K-food Craze Drives KurlyUSA Launch in the US

First Cross-Border B2C Service Targets Korean-American Consumers

Fresh Food Market Booming in the US,

But Customs Changes and High Logistics Costs Remain Key Challenges

Kurly has thrown its hat into the ring in the US market. As the K-food craze spreads not only among Korean-Americans but also among locals, the company is launching a cross-border direct purchase service that delivers Kurly products sold in Korea to customers across the United States. While the expansion of the fresh food market in the US is a positive sign, customs policies and high logistics costs are expected to be significant hurdles.

Kurly started operating its exclusive online mall in the United States, 'KurlyUSA,' on the 25th (local time). Screenshot from KurlyUSA SNS.

Kurly started operating its exclusive online mall in the United States, 'KurlyUSA,' on the 25th (local time). Screenshot from KurlyUSA SNS.

According to the retail industry on August 31, Kurly began operating its US-exclusive online mall, KurlyUSA, on the 25th (local time). KurlyUSA is a cross-border direct purchase service that delivers Kurly products sold in Korea to anywhere in the US within 48 hours of ordering. The primary target is local Korean-American consumers. Products are fully packaged at the Pyeongtaek logistics center in Gyeonggi Province and shipped via the global logistics company DHL. However, to ensure stable service operation, it will be limited to invitation-only members for the time being. While the specific product lineup has not yet been finalized, export-restricted items such as meat and dairy products will be excluded.

Previously, in June, Kurly established its first overseas subsidiary, Kurly Global, and began beta testing KurlyUSA. At that time, 100 US residents were selected as ambassadors for the beta test, and it is reported that the service was so popular that there were about 2,000 applicants. Popular items in Korea such as Knotted Donuts, Apple House Tteokbokki, and Gwanghwamun Mijin Noodles also received positive responses from local consumers.

This is the first time Kurly is directly targeting local consumers through its own platform. In the past, some popular Kurly products were sold to US consumers via Korean-American markets through business-to-business (B2B) transactions, but the company had never operated directly. However, with the recent Korean Wave (Hallyu) in the US, including K-food and K-beauty, and the increasing number of consumers seeking Korean products, Kurly decided to launch a business-to-consumer (B2C) cross-border direct purchase service. A Kurly representative said, "We aim for an official launch within the year," and explained, "Regardless of the impact of US customs policies, the service is being operated as part of our new business strategy."

K-food's Popularity Is Clear, But Customs and Logistics Costs May Be a Burden

The decision to choose the US as the first overseas market was made in consideration of the spread of the Korean Wave to K-food. According to Korea Agro-Fisheries & Food Trade Corporation (aT) export data, exports of Korean food products to the US reached $1.74014 billion in 2023, up 6.6% from the previous year, and have grown at an average annual rate of 10.4% since 2019. An industry insider commented, "As consumer interest in Korean food has increased significantly, more people are seeking Korean frozen gimbap, hot dogs, and other street foods. The number of Korean grocery stores and restaurants in the US is increasing, making Korean food more accessible, and even major local supermarket chains are selling Korean products, indicating that K-food is becoming mainstream."

The US fresh food market, led by companies like Amazon and Walmart, is also growing rapidly. In 2023, the size of the US online food distribution channel reached $115.872 billion, a 12% increase from the previous year, with an average annual growth rate of 30.1% over the past five years. This is a sharp contrast to the US offline food distribution channel, which has grown at an average annual rate of 6.1%. Kurly, as an online platform, is aiming for growth alongside the expansion of the US fresh food e-commerce market.

However, customs duties are expected to pose a risk. Previously, no tax was imposed on imported goods valued at $800 or less in the US, but starting on the 29th, ad valorem or fixed duties by product will be imposed on imports under $800, depending on the country of origin. If Kurly does not establish its own logistics network, such as local distribution centers, this could lead to price increases. A Kurly representative stated, "The customs policy was an unforeseen variable when we considered entering the US market," and explained, "Limiting KurlyUSA to invitation-only members for now also takes these customs changes into account."

High logistics costs are also a burden. Due to the nature of fresh food, delivery time is a crucial factor in purchasing decisions, and in the geographically vast US, high shipping and storage fees could hurt profitability. Kurly plans to offer free shipping on frozen and refrigerated orders over $89 and ambient goods over $49, but direct air shipping is expected to result in significant logistics costs. Additionally, while DHL, the local delivery partner, offers fast and reliable service, the high cost could put Kurly at a disadvantage in price competition.

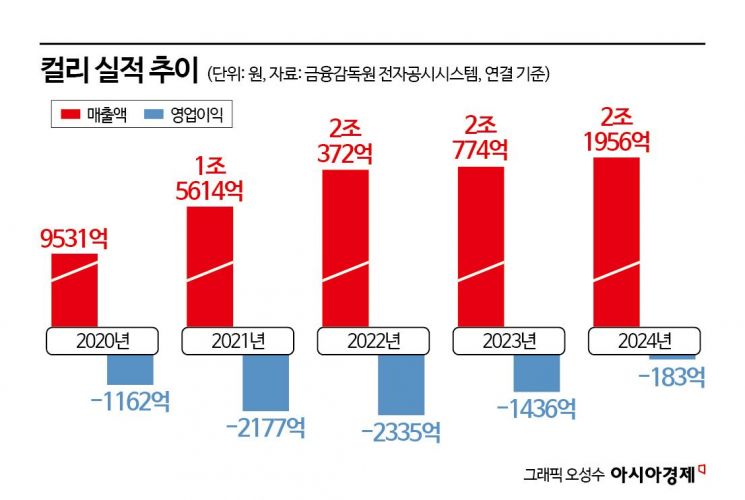

Despite these uncertainties, Kurly's move into the US as a new business is seen as a step toward an initial public offering (IPO). Kurly had pursued an IPO several times, but these plans fell through as market conditions deteriorated. Last year, Kurly's revenue was 2.1956 trillion won, a 6% increase from the previous year, but growth has slowed compared to the past. In 2021, the year-on-year sales growth rate was 30.4%, but last year it was only 5.7%. To ensure a successful IPO, the company needs to demonstrate results through overseas expansion.

Ultimately, differentiation will be essential for Kurly to stand out in the US market. With major US companies like Amazon and Walmart dominating the online market, experts say Kurly needs to establish itself as a specialized K-food platform. In particular, strategies leveraging the "full cold chain system" (maintaining optimal temperatures throughout the distribution process to ensure product freshness) and "next-morning delivery" (orders placed the night before are delivered by early morning the next day), which were key to Kurly's success in Korea, are seen as necessary.

Lee Eunhee, a professor of consumer studies at Inha University, commented, "Recently, Amazon has been expanding same-day delivery for fresh food, and the grocery business is growing. Kurly's cold chain system is world-class. If Kurly emphasizes its competitiveness in fresh food and cold chain logistics, it has a good chance of succeeding in the US market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.