Survey of 20,000 Customers

Phishing Messages and Fake Apps Top List of Concerns

"Real-Time Fraud Detection and Warning Features Needed"

K Bank to Strengthen "Safety Lab" Functions

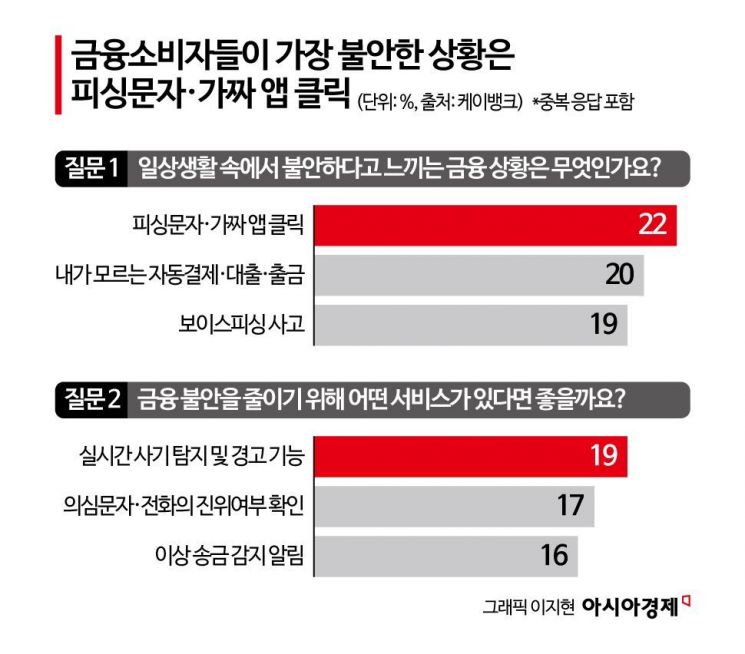

When do customers actually feel anxious about financial situations? K Bank asked this question directly to 20,000 customers through its application (app). The most common response was "phishing messages and fake apps," followed by "unknown loans, withdrawals, or automatic payments," and "voice phishing." K Bank plans to strengthen its financial fraud prevention services, including real-time detection and warning features, based on these results.

Last month, K Bank conducted a survey on its app, asking customers, "Please tell us about the elements of financial fraud that make you feel anxious." About 20,000 customers participated in the survey. There were two questions: "What financial situations in your daily life make you feel anxious?" and "What services do you think are necessary to reduce financial anxiety?" Multiple answers were allowed for each question.

Customers responded that clicking on phishing messages and fake apps (22%) made them feel the most anxious. Cases where unknown loans, withdrawals, or automatic payments occurred accounted for 20%. Voice phishing, the most widely known financial fraud method, was also cited as a source of anxiety by 19% of respondents. K Bank explained, "As financial fraud schemes become increasingly sophisticated, it is becoming harder to distinguish between real and fake, and it is difficult for customers to immediately recognize or respond to incidents when they occur, which further heightens their anxiety."

The services that customers thought were most needed to reduce financial anxiety were consistent with the top concerns. The most common response, at 19%, was the need for real-time fraud detection and warning features. However, a similar number of customers also expressed the need for services that verify suspicious messages and calls (17%) or detect and alert users to abnormal transfers (16%).

This is the second time a financial institution has conducted a survey on financial fraud. In August 2023, Toss conducted a survey as part of a security campaign during "Information Protection Month," asking customers about "moments when they feel financial anxiety." A total of 8,954 responses were received, with voice phishing and smishing ranking first (61%), followed by secondhand transaction scams (16%) and malicious apps (9%). K Bank went a step further by conducting a new survey to identify the specific situations that make customers anxious and to provide appropriate services. In fact, K Bank plans to introduce a feature in the second half of this year that will allow customers to enter suspicious messages into the app, where artificial intelligence (AI) will automatically determine whether the message is smishing.

K Bank also plans to strengthen its "Safety Lab" feature based on the survey results. In February of this year, the K Bank Consumer Protection Office established the "Safety Lab" within the K Bank app. This brings together services and features designed to protect customers from various types of financial fraud, making them easier and more convenient to use. Many of the services introduced by the lab are the first of their kind in the banking sector.

The comprehensive Jeonse Safety 3-in-1 Full Care Service, designed to prevent jeonse fraud, is a representative example. Following the launch of the "Jeonse Safety Service" and "My Home Change Notification" service last year, K Bank introduced the "HF Jeonse Protection Guarantee" in partnership with the Korea Housing Finance Corporation in January. For example, if you enter the address of a property you plan to lease into the "Jeonse Safety Service" before signing a contract, you can immediately check for any issues in the certified copy of the register and whether the "HF Jeonse Protection Guarantee" is available. If you register the address with "My Home Change Notification," you will receive real-time updates on changes to the register from before the contract is signed until after moving in. Subsequently, by applying for a K Bank jeonse loan and joining the "HF Jeonse Protection Guarantee" during the contract and loan process, you can ensure your deposit is safely protected.

In addition, the lab has launched other financial transaction-related services, such as the "Full Compensation for Identity Theft" service, which adds an identity verification step when changing mobile devices and fully compensates for losses in the event of identity theft, and the "Safe Credit Transaction Block" service, which prevents new loan frauds under your name.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)