"Why Exclude REITs with 90% Dividend Payout?"

Debate Over Fairness in Tax Benefits for High-Dividend Investments

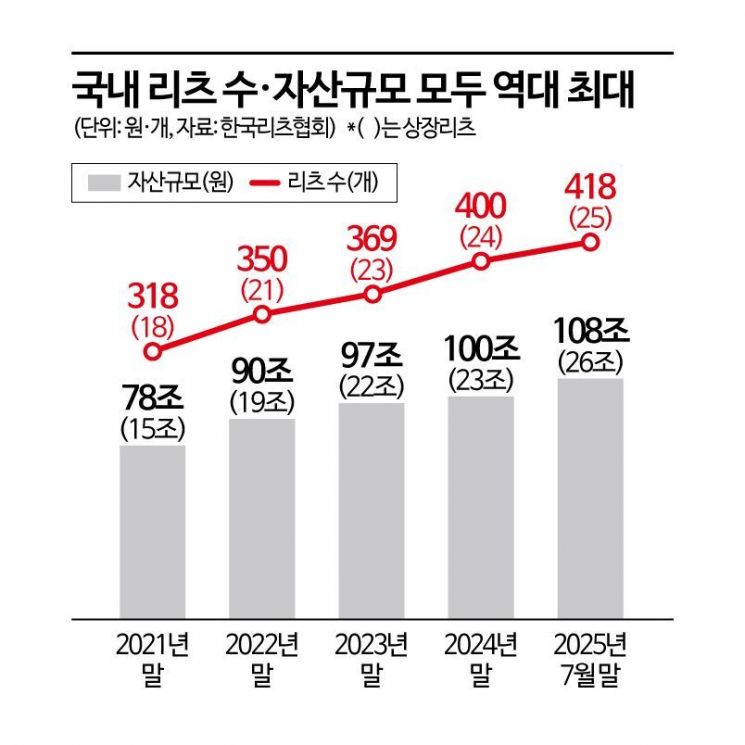

Although the domestic REITs (Real Estate Investment Trusts) market has grown to its largest size ever, discontent is rising in the investment industry after the Lee Jaemyung administration excluded REITs from the scope of "separate taxation on dividend income" in its proposed tax reform. Critics argue that while tax benefits are being granted to high-dividend companies to revitalize the stock market, excluding REITs-which have a payout ratio exceeding 90%-is unfair.

On August 13, the Korea REITs Association held the "Forum on Improving the Separate Taxation System for REITs Dividend Income" at its headquarters in Yeongdeungpo-gu, Seoul. Shin Dongsoo, head of research at the Korea REITs Association, presented proposals for improving the system. The forum was chaired by Oh Yoon, professor at Hanyang University Law School, and included panelists such as Kim Wanyong, professor at Hanyang Cyber University; Kwon Ohyun, professor at Soongeui Women’s College; Hwang Kyoooh, official at the Ministry of Land, Infrastructure and Transport’s Real Estate Investment System Division; and Kim Jaehyun, head of ESR Kendall Square REITs Management.

In his opening remarks, Jung Byungyun, chairman of the Korea REITs Association, said, "Last year, we held a ceremony to commemorate reaching 100 trillion won in REITs, and as of July this year, the figure has grown to 108 trillion won." He added, "Japan and Singapore started later than us, but their markets are 20 times and 12 times larger, respectively." He continued, "Singapore does not tax REIT dividend income at all, and Japan provides strong support, such as a 60% reduction in acquisition tax. Despite REITs being a good policy tool in Korea, there are no incentives for investors."

He further stated, "In the recent tax reform, high-dividend companies are granted separate taxation benefits, but REITs, which are required to distribute more than 90% of profits as dividends, were explicitly excluded. This is somewhat unfair and lacks equity."

Chairman Jung explained that the government’s rationale for excluding REITs from the scope of high-dividend separate taxation appears to be based on two points: first, that REITs are already receiving separate taxation benefits; and second, that since REITs are required by law to distribute more than 90% of their profits as dividends, including them in the system would not increase dividend payouts. He added, "The current separate taxation system is limited by a 50 million won cap, a three-year holding period, exclusion from comprehensive financial income taxation, and other complex procedures, making it virtually ineffective. In 2023, the average benefit per investor was only about 1,000 won."

Jung Byungyun, chairman of the Korea REITs Association, is delivering the opening remarks at the "Discussion on the Improvement of the Separate Taxation System for REITs Dividend Income" held at the association headquarters in Yeongdeungpo-gu, Seoul on the 13th. Photo by Choi Seoyoon

Jung Byungyun, chairman of the Korea REITs Association, is delivering the opening remarks at the "Discussion on the Improvement of the Separate Taxation System for REITs Dividend Income" held at the association headquarters in Yeongdeungpo-gu, Seoul on the 13th. Photo by Choi Seoyoon

According to the association, as of the end of last month, there were 418 domestic REITs with total assets of 108.04 trillion won, marking an increase of 4.5% and 7.9%, respectively, compared to the end of last year (400 REITs, 100.1 trillion won). Both figures are record highs. The number of listed REITs also grew to 25, with a total market capitalization of 8.8624 trillion won. In particular, the supply of rental housing through residential REITs is approaching 200,000 units, highlighting the growing presence of REITs in both policy and private markets.

