Kakao Rises Over 11% This Month

Naver Drops More Than 4%

Institutions and Foreign Investors Buy Kakao, Individuals Favor Naver

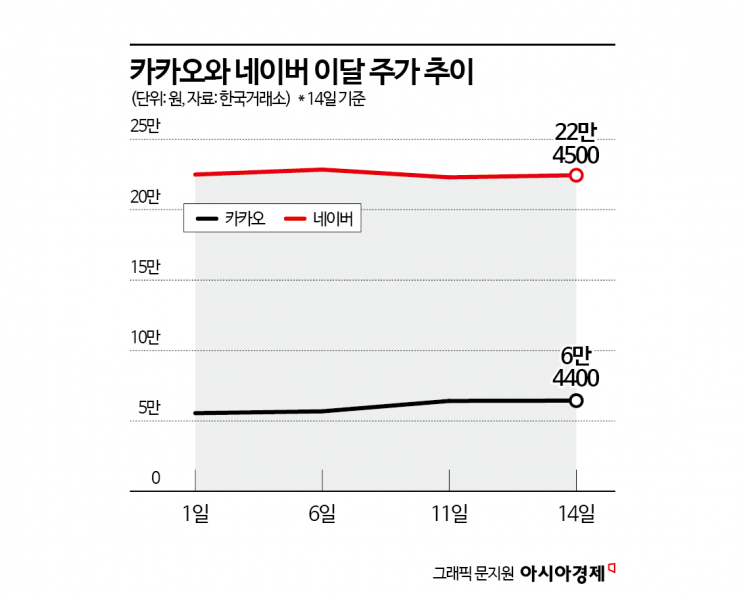

Kakao and Naver stocks have shown diverging trends. While Kakao has risen by more than 11% this month, Naver has declined by over 4%. Institutional and foreign investors have been net buyers of Kakao, whereas retail investors have been net buyers of Naver, resulting in contrasting fortunes for each group.

According to the Korea Exchange on August 18, Kakao closed at 64,400 won on August 14, up 1.42% from the previous day. The stock has gained 11.03% so far this month. In contrast, Naver finished at 224,500 won, down 0.22%, marking a 4.47% decline for the month.

The contrasting supply and demand dynamics appear to have influenced the stock price movements of both companies. This month, institutional investors were the largest net buyers of Kakao, purchasing 369.6 billion won worth of shares. On the other hand, they were net sellers of Naver, offloading 252.3 billion won, making it the third most sold stock after LG CNS and SK Hynix.

Foreign investors were also significant net buyers of Kakao, purchasing 328.5 billion won, second only to SK Hynix. In contrast, Naver was the most heavily sold stock by foreign investors, with net sales of 586.5 billion won this month. Retail investors, meanwhile, were the largest net buyers of Naver, purchasing 825.4 billion won. Kakao was the stock they sold the most, with net sales of 688.2 billion won.

The strong buying interest in Kakao from institutional and foreign investors is attributed to its robust earnings. Kakao posted a surprise earnings beat in the second quarter of this year. Revenue for the second quarter rose 1% year-on-year to 2.0283 trillion won, while operating profit jumped 39% to 185.9 billion won. These figures represent the highest second-quarter results in the company's history, significantly exceeding market expectations. Sunhwa Lee, a researcher at KB Securities, noted, "Key subsidiaries such as Kakao Pay, Piccoma, and SM Entertainment saw improved performance, and company-wide cost efficiency measures led to record operating profit." She added, "In the second half of the year, Kakao plans to define KakaoTalk renewal and artificial intelligence (AI) services as core businesses, with new services for their long-term growth to be launched sequentially. Starting in the fourth quarter, when the effects of the KakaoTalk renewal are reflected, the high-margin Talk Biz segment is expected to accelerate its growth, leading to a significant improvement in overall profitability."

Although Naver was selected earlier this month as one of five elite teams for the "Independent AI Foundation Model Project (National AI Champions)," the stock has weakened as institutional and foreign investors sold off their holdings. While the company met market expectations, its second-quarter results left some investors disappointed. Naver's second-quarter revenue rose 11.7% year-on-year to 2.92 trillion won, and operating profit increased 10.3% to 521.6 billion won. Jaemin Ahn, a researcher at NH Investment & Securities, commented, "Despite strong growth in commerce revenue following the introduction of sales commissions in June, increased marketing expenses resulted in less-than-expected operating profit."

Some analysts argue that Naver's unique AI strengths deserve more attention. Ahn stated, "Concerns about the weakening competitiveness of Naver's search and portal services due to global big tech's AI push are excessive." He explained, "Naver's unrivaled database of search, commerce, local information, and community services could actually give it an edge over global big tech competitors." He added, "Naver's strengths are also expected to stand out in the sovereign AI market, as it has been selected as a government-led Korean foundation model provider, validating its technological capabilities. Additionally, being chosen as a GPU rental service provider is expected to help reduce costs and enhance GPU utilization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.