales of American-made vehicles, especially pickup trucks, remains a source of conflict as it does not match domestic consumer demand. Lee Hangoo, a research fellow at the Korea Automotive Technology Institute, said, "What the United States wants most is for American-made cars, especially pickup trucks, to sell well in Korea to correct the trade imbalance. The issue is that Korean consumers do not buy American cars, so how to persuade the U.S. on this demand in the future is crucial."

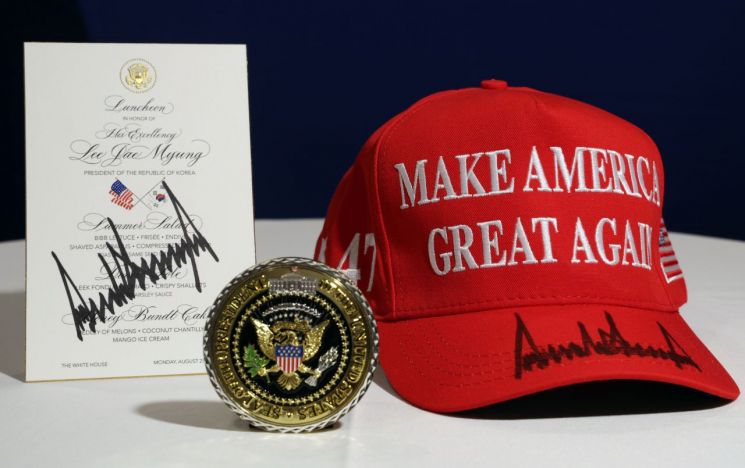

The presidential office revealed on the 25th (local time) a gift given by U.S. President Donald Trump to President Lee Jae Myung after a summit at the White House in Washington DC. It includes a White House commemorative medal, a 'MAGA' (Make America Great Again) hat signed by President Trump, and a lunch menu. August 26, 2025. Yonhap News Agency.

The presidential office revealed on the 25th (local time) a gift given by U.S. President Donald Trump to President Lee Jae Myung after a summit at the White House in Washington DC. It includes a White House commemorative medal, a 'MAGA' (Make America Great Again) hat signed by President Trump, and a lunch menu. August 26, 2025. Yonhap News Agency.

Semiconductors were not directly discussed at the summit, but the industry sees them as the most pressing challenge. Since the European Union settled on a 15% tariff rate in its negotiations with the United States, Korea can expect similar treatment. However, there are growing expectations that the U.S. may seek to exempt or reduce tariffs only if companies make local investments. Experts note that by directly linking tariff benefits to investment, the U.S. could intervene in corporate decision-making, and Korean companies may face a dual burden of managing both their ongoing large-scale investments in the U.S. and their dependency on the Chinese market. In particular, if the U.S. pushes for additional investment, companies would have to spend more to receive tariff benefits, which could in turn reduce their capacity for domestic investment. Han Areum, a senior research fellow at the Korea International Trade Association, said, "For semiconductors or pharmaceuticals, the measures have not yet been finalized, and the tariff proclamation is needed for confirmation. The government and companies must develop swift response strategies."

For steel, the potential for improvement is even more limited. The agreement with the European Union only reached the stage of starting discussions on tariff rate quotas (TRQs), without including specific reduction measures. With strong opposition from the U.S. steel industry persisting, most expect it will be difficult to reduce the tariff burden in the short term. An industry official explained, "For automobiles, the U.S. Big Three have significant overseas production, making interests complex, but for steel, the U.S. has a solid domestic production base and strong protectionist demands. Realistically, Korea cannot expect a significant reduction." Experts also analyze that steel is a symbolic sector in U.S. industrial policy, so short-term improvement is unlikely.

There are also clear follow-up tasks in strategic industries such as nuclear power, shipbuilding, and defense. In nuclear power, Korea Hydro & Nuclear Power and Westinghouse need to develop concrete cooperation plans. In shipbuilding, there are calls for entering the U.S. market through the acquisition of U.S. subsidiaries or the establishment of joint ventures. Koo Kibo, a professor at Soongsil University’s Department of Global Commerce, said, "In shipbuilding, it is necessary to expand orders through joint ventures or local subsidiaries with U.S. partners. For nuclear power, Korea Hydro & Nuclear Power must create a specific cooperation model with Westinghouse." In the defense sector, there are also suggestions that companies should prepare for possible changes in the role of U.S. Forces Korea and restructure their product portfolios to focus on advanced weaponry.

Regarding investment in the United States, there are concerns that the tariff agreement is largely a quid pro quo, making the connection with domestic industry all the more important. Experts stress that large-scale U.S. investments by Korean companies should be implemented in conjunction with the domestic industrial ecosystem to avoid becoming a mere cost burden. Jung Manki, chairman of the Korea Industry Alliance Forum, said, "The 15% reciprocal tariff is new, and the free trade agreement (FTA) is gone. As even domestic investment resources are flowing out, it is necessary to strengthen the industrial base and enhance competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.