Despite Tariff Impact on Transformers, No Change in Localization Strategy

Why LS Electric Is Taking a Different Path from Hyundai Electric and Hyosung Heavy Industries

Expanding U.S. Market Penetration by Focusing on Core Strength: Distribution

LS Electric is strengthening its strategy for switchgear, which is considered a "tariff-free zone," amid the imposition of high tariffs of up to 50% on steel and aluminum derivative products in the United States. Unlike competitors that are expanding local production of transformers, which face significant tariff burdens, LS Electric believes that focusing on its main product line-switchgear-will be sufficient to maintain its competitiveness.

According to the power industry on August 22, LS Electric has decided not to consider local production of transformers in the United States, despite the implementation of a 50% tariff on steel and aluminum derivative products. While transformers exported to North America will inevitably face tariff burdens, switchgear and low-voltage power equipment-which accounted for more than 60% of LS Electric's approximately KRW 700 billion in North American sales last year-are exempt from these tariffs. The company believes this will allow it to absorb much of the impact.

In contrast, other competitors plan to expand local production because oriented electrical steel, which accounts for 30-40% of the total cost of finished transformers, is now subject to tariffs. However, the effectiveness of this strategy remains uncertain due to the weak local supply of raw materials in the United States.

LS Electric is focusing more on the distribution (switchgear) market than on the transmission (transformer) market. The company has maintained a majority market share in the domestic distribution market for over a decade, demonstrating its technological competitiveness. Although transformers were not its main product, LS Electric expanded its portfolio by supplying products locally when companies such as Samsung Electronics and Hyundai Motor expanded their production bases in the United States. Subsequently, the company benefited from the expansion of artificial intelligence (AI) data centers and the demand for replacing the aging U.S. power grid.

LS Electric's greatest strength lies in its technological competitiveness in distribution. While IEC standards are commonly used in the global power equipment market, the U.S. market requires the much stricter UL certification. Obtaining new certification for a single product requires an effort comparable to developing an entirely new product, making the U.S. power market a high-barrier market.

An LS Electric representative explained, "Since the early 2010s, we have focused on securing UL certification, foreseeing the growth potential of the U.S. market. As a result, we are currently the only domestic power equipment company with UL certification for switchgear." The company has also steadily expanded its next-generation distribution technologies, such as smart switchgear and solid-state circuit breakers (SSCB).

Another key factor is market growth potential. Although individual ultra-high-voltage transformers command prices in the hundreds of millions of won, the distribution market as a whole is expected to grow to nearly six times the size of the transmission market.

According to market research firm Global Market Insights, the transformer market is projected to grow from $63.8 billion (about KRW 89 trillion) last year to $122.7 billion (about KRW 171 trillion) by 2034. During the same period, the distribution market is expected to expand from $287.7 billion (about KRW 422 trillion) to $613.2 billion (about KRW 900 trillion). Notably, the U.S. Energy Information Administration (EIA) recently stated that, over the past five years, the largest portion of U.S. power infrastructure investment has been allocated to distribution infrastructure. This is expected to provide a solid market foundation for LS Electric's strategy of specializing in switchgear and low-voltage power equipment in the U.S. market.

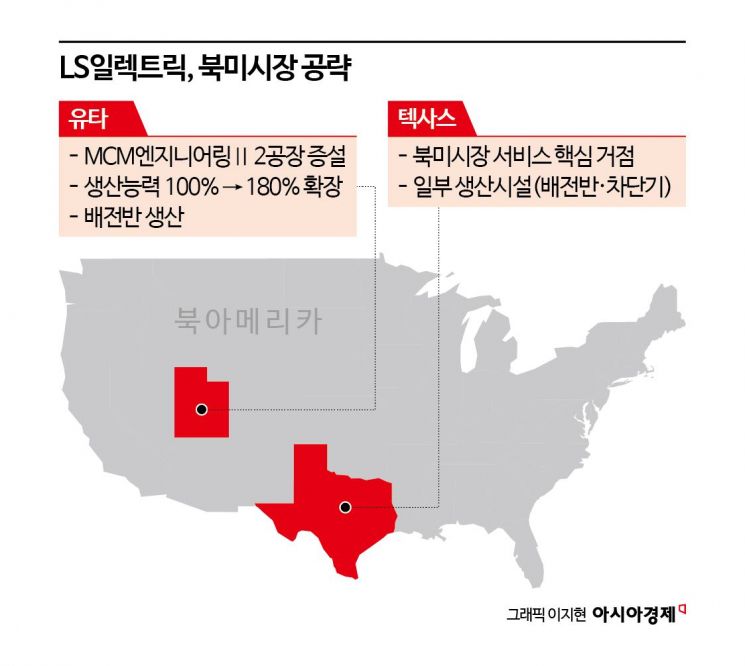

Meanwhile, LS Electric completed the construction of its Bastrop Campus in Texas this year. The company also remodeled part of the site to establish a 3,300-square-meter switchgear production plant. In addition, LS Electric acquired MCM Engineering II, a switchgear manufacturer based in Cedar City, Utah, and completed the expansion of a second plant earlier this year. The company is also considering further expansion based on local market trends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.