Agricultural, Forestry, and Fishery Products Up 5.6%, Highest in 1 Year and 11 Months

Beef and Pork Prices Rise by 6.5% and 4.2% from Previous Month

Despite Continued Uncertainty in August Weather Conditions...

External Factors Such as Oil Prices and Exchange Rates Remain Mixed

In July, when heatwaves and heavy rains were at their peak, the producer price index (PPI) continued its upward trend for the second consecutive month. Due to increased summer demand and supply shortages caused by worsening weather conditions, the price of spinach soared by 171.6% compared to the previous month, while cabbage surged by 51.7%. With beef and pork prices also rising, the producer price index for agricultural, forestry, and fishery products recorded its highest growth in 1 year and 11 months.

Poor Harvest and Growth Due to Heatwaves... Agricultural, Forestry, and Fishery Products Up 5.6%, Highest in 1 Year and 11 Months

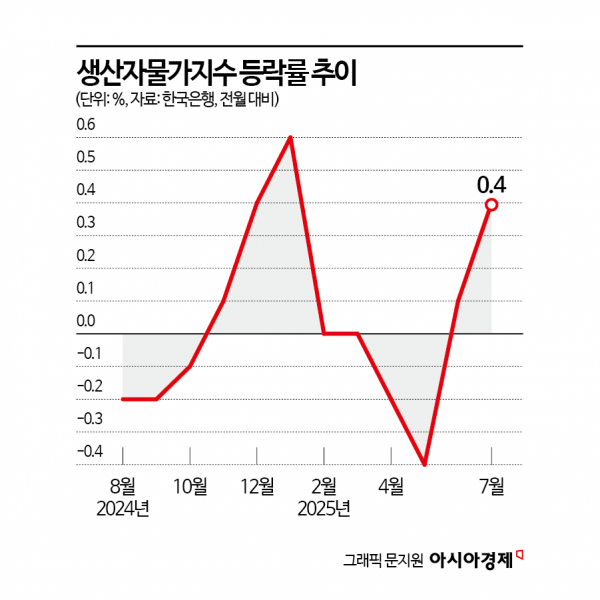

According to the "Provisional Producer Price Index for July 2025" released by the Bank of Korea on the 21st, last month's PPI stood at 120.20 (2020=100), up 0.4% from the previous month. Agricultural products and services led the increase, marking two consecutive months of growth. Compared to the same period last year, the index rose by 0.5%.

By category, agricultural, forestry, and fishery products rose by 5.6% from the previous month, driven by increases in agricultural products (8.9%) and livestock products (3.8%). This is the highest growth rate since August 2023 (7.2%), nearly 1 year and 11 months ago. Lee Moonhee, head of the Price Statistics Team at the Economic Statistics Department of the Bank of Korea, explained, "Agricultural products, including spinach and cabbage, which saw significant price hikes this month, were affected by poor harvests due to worsening weather conditions such as heatwaves and heavy rains in July." Agricultural products also posted their highest growth rate since January 2024 (9.3%).

Livestock products such as beef (6.5%) and pork (4.2%) saw price increases as demand rose during the vacation season. In addition, supply disruptions caused by poor growth and increased mortality due to heatwaves also contributed to the price hikes. Lee analyzed, "For vegetables and livestock products, the increased number of heatwave days in July this year compared to the same month last year generally affected prices." Regarding the impact of the consumer coupon program aimed at revitalizing livelihoods, he said it is still difficult to assess. Lee stated, "Since the consumer coupons were distributed from late July, it is statistically challenging to distinguish their actual impact at this point," but added, "It may have influenced expectations of increased demand."

For manufactured goods, coal and petroleum products (2.2%) and computers·electronic and optical devices (0.6%) rose, resulting in a 0.2% increase from the previous month. Electricity, gas, water, and waste services fell by 1.1% from the previous month, led by a drop in residential electricity (-12.6%). Services such as restaurant and accommodation services (1.1%) and financial and insurance services (1.4%) increased by 0.4% compared to the previous month.

By special classification, food products-including edible agricultural, forestry, and fishery products and processed foods-rose by 2.6% from the previous month, while fresh foods jumped by 9.9%. Energy, including petroleum products, fell by 0.4%. IT products rose by 0.3% from the previous month. Items excluding food and energy increased by 0.2% from the previous month.

Uncertain Weather Conditions in August... Mixed Trends in External Factors Such as Oil Prices and Exchange Rates

It remains uncertain whether the PPI will continue to rise this month. Worsening weather conditions in August are still contributing to instability in the prices of agricultural, forestry, and fishery products, but the reduction in industrial city gas rates is exerting downward pressure. Major external factors such as oil prices and exchange rates are also showing divergent trends. Lee stated, "So far this month, the average price of Dubai crude oil has fallen by 2.3% compared to the previous month, while the won-dollar exchange rate has risen by 0.9%," adding, "We need to monitor the situation further to determine the direction for this month."

Last month, domestic supply prices rose by 0.8% compared to the previous month, but fell by 1.0% year-on-year. The domestic supply price index measures the price changes of goods and services supplied domestically (including domestic shipments and imports) to track the ripple effects of price fluctuations. By stage of production, prices for raw materials (4.6%), intermediate goods (0.4%), and final goods (0.5%) all increased.

The total output price index, which measures the price changes of goods and services including exports as well as domestic shipments to capture overall price fluctuations of domestic products, rose by 0.6% from the previous month. Although electricity, gas, water, and waste services (-1.1%) declined, manufactured goods (0.6%) and other categories increased.Year-on-year, the index fell by 0.5%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)