Possibility of Allowing Live Broadcasts and Relaxing Screen Regulations

Mounting Burden of Transmission Fees, Industry Warns of "Inevitable Cutthroat Competition"

The government is accelerating its review of introducing a data home shopping (T-commerce) channel dedicated to small and medium-sized enterprises (SMEs) and small business owners, as promised by President Lee Jaemyung. In order to include approval conditions and the expected ripple effects in the specific measures to be announced in October, the government is widely gathering expert opinions and industry feedback.

T-commerce is a form of data home shopping that merges broadcasting and telecommunications, allowing viewers to search for and order products via remote control while watching TV. Unlike traditional TV home shopping, which features live hosts, T-commerce mainly operates through pre-recorded broadcasts, resulting in relatively lower barriers to entry.

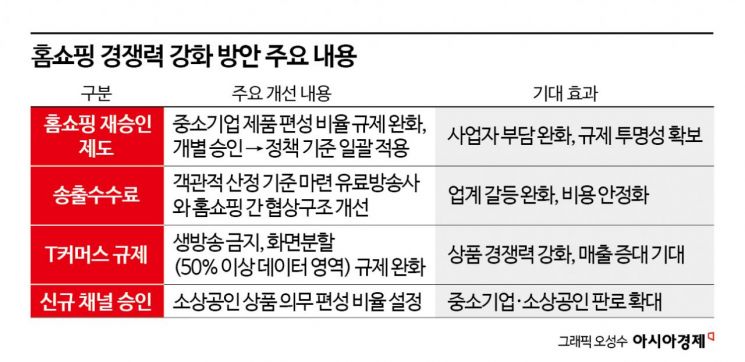

According to the Ministry of Science and ICT and industry sources on August 25, the government will announce a 'Home Shopping Competitiveness Enhancement Plan' in October. This plan is based on proposals developed by the 'Home Shopping Industry Competitiveness Enhancement Task Force,' launched in June last year, together with external research. The task force, which includes 17 experts in broadcasting, law, economics, and business management, has focused its discussions on four main areas: improving home shopping re-approval regulations, establishing criteria for transmission fees, easing T-commerce regulations, and approving new channels.

Focus on Mandatory Programming for Small Business Products

The main justification for launching a new T-commerce channel is to expand sales channels for small business owners and SMEs. The Ministry of Science and ICT is reviewing the possibility of establishing new T-commerce channels and will also examine approval requirements such as programming ratios for small business products. For example, the ratio could be set at 30% for small business products, 40% for SME products, and 30% for large company products. However, the number of channels to be allowed has not yet been determined. Home&Shopping and Public Home Shopping are reportedly showing interest.

Currently, there are seven TV home shopping channels in the market: CJ OnStyle, GS Shop, Lotte Homeshopping, Hyundai Homeshopping, NS Homeshopping, Home&Shopping, and Public Home Shopping. In addition, there are 10 T-commerce channels in operation, including SK Stoa, Shinsegae Live Shopping, KT Alpha Shopping, Shopping NT, and W Shopping.

The Ministry of Science and ICT recently met with representatives from TV home shopping and T-commerce channels to discuss regulatory improvements and the potential impact of introducing new channels. An industry insider said, "Since the government is pursuing channel approvals to support small business owners, programming ratios will be the main point of contention."

Possibility of Allowing Live Broadcasts and Easing Screen Regulations

The Ministry of Science and ICT is also considering easing the current restrictions on T-commerce, including the ban on live broadcasts and the requirement that only 50% of the screen can be used for data. Currently, only pre-recorded broadcasts are allowed, and more than half of the screen must be allocated to data segments. If live broadcasts and expanded video segments are permitted, it is expected that product competitiveness will improve.

Mandatory programming regulations for SME products, which have been imposed during the home shopping re-approval process, are also under review. The government is discussing the possibility of establishing uniform policy standards, rather than imposing individual approval conditions in the medium to long term. Currently, TV home shopping channels are required to allocate 55-70% of their programming to SME products, while T-commerce channels must allocate at least 70%.

The issue of transmission fees is also being raised. The government intends to establish objective criteria for calculating these fees in order to reduce conflicts between pay-TV operators and home shopping channels. A T-commerce representative pointed out, "There is a need for practical improvements such as easing the SME programming ratio," adding, "The burden of education and investment ratios, as well as contributions to the broadcasting development fund, should also be reduced."

Industry: "Regulatory Easing Is Welcome, But Overheated Competition Is a Concern"

The industry welcomes the overall trend toward regulatory easing but remains cautious about the addition of new channels. Home shopping executives told the government, "With declining sales and increasing cost pressures, the emergence of new competitors will inevitably add to the burden."

They first pointed out the issue of product sourcing. Since the number of SMEs capable of supplying home shopping channels is limited, an increase in the number of channels could lead to repeated programming of the same products, and the resulting inventory and production burdens may reduce the number of participating companies. An industry official explained, "If the industry slump worsens, funding for content production companies will also decrease, potentially shrinking the entire ecosystem."

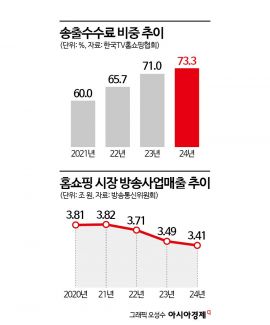

Transmission fees are a major concern for the industry. According to the Korea TV Home Shopping Association, the ratio of transmission fees to sales reached 73.3% last year. The ratio has increased annually: 60% in 2021, 65.7% in 2022, and 71% in 2023. In contrast, total home shopping (TV + data) sales declined from 3.8118 trillion won in 2020 to 3.417 trillion won last year, marking five consecutive years of negative growth and the lowest level since 2012. Home shopping companies emphasized, "We are paying high transmission fees to secure prime (golden) channel positions, but if the number of operators increases, competition for these positions will drive fees even higher, further undermining the profitability of the entire industry."

An industry insider commented, "While the previous administration pushed ahead unilaterally, the current government is listening to industry opinions and offering incentives. There is hope, as the current minister comes from the private sector and understands the realities." He added, "The need to introduce AI-based commerce was also discussed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.