However, in the tax reform plan announced by the Ministry of Economy and Finance on July 31, companies with a dividend payout ratio of 40% or more, or those with a ratio of at least 25% and a dividend increase of more than 5% compared to the previous three-year average, are eligible for separate taxation benefits. Yet, REITs, which are required by the Real Estate Investment Company Act to distribute at least 90% of profits as dividends, were completely excluded. The association protested, saying, "Excluding REITs, which have a much higher payout ratio, is reverse discrimination. It is inequitable and will lead to a contraction in investment."

Participants at the forum unanimously called for the government to move away from a "biased tax policy" focused solely on the stock market. In his presentation on "Proposals for Improving the Separate Taxation System for REITs Dividend Income," researcher Shin Dongsoo specifically pointed out the lack of effectiveness in the current system. He said, "The current REITs separate taxation system is virtually unused due to conditions such as a 50 million won investment cap, a holding period of more than three years, a separate application required for each purchase, and the requirement that the investor is not subject to comprehensive financial income taxation for three years. As a result, in 2023, the average tax benefit per investor was only 981 won."

Researcher Shin stated, "Even if REITs are included in the government's latest tax reform, the reduction in tax revenue would be about 1.66 billion won. In contrast, cutting dividend income tax on REITs would lead to a substantial increase in dividend payouts and restore investment appeal, resulting in a much greater market revitalization effect." He added, "90.68% of listed REIT investors (404,796 individuals) are small investors with less than 50 million won invested, and 99.98% of all investors are minority shareholders. REITs are an important investment vehicle that contributes to wealth building and retirement income stability for the public, so excluding them from tax benefits is inconsistent with policy objectives."

According to the association, as of the first half of this year, there were a total of 446,418 individual investors in listed REITs. Of these, only 404,796 (90.68%) with investments under 50 million won are eligible for the current separate taxation system. In contrast, 41,622 investors (9.11%) with investments exceeding 50 million won but annual dividend income under 20 million won receive no tax benefits. The association pointed out, "Not only high-net-worth investors but also a significant number of middle-class investors seeking stable dividends are excluded, reducing the effectiveness of the system."

The industry is concerned that if investors begin to exit, liquidity in the listed REITs market could rapidly decline. Furthermore, this directly conflicts with the Democratic Party's policy pledge to expand residential REITs. Although a project REITs system has recently been introduced to replace Project Financing Vehicles (PFVs), continued tax disadvantages would inevitably shrink the market rather than help it take root. Kim Jaehyun, division head, said, "Currently, many individual investors are investing in REITs for retirement planning, based on the stability and dividend potential of REITs. If REITs are excluded from the tax reform, many investors will leave, which will not only destabilize the REITs market but also make it difficult to manage retirement funds stably, ultimately leading to a contraction of the market."

On the 13th, participants are taking a commemorative photo at the "Discussion on the Improvement of the Separate Taxation System for REITs Dividend Income" held at the Korea REITs Association headquarters in Yeongdeungpo-gu, Seoul. Photo by Korea REITs Association

On the 13th, participants are taking a commemorative photo at the "Discussion on the Improvement of the Separate Taxation System for REITs Dividend Income" held at the Korea REITs Association headquarters in Yeongdeungpo-gu, Seoul. Photo by Korea REITs Association

In the subsequent discussion, Professor Kim Wanyong stated, "Improving the REITs tax system is not just a matter of tax equity, but an essential task for achieving national policy goals such as diversifying retirement income and stabilizing the housing market." Professor Kwon Ohyun noted, "The current 50 million won investment cap for low-tax separate taxation on REITs dividend income has minimal impact," and argued, "The investment cap should be raised to around 20 million won in terms of dividend income." Professor Kwon further emphasized, "Rather than applying a sunset clause through special provisions, this should be permanently stipulated by amending the Income Tax Act." Official Hwang Kyoooh said, "REITs should be included in the scope of separate taxation on dividend income," and pledged to play a necessary role in the legislative review process in the second half of the year.

Unlike Korea, other countries provide bold tax incentives to promote REITs. Singapore exempts REIT dividend income from tax entirely, and Japan significantly reduces acquisition and registration taxes. In the United States, capital gains tax is deferred when real estate is contributed in kind to a REIT. As a result, the market capitalization of listed REITs in Singapore is close to 20% of GDP, and in Japan it is 2.2%, whereas in Korea it is only 0.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.