Active Debate Over Introduction of Korean Won Stablecoin

Supporters Emphasize Advantages Such as Convenience in International Payments and Expansion of Financial Services

Opponents Raise Concerns Over Financial Stability and Effectiveness of Monetary Policy

Legislative Bills Proposed in National Assembly, Institutionalization Becoming More Tangible

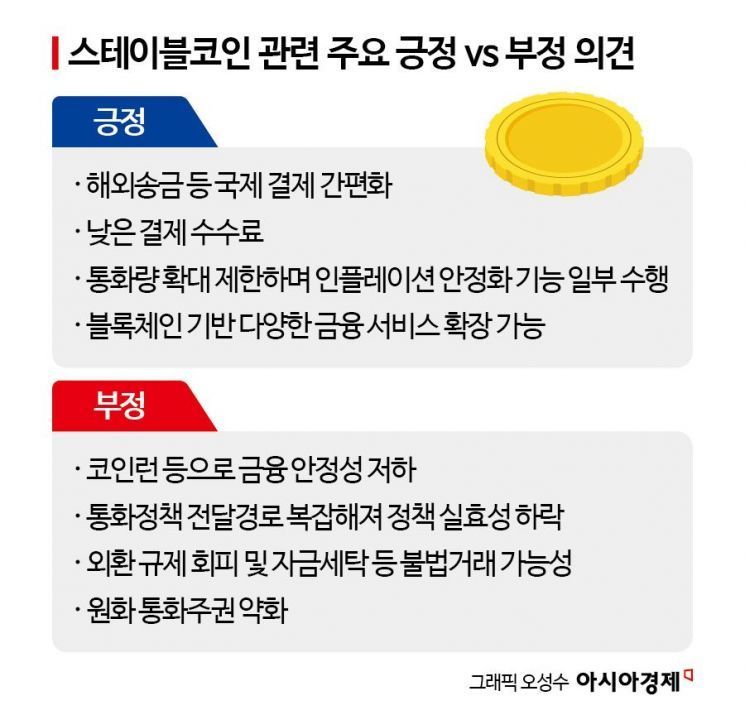

As stablecoins gain increasing influence in global financial markets, discussions surrounding the introduction of a Korean won-based stablecoin are becoming more active domestically. While the National Assembly is seeing a series of legislative bills aimed at institutionalizing stablecoins, the divide between positive and negative public opinion on stablecoin regulation is also becoming more pronounced.

Active Discussion on Introducing a Korean Won Stablecoin Amidst Sharp Division in Public Opinion

According to the National Assembly and the financial sector on August 26, there are currently four bills related to stablecoins that have been proposed in the National Assembly. These were sponsored by Min Byungdeok, Ahn Dogeol, and Kim Hyunjung of the Democratic Party of Korea, as well as Kim Eunhye of the People Power Party. Most of these bills designate banks as the issuers and set strict requirements, such as a minimum capital of 5 billion won. Only Assemblyman Min allows businesses with at least 500 million won in capital to issue stablecoins. While multiple bills have been proposed in the National Assembly, the Financial Services Commission is also preparing to announce a government bill within the year, continuing the push for legislation.

As the legalization of a Korean won-based stablecoin becomes more tangible, concerns surrounding its introduction persist. The primary worries regarding the spread of stablecoins are the potential decline in financial stability and the reduced effectiveness of monetary policy.

According to a report published in May by the Bank for International Settlements (BIS), which examined the impact of stablecoins on U.S. Treasury yields, inflows of funds into the stablecoin market led to lower short-term Treasury yields. When approximately $3.5 billion (4.85 trillion won) flowed into the stablecoin market over five days, the three-month Treasury yield dropped by 0.02 to 0.025 percentage points within ten days. Song Taewon, head of the Digital Finance Team at the Korea Deposit Insurance Corporation, explained, "This effect is similar to the impact of a small-scale quantitative easing (QE) on long-term Treasury yields," adding, "This suggests that stablecoins are establishing themselves as real market participants in the short-term Treasury market."

When funds flow out of the stablecoin market, the impact on the Treasury yield market is even more significant. If $3.5 billion is withdrawn from the stablecoin market over five days, the three-month short-term Treasury yield rises by about 0.06 to 0.08 percentage points within ten days. This indicates that a coin run could have a substantial impact on financial markets.

Ultimately, the expansion of the stablecoin market could affect market interest rates through various channels, raising concerns about the diminished effectiveness of central bank monetary policy. Song emphasized, "As the stablecoin market grows, its impact on short-term interest rates increases non-linearly. This complicates the transmission mechanism of monetary policy and could ultimately weaken its effectiveness."

There are also concerns about the negative impact of stablecoin proliferation on commercial banks. NICE Investors Service warned in a report on August 25 that if funds move to stablecoins, banks' deposit bases could shrink and their intermediary function could weaken. In particular, if banks serve only as custodians of reserves rather than as stablecoin issuers, their funding costs for attracting deposits may rise, and their net interest margin may decline.

Lee Junghyun, senior researcher at NICE Investors Service, stated, "Banks will inevitably face competition from low-cost stablecoin-based services in remittance and payment, which could reduce their existing fee income. Weakening deposit bases and declining interest and fee income could undermine banks' profitability," he predicted.

Advantages Highlighted: Convenience in International Remittance and Lower Transaction Fees

While concerns about the negative aspects of stablecoins persist, there is a growing movement to actively introduce them into the domestic market to create new value. The main advantages of stablecoins include convenience in international remittance, lower transaction fees, and the creation of diverse financial infrastructure.

Ahn Dogeol, a Democratic Party of Korea assemblyman preparing for the introduction of a Korean won-based stablecoin, emphasized, "As the United States and major European countries rapidly transition to a digital economy, we also need to introduce a Korean won-based stablecoin to establish a global payment and settlement system and secure monetary sovereignty." He added, "Through the international use of a won-based stablecoin, we can expect to internationalize the won and expand our global economic influence. A well-designed won-based stablecoin will promote efficiency in the domestic financial infrastructure by reducing payment and settlement costs and enabling real-time interbank settlements."

There are also calls, especially from the fintech sector, to allow a variety of issuers beyond banks to broaden the ecosystem for Korean won-based stablecoins. Lee Byungkyu, Director of Innovation Growth Support at Naver Pay, argued at a National Assembly seminar last week, "It is crucial to create an open competitive environment where various technology companies can participate, rather than restricting stablecoins to a closed structure dominated by a specific industry," highlighting the need to open the market to non-bank entities.

Some even argue that stablecoins could help address inflation issues. Kim Yung, a researcher at NH Investment & Securities, claimed, "With inflation persistently exceeding target levels, stablecoins could unexpectedly help limit money supply expansion and partially stabilize inflation." He added, "There is historical research showing that private currency issuance contributed to inflation stability, citing the example of the free banking era in 19th-century America, when inflation remained low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)