Annual 9% Growth Needed to Reach 5,000

Accelerating AX in Mobility, Robotics, and Smart Factories

Resolving the "Korea Discount" Through Corporate Governance Reform

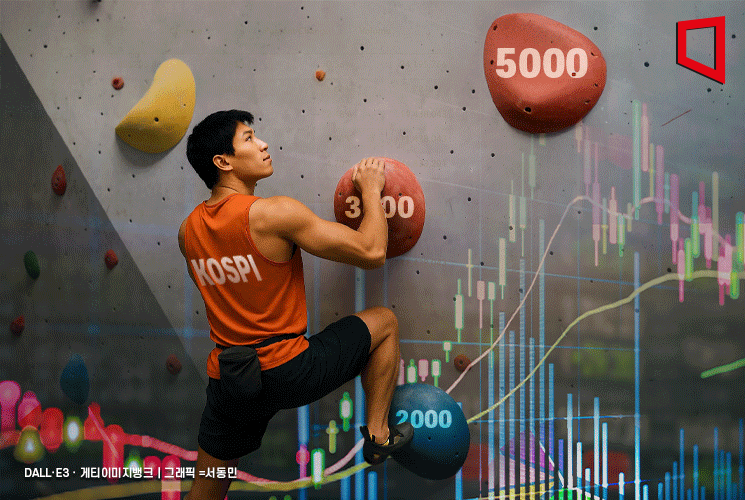

The KOSPI index surpassed 1,000 points in 1989, 2,000 in 2007, and 3,000 in 2021. It took over a decade for the index to reach each new milestone. To achieve the KOSPI 5,000 target set by the Lee Jaemyung administration, an annual growth rate of 9% is required. Some argue that this is impossible given the current domestic and global environment.

On August 12, iM Securities analyzed in its "KOSPI 5000 Scenario" report that reaching KOSPI 5,000 is possible through equipping all industries with AI-powered growth engines (Boost-up Engine) and resolving factors behind the so-called Korea Discount, such as governance issues.

The key variables determining stock prices are corporate earnings and valuation multiples. The introduction of new growth engines impacts earnings, while resolving the Korea Discount affects valuation multiples.

Earning: Physical AI as a Growth Engine by Integrating AI into Manufacturing

The Lee Jaemyung administration has announced its plan to make Korea one of the world's top three AI powerhouses by investing 100 trillion won to build a nationwide AI ecosystem. Both the government and the business sector agree that physical artificial intelligence-created by integrating AI with manufacturing, which accounts for 24% of Korea's GDP and is a key future trend-should be the country's new growth engine.

Countries around the world are already utilizing AI in various fields such as manufacturing, transportation, distribution, and defense. iM Securities identified mobility, robotics, smart factories, UAVs (Unmanned Aerial Vehicles), and UWSs (Unmanned Weapon Systems) as the most important elements of physical AI. Having already achieved a rapid and successful digital transformation (DX), Korea now needs to concentrate its national capabilities on an AI transformation (AX).

The groundwork is already in place. According to Forbes, 62 Korean companies are included among the Global 2000, ranking Korea sixth after the United States, China, Japan, India, and the United Kingdom. Canada, Germany, France, and Switzerland follow Korea. Most companies in the Forbes 2000 are from resource-rich countries, highly populated nations, or advanced economies with developed banking, finance, insurance, construction, utilities, energy, and materials sectors. However, Korea stands out for its high proportion of manufacturing and IT software/services companies.

On the 27th, Hanwha Robotics' collaborative robot was exhibited at the '2024 Smart Factory and Automation Industry Exhibition' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 27th, Hanwha Robotics' collaborative robot was exhibited at the '2024 Smart Factory and Automation Industry Exhibition' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Multiple: Companies Should Respect Minority Shareholders' Rights ... The Government Must View the Stock Market as a Tool for Corporate Financing and Wealth Building

Restoring 'trust' is crucial to eliminating the Korea Discount. iM Securities emphasized, "There needs to be a redefinition of shareholder identity," adding, "Shareholders should be recognized as the 'owners' and joint 'proprietors' of a company, not merely as 'investors.'"

The Lee Jaemyung administration has also specified 'shareholders' as beneficiaries of directors' fiduciary duties through amendments to the Commercial Act. The expansion of independent directors and separate election of audit committee members are also planned. Regarding directors' fiduciary duties to shareholders, iM Securities analyzed, "If a philosophy that respects the rights and interests of minority shareholders is prioritized, it can prevent the chronic issues in Korea's stock market-such as physical spin-offs and value dilution from dual listings-which concentrate benefits on controlling shareholders and create a vicious cycle of index dilution."

The government also needs to change its perception of the stock market. A recent example is the controversial tightening of the major shareholder threshold for capital gains tax from 5 billion won to 1 billion won. Over the past decade, the government has repeatedly tightened requirements for major shareholders when stock prices rose and fiscal deficits widened, only to relax them again later. iM Securities stressed, "The authorities must decide whether to view the stock market as a source of tax revenue or as a means for corporate financing, wealth accumulation for citizens, and proactive preparation for an aging society."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.