10 Months After Launch of Insurance Claim Trusts

Minimal Enrollment Beyond Samsung and Kyobo

Regulatory Easing Needed, Including Recognition of Accident and Illness Insurance as Trust Assets

It has been about 10 months since insurance claim trust services were introduced, but they have not gained as much traction as initially expected. At the time of the system's launch, the market was anticipated to reach approximately 900 trillion won, drawing significant attention. However, only a few major companies have seen substantial enrollment in these products. Experts advise that regulatory improvements, such as expanding the scope of eligible trusts, are necessary.

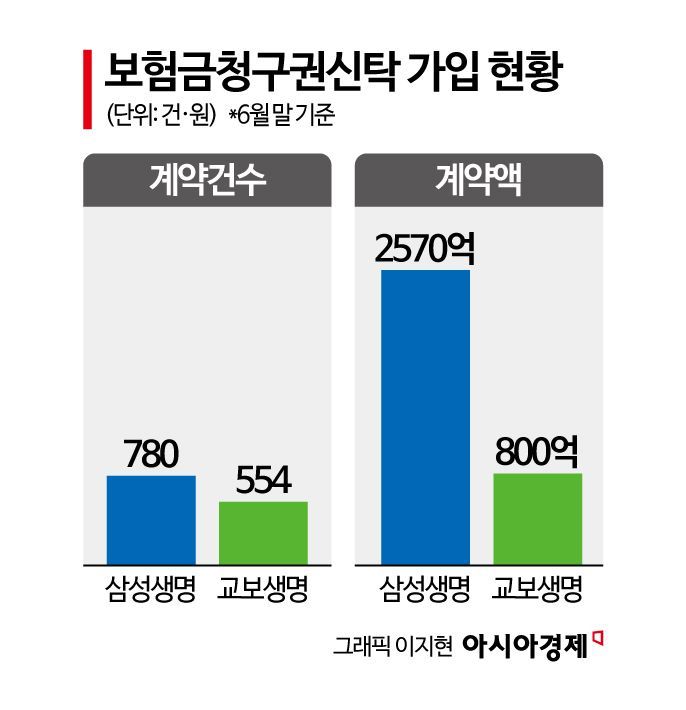

According to the financial industry on August 25, as of the end of June, Samsung Life Insurance had accumulated 780 insurance claim trust contracts, with a total amount of 257 billion won. Kyobo Life Insurance recorded 554 accumulated contracts, with a total amount of about 80 billion won. Excluding these two insurers, the performance of insurance claim trust contracts remains negligible among other companies.

An image depicting an insurance company engaged in insurance claim trust services, but the activity is not properly thriving, as described by ChatGPT. ChatGPT

An image depicting an insurance company engaged in insurance claim trust services, but the activity is not properly thriving, as described by ChatGPT. ChatGPT

An insurance claim trust is a product in which the benefactor entrusts their life insurance payout to a trust company, such as an insurer, which then manages and operates the funds, distributing them to the heirs (beneficiaries) according to conditions and timing set in advance by the customer. The market for these products opened after a legal amendment in November last year allowed general life insurance payouts of 30 million won or more to be entrusted. As of the end of the first quarter, the outstanding balance of life insurance policies with death coverage at 22 life insurers was about 882 trillion won, indicating significant market potential and fueling high expectations at the time of launch.

However, with a few exceptions, most life insurers have been lukewarm about introducing insurance claim trusts. Currently, only five insurers-Samsung Life, Kyobo Life, Hanwha Life, Mirae Asset Life, and Heungkuk Life-are authorized to conduct comprehensive property trust business. Since Kyobo Life acquired the qualification for comprehensive property trusts in June last year, this five-company structure has remained unchanged, and no additional insurers have obtained the qualification since the introduction of insurance claim trusts. An industry official stated, "The commission for insurance claim trusts is not high, so it is often considered more profitable to sell another insurance product with the same workforce. For insurers affiliated with financial holding companies, it is also difficult to expand new organizations because their banks already handle trust business."

Experts unanimously agree that further institutional improvements are needed to vitalize insurance claim trusts. A frequently discussed measure is to recognize not only death benefits but also accident and illness insurance payouts as trust assets. This approach is already being implemented in the United States and Japan. Ji Gwangwoon, a professor at the School of Law at Kunsan National University, said, "The scope of trust assets should be expanded to include accident and illness insurance payouts, and the minimum trust amount restriction should be abolished so that insurers can set it autonomously. It is also necessary to relax the provision that prohibits policy loans (contract loans) at the time of trust contract execution."

There are also opinions that the range of trust beneficiaries should be broadened. In Korea, trust beneficiaries are currently limited to spouses and direct blood relatives, which fails to reflect changing family structures such as common-law marriages, engagements, or same-sex unions. In Japan, both individuals and organizations can be designated as beneficiaries. If desired, a person can freely leave their insurance payout to a common-law spouse, school, religious group, or social organization.

There have also been suggestions to ease the qualification requirements for those recommending insurance claim trusts. Under the current Capital Markets Act, only trust investment solicitation agents with certain qualifications can sell insurance claim trusts. Professor Ji stated, "It would be better to establish a qualification system with simplified requirements compared to trust investment solicitation agents, allowing insurance planners to sell these products. It would also be desirable for the Korea Life Insurance Association to develop a separate qualification exam and training program."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.