Ranking of Business Diversification Among Financial Groups: KB and Shinhan Rated Highly

Hana, Woori, BNK, and iM Receive Lower Marks

"Business Diversification Essential to Reduce Excessive Dependence on Banking"

Among the major domestic financial holding companies, KB Financial Group and Shinhan Financial Group are being recognized for achieving the most significant results in business diversification. As the Lee Jaemyung administration has publicly criticized banks for excessive interest-based profits, reducing reliance on banking and securing revenue sources from non-banking sectors has emerged as a key task for financial holding companies.

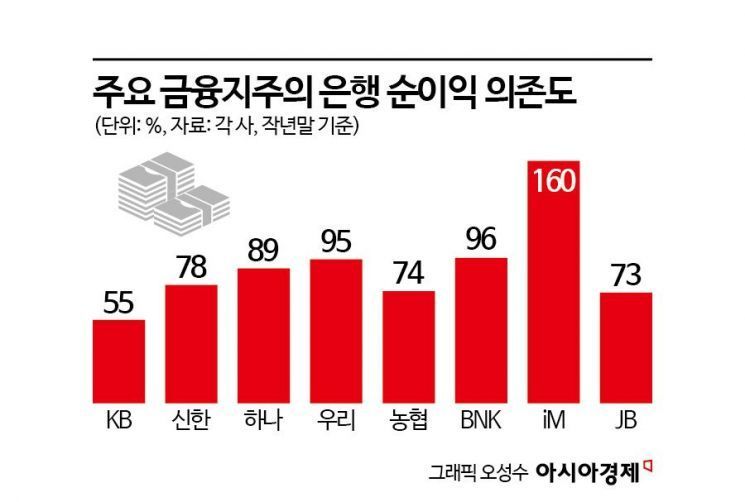

On the 27th, Korea Ratings selected KB Financial Group as the most diversified among domestic financial holding companies. As of the end of last year, KB Financial Group's dependence on net profit from its banking business was 55%, the lowest among domestic financial holding companies.

KB Financial Group was able to lower its reliance on net profit from banking because its major subsidiaries have top-tier market positions in their respective sectors. As of the end of the first quarter this year, based on total assets, KB Financial Group's subsidiaries ranked first in banking, second in credit cards, third in securities, third in capital, and fifth in non-life insurance, with multiple strong affiliates contributing to the diversification of net profit. This is attributed to KB's active investments and structural reforms in various subsidiaries such as capital and insurance since 2021.

Shinhan Financial Group has also been evaluated as achieving business diversification on par with KB. As of the end of last year, Shinhan's dependence on net profit from banking was 78%, higher than KB but still relatively low compared to other financial holding companies. Shinhan also succeeded in business diversification by restructuring subsidiaries and making equity investments centered on insurance, asset management, and asset trust. In particular, Shinhan received high marks for integrating Shinhan Life Insurance and Orange Life in 2021 to launch Shinhan Life.

Hana Financial Group and Woori Financial Group showed weaker performance in business diversification, with reliance on net profit from banking at 89% and 95%, respectively, higher than other financial holding companies. Hana Financial Group had a weaker market position in insurance compared to leading financial groups and a high dependence on net profit from banking. Woori Financial Group is also pursuing business diversification, but its reliance on net profit from Woori Bank remains excessively high. However, as the group acquired stakes in Dongyang Life Insurance and ABL Life Insurance this year, it is expected to reduce its dependence on banking.

NongHyup Financial Group had a banking dependence of 74%, the second lowest among the top five financial holding companies after KB. However, as NongHyup Bank, which accounts for about 75% of the group's total assets, performs public functions, overcoming its lower profitability compared to commercial banks was cited as a challenge.

For financial holding companies with regional banks as core subsidiaries, such as BNK Financial Group and iM Financial Group, reliance on banking was high. BNK's dependence on net profit from Busan Bank and Kyongnam Bank reached 96%, and in the case of iM, due to losses in non-banking sectors, dependence on net profit from iM Bank soared to 160%.

Kim Kyungkeun, Senior Researcher at Korea Ratings, said, "During the upcoming interest rate cut cycle, a contraction in banks' net interest margins appears inevitable," adding, "This year, performance differentiation will be driven more by the expansion of non-interest income from securities, insurance, and capital rather than simple interest income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)