KOSPI Falls for Third Straight Session

Index Briefly Drops Below 3,100 During Trading

First-Half Leaders Like Defense and Nuclear Stocks Slump

Investor Sentiment Hit by Policy Concerns and AI Bubble Fears

The sluggish performance of the KOSPI continues. Defense and nuclear power stocks, which drove the index's rise in the first half of the year, have now become the main factors dragging the index down in the second half, and there are no clear new leading sectors to offset this trend. Investor sentiment has weakened significantly amid policy-related uncertainties and the growing narrative of an artificial intelligence (AI) bubble.

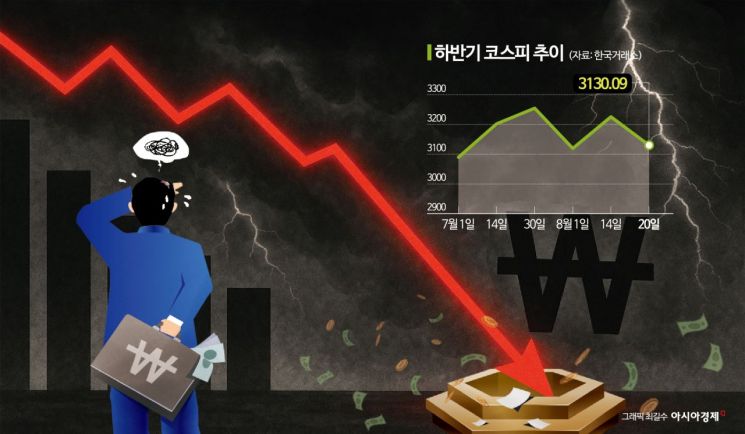

According to the Korea Exchange on the 21st, the KOSPI closed at 3,130.09 on the previous day, down 0.68%. This marked the third consecutive day of decline. Notably, during the previous trading session, the index briefly fell below the 3,100 level. It was the first time since July 8 that the KOSPI had dropped below 3,100 during trading hours. Although the KOSPI at one point fell by more than 2%, it gradually pared its losses and recovered above the 3,100 mark.

The weakness of defense and nuclear power stocks, which had driven the KOSPI's gains in the first half, is now contributing to the overall decline. On the previous day, Doosan Enerbility fell for the fourth consecutive session, closing down 3.53% at 57,400 won. The stock, which hovered around the 70,000 won level last week, has now dropped to the 57,000 won range. KEPCO KPS and KEPCO Engineering & Construction also declined by 2.21% and 3.65%, respectively. Nuclear power stocks have been shaken by the controversy over the so-called "humiliating contract" that Korea Hydro & Nuclear Power and Korea Electric Power Corporation signed with Westinghouse in the United States.

Defense stocks have also performed poorly recently, amid the possibility of an end to the war between Russia and Ukraine. Hanwha Aerospace, which was on the verge of becoming a blue-chip stock after rising to 998,000 won at the end of last month, has fallen to the 810,000 won range. Hanwha Aerospace has dropped 18.07% so far this month. Hyundai Rotem has also declined by 15.50% this month.

As the United States expanded its 50% tariffs on imported steel and aluminum products to include construction and power equipment derivatives, power equipment stocks-which were among the leading sectors in the first half-have also weakened. LS ELECTRIC has fallen 16.43% this month, while HD Hyundai Electric has dropped 10.88%.

Jung Haechang, a researcher at Daishin Securities, analyzed, "Nuclear power, defense, and power equipment led the market's gains in the first half, causing stock prices to rise and making these sectors relatively expensive. As the upward momentum weakened, investors became more sensitive to negative issues, leading to profit-taking and putting pressure on both stock prices and the index overall."

The AI bubble narrative has also negatively affected investor sentiment. On August 19 (local time), following OpenAI CEO Sam Altman's comments about a potential bubble in AI-related stocks, technology stocks weakened on the New York Stock Exchange, and Nvidia fell by 3.5%. As a result, SK hynix also declined by 2.85%.

Concerns related to policy remain persistent. Lee Jaewon, a researcher at Shinhan Investment & Securities, explained, "The Yellow Envelope Act is scheduled to be submitted to the plenary session on the 23rd in its original form, providing an excuse for further profit-taking in sectors such as shipbuilding. Meanwhile, the tug-of-war between the government and the National Assembly over strengthening or maintaining the major shareholder capital gains tax continues, causing fatigue among investors."

Additionally, there is further pressure from upcoming events such as the Jackson Hole meeting, a speech by Jerome Powell, Chair of the US Federal Reserve, and the government's announcement regarding the criteria for the major shareholder capital gains tax. The possibility that the outcomes of these events could negatively impact the market cannot be ruled out. Na Junghwan, a researcher at NH Investment & Securities, stated, "With the KOSPI having fallen to the 3,130 level, there is a risk that the outcomes of upcoming events could have a negative effect on the market. After the release of the US Consumer Price Index (CPI) for July, the probability of the Federal Reserve cutting the benchmark interest rate at the September Federal Open Market Committee (FOMC) meeting rose to 100%, but has now decreased to around 83%. This is because there are concerns that Chair Powell may signal a rate freeze to curb inflation caused by tariffs, contrary to market expectations." He added, "There are also expectations that the government's major shareholder capital gains tax threshold will remain at the current 5 billion won, but the possibility of it being strengthened cannot be ruled out."

If the outcomes of these events differ from market expectations, some predict that the KOSPI could fall below the 3,100 level. Researcher Na said, "If the anticipated events turn out worse than expected, the KOSPI could drop below 3,100. However, the 3,000 level is expected to serve as the first support line, as it corresponds to a forward price-to-earnings ratio (PER) of 10 times, and the 2,900 level as the second support line, corresponding to a trailing price-to-book ratio (PBR) of 1.0 times. If the index declines, the government may introduce favorable policies, so after a short-term adjustment due to these events, it would be advisable to approach the market from a buying perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.